I love my Yotta Savings account (review). It’s super fun waiting for the nightly prize draw and, for November, I averaged a 1.61% APY on my money. That’s more than 3 times a Marcus savings account plus I had fun.

But they made a chance today, that goes into effect in 10 days on Dec 14th, 2020, that you need to know about.

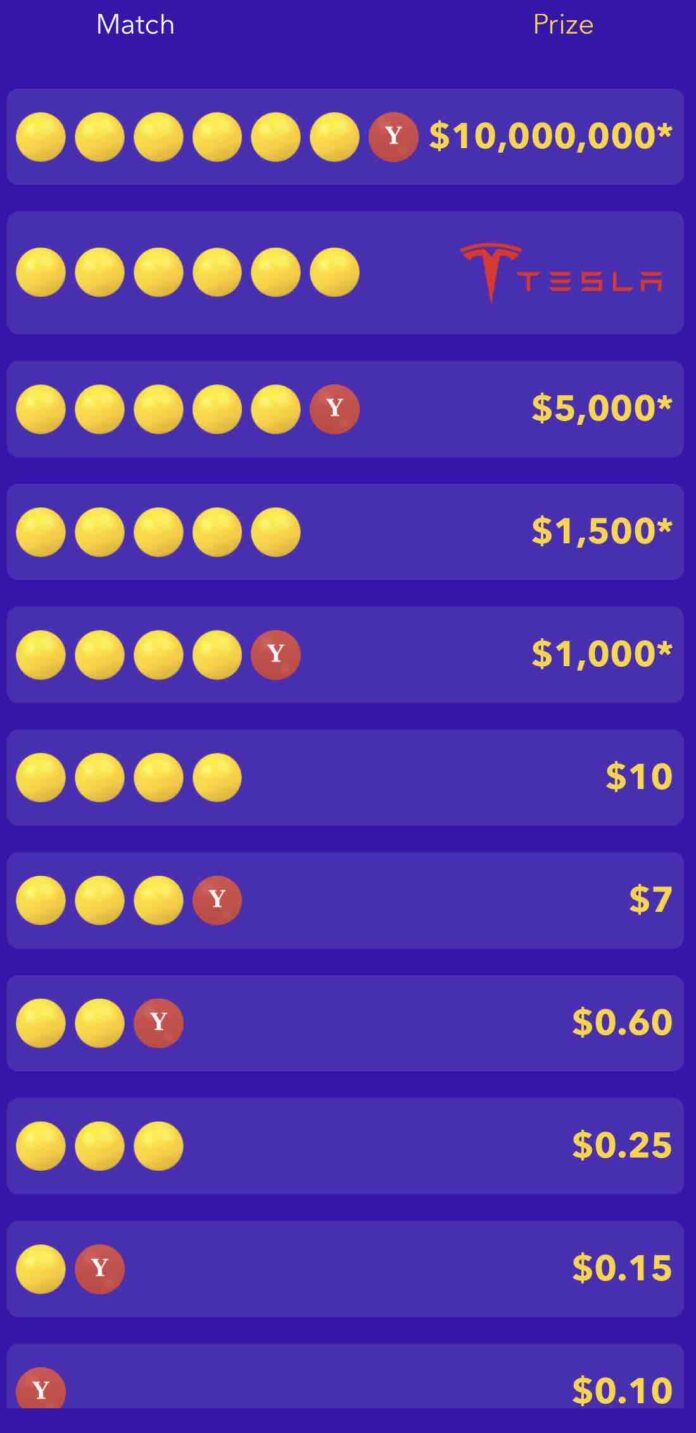

In their monthly newsletter today, they explained the change:

|

Balance Tiers (Only impacting accounts with $25,000+ balances)

|

|

As interest rates continue to stagnate, we’re constantly looking for ways to maintain the size of our prizes and keep Yotta as one of the highest value savings accounts on the market. In order to do so we’re introducing two tiers of accounts based on balance. This change will take effect for weekly drawings starting Monday, December 14, 2020.

|

Does this mean you should close your Yotta account? Absolutely not!

Does this mean that you should limit your balance to $25,000 or less? Sadly, yes.

This reminds me of the glory days of BankDirect accounts. People would sock away more money than you’d expect to earn AAdvantage miles and, back in the early 2010’s, we had low interest rates as well. They then limited things by 1) limiting you to one account and 2) limiting the amount that earned full mileage. Over that earned a reduced amount and, like here, meant that an optimal balance was at or below that threshold.

This change means that for every dollar over $25,000 you hold on deposit after December 14th, you will earn 1/6th the total expected (average) interest.

If you don’t have a Yotta Savings account, you by all means still should (unless they make further adjustments) as it still handily beats, on average, any other savings account for a $25,000 balance. Using a referral link gets us both some extra prize draw tickets as well, though I don’t factor that into my math with the whopping 3 referrals I have 😉

But whatever you do, don’t park more than $25,000 there and, if you have more there now, plan to withdraw on or before Dec 14th. Keep in mind you can only transfer in or out $10,000 per day and $40,000 per calendar month. (And for some odd reason, $100,000 per year). You are also subject to a maximum of 6 withdrawals a month.

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group.

And if this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Last Day for Old Pricing – March 25] Hyatt’s Yearly Category Changes Are Up Impression Isla Mujeres by Secrets](https://milestalk.com/wp-content/uploads/2023/12/SEIIM-P0007-Main-Pool.16x9.jpg-218x150.webp)