Yes, earn… not pay. And you’ll actually profit 3.04%.

In this article

How to Earn 3.04% (Or More) Paying Tax This Quarter

Many of us have to pay taxes quarterly. My go-to card for this is the Citi Double Cash. As I outline in my article on paying taxes by credit card, you can’t lose on this payment method with a Double Cash. You can have a tiny gain or you can get a bigger gain if you wind up transferring your cash back to ThankYou points.

But even better is profiting by a minimum of 3.04% with a similar opportunity to outsize your returns.

One thing: You’ll need a Chase Freedom Flex credit card (or an older Chase Freedom) to do this. If you don’t have one yet, it’s not too late to get one and still do this.

One of this quarter’s “5X rotating bonus categories” for the Chase Freedom Flex and Chase Freedom (no longer available to new applicants) credit cards is PayPal. That means that for up to $1,500 in purchases at PayPal from Oct 1 to Dec 31, 2020, you’ll earn 5X rewards as long as you’ve opted-in to the quarter’s rotating categories.

How Can You Pay Taxes with PayPal?

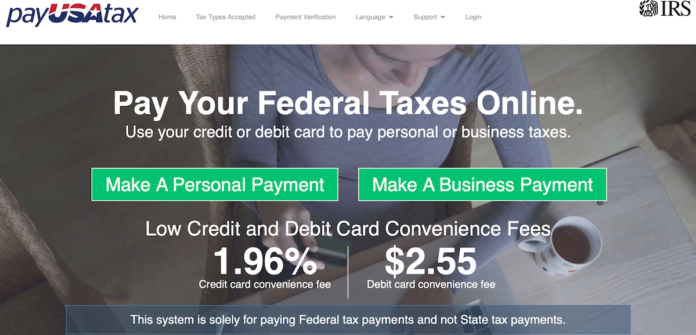

You can pay estimated taxes at Pay USA Tax with a convenience fee of 1.96%.

While the limit of $1,500 (for the quarter) that will earn 5X isn’t a ton, anyone can pay tax this way (even if you aren’t self-employed, there’s no reason you can’t make an estimated payment and get a refund later if you don’t owe that much – though it’s a small interest free loan to Uncle Sam).

Paying the max of $1,500 will earn you $75 cashback in the form of 7,500 Chase Ultimate Rewards points.

The Math: Using PayPal in Q4 2020 to Pay Tax with a Chase Freedom Flex or Chase Freedom card

If you only have a Chase Freedom Flex or Chase Freedom, this is worth exactly $75 in rewards for a $29.40 convenience fee when you pay the maximum of $1,500. (After $1,500 in the quarter, you’ll only earn 1% back, which would be a money losing deal).

$45.60 is your gain. That’s as easy as it gets, assuming you weren’t already going to make other purchases this quarter using PayPal.

But if you have a Chase Sapphire Reserve and use the points at 1.5c per point (via the travel portal or via Pay Yourself Back), you’ve made $68.40.

Or, if you have a Chase Sapphire Reserve, Chase Sapphire Preferred or a Chase Ink Business Preferred, then you can also take advantage of all of the Chase travel partner transfers. My favorite is Hyatt where I always get at least 2 cents per point in value, making this deal worth over $91 to me.

Also see:

- Chase Freedom Flex vs. Chase Freedom Unlimited: What’s the Difference?

- Chase Freedom Flex vs. Chase Freedom: All of Your Questions Answered

Questions?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group.

And if this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.