UPDATED: April 5th, 2018

This is a topic a lot of people have asked me to cover. I don’t personally fly Southwest. I have, and I get why some people love it, but it’s not my thing.

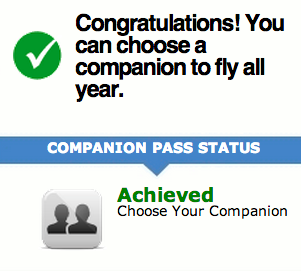

But for those of you that love Southwest, there is NO REASON for you to not have a Companion Pass where you designate a companion that flies free with you (only paying taxes) for the year. You can easily save THOUSANDS in a year with this. Once earned, you’ll have the status for the rest of the year and the next calendar year as well, so if you do it at the start of a calendar year, you can get two full years!

Southwest is also about to launch flights from the US to Hawaii…. so this pass just got a bit more valuable.

The way you get this status level is 100 flights or 110,000 Rapid Rewards points earned in a calendar year.

Yes, that’s a lot. BUT, what if you could just sign up for 2 credit cards, spend $2k to $3k on each (within 3 months)?

That’s a lot more doable, isn’t it?

And it’s actually that simple. At present, there are 50,000 point sign up offers for both of the personal Chase Southwest cards (Southwest Rapid Rewards® Plus Credit Card and Southwest Rapid Rewards® Premier Credit Card) and the Chase Southwest Business card. Each card requires $2,000 in spend within 3 months ($3k for the business card). You could do them at the same time, or staggered if you can’t complete the spend simultaneously in 3 months – although we never know how long each offer may stick around and may change (decrease or increase) at any time. Together, with the 50k bonuses, you are earning 105,000 points total after you have spent the $2k / $3k per card for the bonus. Note: Any combination of the three cards work for now, though I wouldn’t be surprised if Chase were to introduce a restriction (i.e. only one SW personal card).

Note: The above assumes a personal signup offer of 50,000 points for the personal card the offers fluctuate between 40,000 and 50,000 bonus points with the initial minimum spend bonus. If you check the signup links and the personal card is 40,000, you can either wait for the 50,000 bonus offer to return OR you’ll need to earn an extra 5,000 points by other means after meeting both spend bonuses to get to 110,000 total points and your Companion Pass.

Update: the above shoe finally dropped as expected. You must now get one personal and one business card. Chase will deny an application for both consumer cards (i.e. once you have one Southwest consumer card, you will not be approved for the other, similar to Chase’s recent rule that you can only get the Chase Sapphire Reserve or Preferred, but not both).

So now if you get two cards, one personal and one business, you qualify. I can only imagine at some point in the future this goes away, so I’d get it sooner rather than later.

As a reminder, I keep current credit card offers on the travel rewards credit card page (and earn a commission if you apply through those links, which I greatly appreciate). There is a section for Travel/Airline Cards.

![Capital One Miles [Complete Guide] capital one miles guide](https://milestalk.com/wp-content/uploads/2022/01/caponeguide-218x150.jpg)