For many of us, both the personal and business versions of the SPG American Express credit cards were the go-to card for all non-bonused spend. By non-bonused spend, I mean where we didn’t have a card offering 2x, 3x, or 5x points in a category, such as travel or dining. The SPG Amex would earn just one Starpoint per dollar, but since I valued Starpoints at 2.5 cents a piece, it was still better than a 2x.

All that has changed as of yesterday, with the earnings for “everyday spend” on the card reduced to just 2 Marriott points per dollar. To the uninitiated, it *sounds* like points earning doubled. But since each Marriott point is worth just 1/3 of a Starpoint, the reality is that you are earning 2/3 the amount you did yesterday for the same spend. If you hadn’t been paying attention for the last couple of years, you may have missed that you were (still are until the SPG program end date of August 18th) able to freely convert Starpoints to Marriott points at a 1 to 3 ratio.

There are some exceptions: The new SPG Business Amex will earn 4 points per dollar on gas. That’s like 1.33 old Starpoints and I’ll probably take advantage of that. Same for shipping. It also gives 4x on wireless phone payments, but I won’t do that – because I get free cell phone insurance by charging that to my Chase Ink Preferred.

And I still wholly support either card in terms of a new card bonus (75,000 points now for the Personal version and 100,000 for the Business version) and for the annual free night you get worth up to 35,000 Marriott points.

But does our other spend go now?

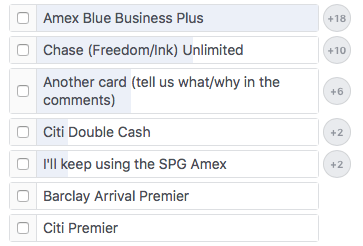

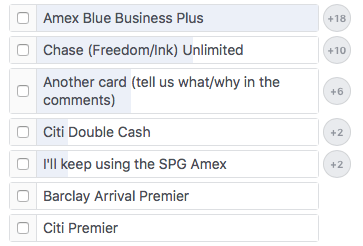

I put the question to the MilesTalk Facebook group and the results were in line with my own opinions.

Resoundingly, the American Express Blue Business Plus Card came out on top. It has no annual fee and earns 2x Membership Rewards on all purchases up to $50,000 a year. Simple. And they are “standard” Membership Rewards points, meaning that they are fully transferable to Amex airline and hotel partners. Some people go way over that 50k limit, though.

For sure, another best option is the Chase Freedom Unlimited (or Chase Ink Unlimited). These cards earn 1.5x Ultimate Rewards on everything and can be combined with your points from a Chase Sapphire Reserve or Chase Sapphire Preferred, unlocking their value for transfer to travel partners or even for spending in the travel portal. Even with just a Chase Sapphire Preferred or Chase Ink Preferred to combine the Unlimited points into, your minimum yield is 2.25% when spent on travel. That’s because you are earning 1.5x points on everything and then, once combined, you can spend in the portal at a “value” 1.25 cents per point with a Preferred card (50,000 points equals $625 in travel) or 1.5 cents per point with the Reserve (50,000 points equals $750 in travel).

What else made the list?

Not too much! The Barclay’s Arrival Premier was dead on Arrival (ha!) and no love for the Citi Premier either. The Citi Double Cash, which earns a flat 2% in cash, got 2 votes. And from the comments, the Discover Miles card got some love since you get 3% back in your first year (but just 1.5% thereafter). Note, you are getting cash for travel, not what I call actual “miles.”

Related link: Apply for Hotel Rewards Credit Cards. Using this link supports MilesTalk.

Would you add anything to this list? Let me know here, on Twitter, or in the private MilesTalk Facebook group.

New to all of this? My new “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available now.

Discover Miles!!