I just got approved for a Capital One Spark Cash for Business card and I thought my experience might be informative for some that may be applying or thinking about applying.

The Capital One Spark Cash card is appealing because it earns a flat 2% cash back for unlimited business spend (no $50k yearly limit like the Amex Blue Business Cash), has no foreign transaction fees, and, thanks to a very recent change, the Spark Cash no longer reports to your personal credit. That change also means that it no longer counts against your 5/24 count.

Additionally, you can transfer your accrued Cash to a Capital One Spark Miles card. This means that having both the Spark Cash and the Spark Miles card allows you a sort of optionality where you can redeem for cash any time or redeem for frequent flyer miles any time. (If you just have a Spark Miles, you cannot cash out for cash at full value.)

(Side note: Capital One does still ding all three credit bureaus when checking your credit which is also very annoying – no other bank feels that need.)

Now, I’ve had a Spark Cash for a long, long time. And I had a permanent annual fee waiver on my Spark Cash, as I describe in this article. But earlier this year, Capital One closed my Spark Cash card for inactivity. I’d spent on my Spark Miles, but not my Spark Cash. In fact, I’d always wanted to spend more on my Spark cards, but held back because I hate how it historically reported to your personal credit profile, making your overall utilization look higher and knocking down your score as a result.

When Capital One closed my old Spark Cash I was pretty annoyed. I had a nice line of credit on it. I called within a few minutes of getting the notice and was informed that it could not be reopened. I was welcome to apply for a new one, however. OK…

I let it go until now because I haven’t been too keen on applying for new cards during the worst of the pandemic’s impact on credit markets. They’ve opened back up in the last 2-3 months, though, and it no longer feels risky to grab new cards. (I also got the World of Hyatt card this week.)

And, let’s be honest, this meant that Capital One would be giving me $500 to open the new account (which would have the new added benefit of not reporting to personal credit) vs. just reopening the old one. Talk about customer acquisition cost optimization 😉 The early spend bonus on a new Capital One Spark Cash for Business is $500 when you spend $4,500 in your first 3 months. And like I mentioned, I could transfer that to my Spark Miles and then transfer to an airline program if I want (2:1.5 in most cases).

Back to this Spark Cash application….

I applied Monday. All three bureaus notified me of the hard inquiry. And then the reply…

David, we’re in the process of reviewing your application. This is a standard step in our application process and we’ll be in touch shortly with more information.

Ugh. Now, Capital One does not do “reconsideration” in the way that we normally think of reconsideration with Chase or Citi or most issuers. But you can still call and ask what’s up.

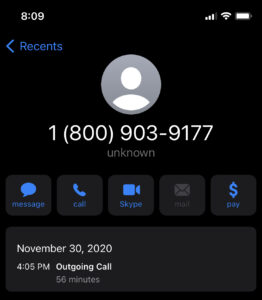

I called 1-800-903-9177 and got a very helpful agent who looked up my application by my SSN, since I hadn’t been given an application number. This call had a 45 minute hold time.

Capital One is still clearly denying a lot of people. She was well into her response about how I shouldn’t take a denial personally, etc and then she stopped and said “Oh, you know, you weren’t denied. It just looks like we need some information to verify your identity.” While I found it odd, since I have another existing Spark account and all the info matches, I said it would be no problem.

The problem, it turned out, was that her system didn’t yet show what information they needed and if it would be something I could provide by phone. She said I could wait for a letter in the mail in 7-14 days, or I could call back in 24-48 hours. Of course, I called back in 24-48 hours 😉

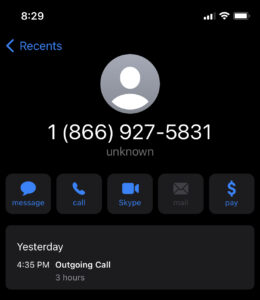

She indicated I’d want to call 1-866-927-5831, so that is what I did. And this is how long the call took.

2:42 was the hold time for a rep to answer; 18 minutes was for the call itself.

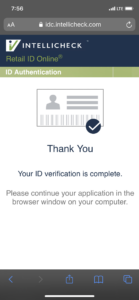

Luckily I was indeed able to complete the verification on the phone. He sent me a link to my cell phone and had me use that link to send a picture of the back and then the front of my Driver’s License. That was it! After that, instant approval.

Now, I was in a rush because I have a charge to make that is both international and not in a bonus category – a prime time to meet minimum spend on this card. That’s why I was so persistent. But Capital One won’t rush a new card, so I’m still stuck waiting 7-10 days now. If I wasn’t in a rush and was content to just wait for the letter by mail asking me for more info, I could have saved 4 hours on the phone.

The good news is that “reviewing your application” isn’t always code for a denial. The bad news is that short of 3-4 hours on the phone, you can’t do too much about it anyway. I’m assuming I would have received a letter with a link to verify – but maybe I still would have had to call?

If it had been a denial, though, there would not have been anything to do since Capital One won’t recon an application.

I know this was more of a “story” than my usual articles, but I thought some going through a Capital One Spark Cash application might find it useful to know what to do if they get the message I did…

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group.

And if this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![Capital One Miles [Complete Guide] capital one miles guide](https://milestalk.com/wp-content/uploads/2022/01/caponeguide-218x150.jpg)

If you’re not already registered for Capital One’s ENO, then do it. Make sure to use the same email address that you have supplied to CapOne and it will automatically find all open and eligible CapOne cards that you currently have. Through ENO, you acan make online purchases with instantly made virtual credit cards that you can choose will charge to whatever CapOne card you want. This works whether or not the card has actually arrived yet.