Rates mentioned below are no longer current.

I have talked a fair bit about the Bask Mileage product, where you earn miles for banking with Bask. Like this article discussing the benefits of having both accounts.

Last year they introduced a separate product that simply earns…. cash.

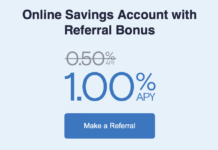

While it’s been competitive from launch, they have increased their rate today to 1.25%.

I personally have always tended towards Marcus, where I’m currently getting 1.2%, but that is through a combination of their base rate (0.6%) + 0.1% for having AARP, + 0.5% for referral bonuses.

Certainly, 1.25% as a base rate with no hoops to jump through is worth mentioning. While no doubt other banks will be increasing rates in the current climate, this is the highest I’m aware of as of writing this article. You can visit Bask Bank here.

Disclosure: While I have partnered with Bask Bank in the past, this post is not sponsored and I earn nothing from this post or if you open an account.

Questions?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.