In this article

American Express Cards with Incidental Airline Credits

There are four Amex credit / charge cards that offer what is called an incidental airline credit.

Those Amex cards are the:

Platinum Card from American Express ($200 per year)

Business Platinum Card from American Express ($200 per year)

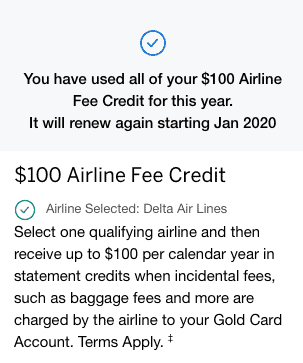

American Express Gold Card ($100 per year)

Hilton Honors Aspire Card from American Express ($250 per year)

The terms of the cards state that you’ll receive “statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline.” (bolding mine).

In all cases, you need to choose ONE airline for the entire year (although it’s often possible to get an exception made once in a year to switch) and then you will automatically receive a statement credit for the charge.

In practice, while not covered by the terms of the program, it’s been possible to buy gift cards to use later. So long as the charge was posted by the airline and not a third party, and under a certain amount ($50 cards were safest), it tended to work. As of the start of this year, it was only a workaround on AA, Delta, and Southwest. Then AA stopped working. And now, per Doctor of Credit, it seems they all have.

Is there another way to use the Amex Incidental Airline Credits?

Loyalty Lobby offers some advice that I have seen work myself, though it’s never going to be a guarantee.

That advice is to make charges directly with the airline (remember, your chosen airline only) for under $100. Buy cheap flights with the card or pay some with a gift card and some with the card. This makes the charge appear to be an incidental charge.

Just remember, it isn’t a guarantee and if it doesn’t work, you can’t call Amex asking for it – because you weren’t meant to in get it the first place.

Does this Change the Equation for Amex Annual Fee Calculations?

Or put another way, does this make it harder to get value out of the annual fees on these cards?

For sure. Currently, I value these airline credits like cash, simply because buying gift cards made them so easy to use.

With this use case seemingly done, I’m curious how you feel this impacts the value of the incidental credits.

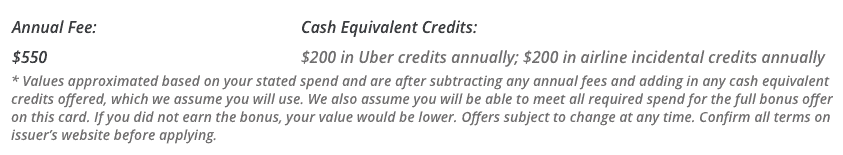

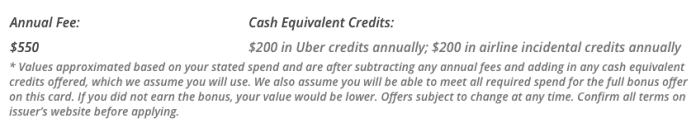

When you use my free rewards calculator at YourBestCreditCards.com, I currently “value” the incidental credits at face value. If the Annual Fee is $250 and the Incidental Credit is $100, I essentially mark the annual fee at $150 ($250 fee minus $100 credit).

Here’s an example on the Platinum Card:

With a card like the Chase Sapphire Reserve, where any travel credit at all is being erased, that makes sense. The $300 credit on that card really is SUPER easy to get.

With Amex going the other direction, really trying to force breakage on that credit, it’s clearly no longer “worth” face value. The Uber credits in the above example, are easy to redeem as long as you use Uber. The Airline incidentals are clear no longer that easy.

I could see listing a $200 credit as “worth” $100-$150 based on the difficulty of using them, but you can definitely still get “up to’ $200 in value.

So, I’d love your feedback… What % of face value are those credits worth?

What do you think?

Let me know here, on Twitter, or in the private MilesTalk Facebook group.

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.