These offers have expired.

American Express and Marriott Bonvoy launched two very enticing new offers today.

I’ve been saying that, due to the pandemic, the co-branded cards would start ramping up bonus offers as things started to reopen. That’s indeed been the case.

Recall that just recently, Chase increased the bonus offer on the Bonvoy Boundless card to include 5 free nights of up to 50,000 Bonvoy points in value per night. Stellar deal for that card, no doubt.

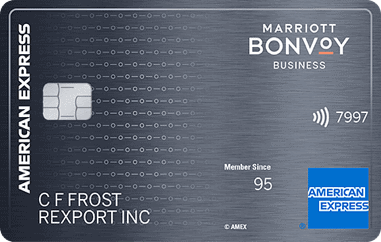

But American Express has upped the ante with new offers on the business version of the Bonvoy family of credit cards, the Bonvoy Business card, and on the premium ($450 fee) version of the personal lineup of cards, the Bonvoy Brilliant. (Rates and Fees)

Both of these offers now include one year of Marriott Bonvoy Platinum status!

In this article

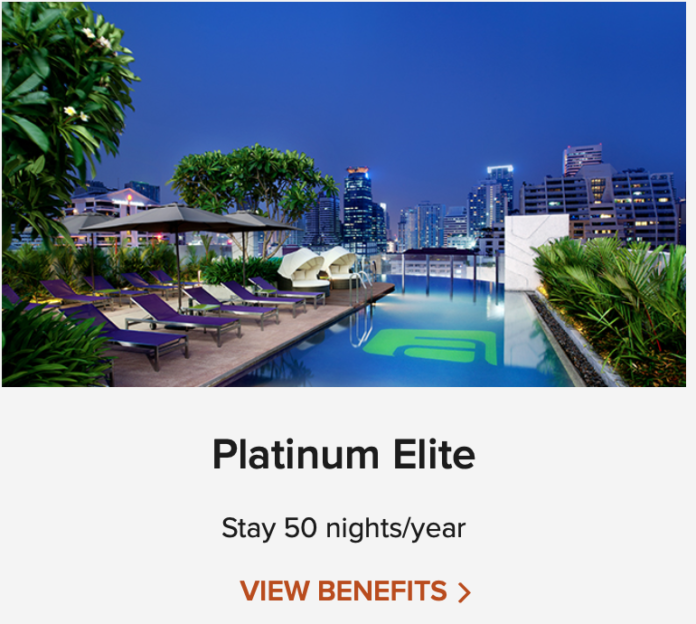

Marriott Platinum Benefits

This is truly exciting because this is the tier in which benefits get real. While Marriott Gold is not worth much at all, Marriott Platinum comes with lounge access where available, complimentary breakfast at most mid and high end brands, and guaranteed 4pm late checkout (except for resort and convention properties). For me, that late checkout is worth its weight in Platinum (haha, sorry!) because I don’t want to wonder if I can get a late checkout when I’m traveling – especially if I need to check out of one and into another where check-in is likely not until 3pm or later. You’ll also get a 50% bonus on all points earned at hotels which can add up nicely.

Let’s take a look at the Welcome Offers.

Bonvoy Business Credit Card from American Express

Welcome Offer: Get 100,000 Marriott Bonvoy points when you spend $5,000 in your first 3 months + get up to $150 in statement credits for purchases on U.S. Advertising in select Media within your first 6 months + PLUS get Marriott Bonvoy Platinum Elite status for one year (February 1, 2021-January 31, 2022)

The offer ends January 13, 2020.

As an Amex card, 5/24 isn’t a concern. But the eligibility rules are still beyond confusing.

Welcome offer not available to applicants who (i) have or have had the Marriott BonvoyTM Premier Plus Business Credit Card from Chase, the Marriott Rewards® Premier Plus Business Credit Card from Chase, the Marriott Bonvoy BusinessTM Credit Card from Chase, or the Marriott Rewards® Business Credit Card from Chase in the last 30 days, (ii) have acquired the Marriott Bonvoy BoundlessTM Credit Card from Chase, the Marriott Rewards® Premier Plus Credit Card from Chase, the Marriott Bonvoy BoldTM Credit Card from Chase, the Marriott BonvoyTM Premier Credit Card from Chase or the Marriott Rewards® Premier Credit Card from Chase in the last 90 days, or (iii) received a new Card Member bonus offer in the last 24 months on the Marriott Bonvoy BoundlessTM Credit Card from Chase, the Marriott Rewards® Premier Plus Credit Card from Chase, the Marriott Bonvoy BoldTM Credit Card from Chase, the Marriott BonvoyTM Premier Plus Credit Card from Chase or the Marriott Rewards® Premier Credit Card from Chase.

More info and how to apply for the Bonvoy Business card

American Express Bonvoy Brilliant

Welcome Offer: Get 100,000 bonus Marriott Bonvoy points when you spend $5,000 in your first three months + 25,000 bonus points after your 1st year as a cardmember (after next year’s annual fee is paid). You’ll also get Marriott Platinum status from 2/1/2021 until 1/31/2022. The offer ends January 13, 2021.

Same deal as above if you have questions on eligibility. Here is the fine print:

Welcome offer not available to applicants who (i) have or have had The Ritz-Carlton™ Credit Card from JPMorgan or the J.P. Morgan Ritz-Carlton Rewards® Credit Card in the last 30 days, (ii) have acquired the Marriott Bonvoy Boundless™ Credit Card from Chase, the Marriott Rewards® Premier Plus Credit Card from Chase, the Marriott Bonvoy™ Premier Credit Card from Chase, the Marriott Rewards®Premier Credit Card from Chase, the Marriott Bonvoy Bold™ Credit Card from Chase, the Marriott Bonvoy™ Premier Plus Business Credit Card from Chase or the Marriott Rewards® Premier Plus Business Credit Card from Chase in the last 90 days, or (iii) received a new Card Member bonus or upgrade offer for the Marriott Bonvoy Boundless™ Credit Card from Chase, Marriott Rewards® Premier Plus Credit Card from Chase, the Marriott Bonvoy™ Premier Credit Card from Chase, the Marriott Rewards® Premier Credit Card from Chase, the Marriott Bonvoy Bold™ Credit Card from Chase, the Marriott Bonvoy™ Premier Plus Business Credit Card from Chase or the Marriott Rewards® Premier Plus Business Credit Card from Chase in the last 24 months.

More info and how to apply for the Bonvoy Brilliant card

Note About the Gifted Platinum Status

*Note: This gifted Platinum status will count as just that – gifted status. It won’t count as 50 elite nights (or any, though you’ll get 15 per year with the cards – up to 30 per year if you have a business and personal Bonvoy card) nor come with Elite Choice Benefits.

I think there offers are just fantastic, though I’m ineligible based on having all the cards already. What do you think?

Thoughts or Questions?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

The following American Express cards were discussed in this article: Rates and Fees for the Marriott Bonvoy Brilliant American Express Card | Rates and Fees for the Marriot Bonvoy(TM) Business Card from American Express