It’s amazing to me how often I hear newcomers to this hobby compare signup bonuses or earn rates of various miles and points and assume that 1 point or mile in one loyalty program equals the same number of points in another.

For example, someone might compare signup bonuses for credit cards of hotel programs:

Marriott: 75,000 point signup bonus

Hilton: 100,000 point signup bonus

IHG: 80,000 point signup bonus

Hyatt: 60,000 point signup bonus

Or they might compare the 100,000 points you can earn with a new Chase Sapphire Preferred or 60,000 from a Chase Sapphire Reserve card against a 50,000 point signup bonus from a Bank of America Premium Rewards credit card and think they are the same.

So let’s get one thing out of the way.

All Points Are Not Created Equal.

While you probably learned in high school Health class that a drink = a drink = a drink, a point ≠ a point ≠ a point.

The biggest thing that anyone not already enmeshed in this hobby lacks is a way to know what any point is worth. I’m going to give you values for all of the above as a comparison, but know that you can always check this “points and miles values” page find out fairly easily how I value various points.

Before I give you all the values and show you how to better compare signup bonuses and earn rates, it’s important to know WHY various points are worth different amounts. In short, it comes down to how many miles or points it will take to redeem for award flights or hotel stays using those points, issues with availability (if any), and how hard it is to earn a particular point. If I can redeem for the same amount of points at New Years Eve in a major city as any other day, I know I can get way more value from that point than in a program where the rates in points go up along with the cash rates.

And it’s why I value American Airlines miles so much higher than Delta miles… because I can redeem AA miles at fantastic redemption rates (5 cents ++ a mile) while I struggle to beat 1.5 cents a mile with Delta.

So let’s take an example from above and compare the a Hilton point against a Marriott point.

I will tell you upfront that I roughly value a Hilton point at 0.5 cents a point. That means If I can’t get a bare minimum of $400 in value for 80,000 points, I’ll pay cash or stay elsewhere. And I value a Marriott point at around 0.6 cents (or a touch less). But I value a Hyatt point at around 1.6 cents. What that means is that if I were offered 60,000 Hyatt points, I’d want to be offered 192,000 Hilton points to think of it as an equivalent offer. It’s so easy to assume a high amount of points is worth more but, to see why it’s not, let’s look at a few hotels in each program along with what it costs in cash and then in points to redeem.

Let’s say I want to stay in Paris at a mid-high end hotel. I’ll pick a random date: September 15th for one night.

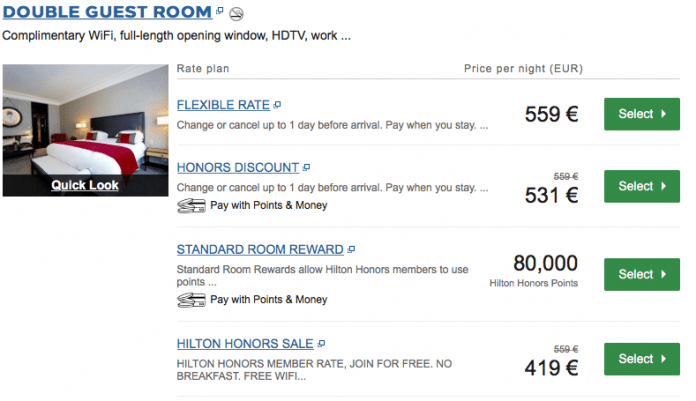

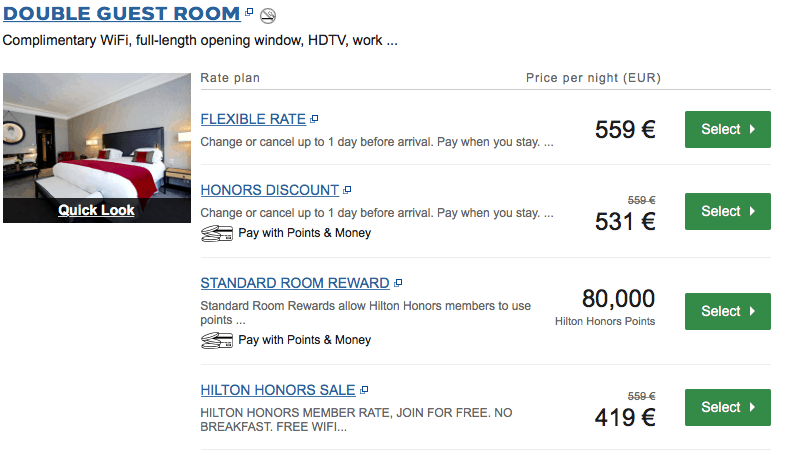

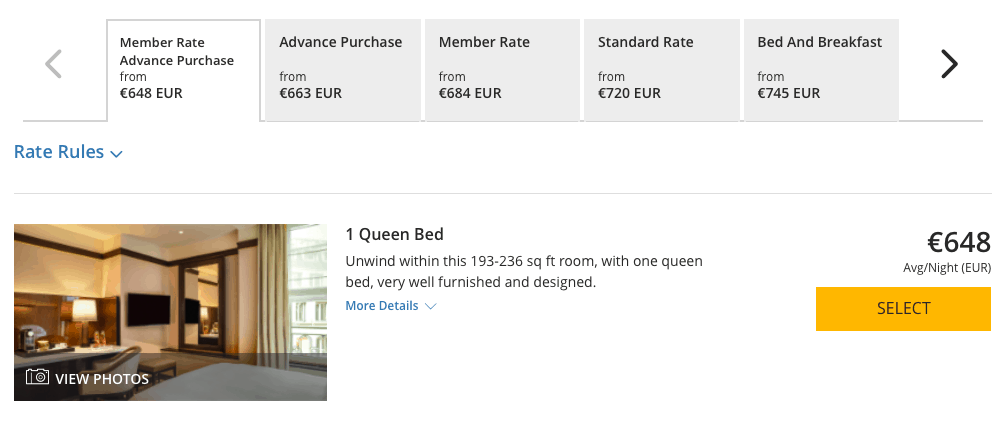

At the Maison Astor in Paris (Curio Collection hotel) for September 15th, I get these rates:

The best I can do is 419 Euro which is $489 USD. Or I can pay 80,000 points. This is a value of 0.061 cents a point or slightly better than their value.

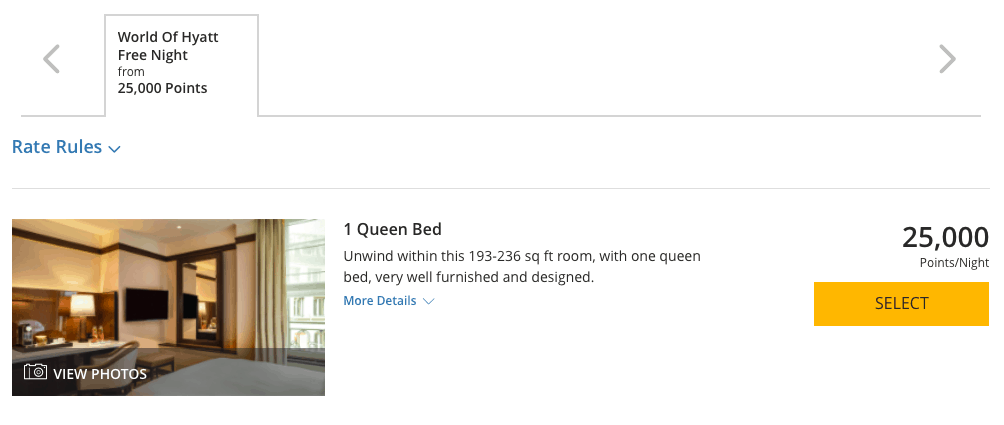

Let’s compare to the Hyatt Paris Madeleine. This has a cash rate for the night of 648 Euro / $757 USD. But I can spend 25,000 World of Hyatt points for that. Here, I yield 3 cents per Hyatt point.

In this case, a Hyatt point appears to be worth 5 times that of a Hilton point!

Now, as with most things, the comparison is not quite that straightforward.

When you book with points, Hilton will give you the 5th night free when you buy 4 with points. Hyatt does not. So your value of Hilton vs. Hyatt would rise with a 5 night stay.

Additionally, Hilton largely ties redemption to cash prices in the ballpark of .5 cents a point, but you can get outsized redemptions during busy times as they do “cap” the rates.

Now, let’s head back to my second example:

75,000 Chase Ultimate Rewards points vs. 50,000 Bank of America Rewards points

You could currently get 75,000 Ultimate Rewards points from two different Chase cards: the Ink Business Cash and Ink Business Unlimited. Or you could get 50,000 Bank of America Rewards points from the Bank of America Premium Rewards credit card.

And yet, the bonus offers on the Chase cards are worth 2.5X as much as the Bank of America card.

That’s because I value Chase Ultimate Rewards points at 1.75 cents a point (bonus value of 75,000 points = $1,312.50) and the Bank of America rewards points at just 1 cent – or $500. Why is that?

- B of A points can be redeemed at 1 cent per point in value. That’s it.

- Chase Ultimate Rewards points can be redeemed for travel at 1- 1.25 cents a point at worst – depending on what Chase cards you carry. If you have the Chase Sapphire Preferred or the Chase Ink Preferred, they are worth 1.25 cents on travel and if you have the Chase Sapphire Reserve they are worth 1.5 cents towards travel. But that’s not all. You can also transfer them to a variety of airline and hotel partners where you can get several cents in value by transferring and redeeming with the airline or hotel. I regularly get more than 1.75 cents per UR point in value, for example, by transferring to Hyatt.

Hopefully that clears up the basic premise of why different points are worth different amounts and why

a point ≠ a point ≠ a point

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![Capital One Miles [Complete Guide] capital one miles guide](https://milestalk.com/wp-content/uploads/2022/01/caponeguide-218x150.jpg)