This article is designed to help you get the Southwest Companion Pass for all of 2024 and 2025. Since it lasts for the year you earn it in AND all of the following year, NOW is a great time to start the process, as I’ll outline below.

Also note that we have new info that even those over 5/24 are being approved for Southwest cards!

NOTE: Since 2023, Southwest has increased the qualification criteria to 135,000 earned points (from 125,000). However, they are also giving anyone that has any Southwest credit card 10,000 Companion Pass Points each year. If you have the card before January 1, you’ll get them at the end of January. If you open the card mid-year, you’ll get them within 30 days of account opening.

From the Terms and Conditions: When a Member opens a Rapid Rewards Credit Card after the first business day of the calendar year, they will receive one boost of 10,000 Companion Pass qualifying points up to 30 days after opening the Rapid Rewards Credit Card.

For this strategy to work perfectly (almost two full years of Companion Pass), you want to apply at the end of the year or early in the year, so that you’ll finish your minimum spend on BOTH cards as early as possible in a calendar year.

Each year, the last couple of months of the year – and the beginning of the next year – is what I call “Southwest Companion Pass Season“

The Southwest Companion Pass is easily one of the most valuable things in miles and points, especially for those focused on as much domestic coach travel as possible for as little money as possible.

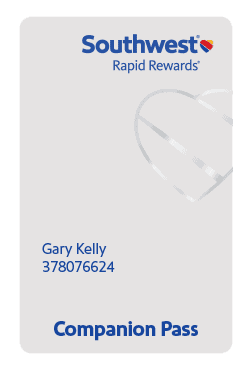

What is the Southwest Companion Pass?

The Southwest Companion Pass allows you to bring a companion on all of your flights for free (just pay taxes and fees) an unlimited amount of times. The Companion Pass includes both paid and award tickets, which is pretty amazing.

You are allowed to change the eligible Companion 3 times per year on a Companion Pass. The only catch is that you can’t change to a new companion while you still have an un-flown ticket with the last one (unless you cancel it).

Southwest Companion Pass

When Should I Get the Southwest Companion Pass?

I’ll get into all of the details on timing below, but this is the important part:

The Southwest Companion Pass is valid for all of the year that you earn it plus the entire next year. If you were to earn the Companion Pass on January 15th, 2024, you would have that Companion Pass through December 31st, 2025!

Let’s say you fly once a month and use the Companion Pass each time on a an average fare of $250 round trip (before taxes and fees, for simplicity).

If you had the pass for a full two years, that would mean that the Southwest Companion Pass was worth an insane $6,000 to you.

How Do You Earn the Southwest Companion Pass?

For context and for those that don’t know, the Southwest Companion Pass is earned when you accrue 135,000 Southwest Rapid Rewards points from certain sources which include flying (obviously) and points earned from credit card bonuses and spend (but not when you transfer points from programs like Chase Ultimate Rewards into Southwest).

This is an increase of 10,000 Southwest Rapid Rewards points from 2022, however, it’s completely offset by the fact that they are also giving anyone that has any Southwest credit card 10,000 Companion Pass Points each year.

But this site is all about credit card rewards, along with miles and points, and that’s where I’m headed.

As long as you can qualify for a business credit card we explain on that page how most people that don’t think they qualify actually do!)), then there is a very easy strategy to get the Companion Pass.

As long as you are still under 5/24 (you’ve opened less than a total of 5 personal credit cards in the last 24 months), you can apply for one Southwest Business credit card and then either a second Southwest Business credit card OR a personal Southwest credit card.

In all cases, you’ll apply for the business card first, both because it has the bigger initial bonus and because it won’t count against your 5/24, so this Companion Pass strategy works even if you are 4/24 now.

Timing and Order of Opening the Southwest Credit Cards to Get 2 Years of Companion Pass

There are five Southwest Airlines Credit Cards. You’ll only need to open two, though, to put this plan into action and earn the Companion Pass.

Let’s begin…

The Southwest® Rapid Rewards® Performance Business Credit Card has an offer on now for 80,000 Rapid Rewards points when you spend $5,000 in 3 months. That is a whopper of a bonus and an integral part of this plan.

Alternatively, you can get the Southwest® Rapid Rewards® Premier Business Credit Card which will give you 60,000 bonus points after you spend $3,000 within 3 months. The annual fee on the Premier Business Credit Card is $99 less, though you get 20,000 less bonus points.

We’ll then want to wait 31 days (or just over a month to make it simple) and then apply for either the other Chase Southwest Business card, the Southwest Rapid Rewards Premier Business Credit Card, which is offering 60,000 bonus points after you spend $3,000 in 3 months (or the Southwest Performance Business Credit Card if you chose the Premier card above), or one of the three personal Southwest credit cards. We recommend the Plus since it has the lowest annual fee.

Southwest Rapid Rewards® Plus Credit Card (Annual Fee: $69)

Offer:

Earn 50,000 Rapid Rewards points after spending $1,000 in the first 3 months from account opening.

Important note: If you get both business cards, you must wait the 31 days between applications as mentioned above. However, if you get one business card and one personal card, you do not have to wait as Chase allows up to two cards in a month, provided they aren’t both business cards. You could even get them the same day.

Just be aware that if you do that, it’s likely that you’ll need to call Chase reconsideration to push the second one through.

The Math on Combining Southwest Credit Card Bonuses for Companion Pass X 2 Years

If you got the Southwest Performance Business Credit Card (for 80,000 points) and the Southwest Rapid Rewards Premier Business Credit Card, you would have 140,000 Companion Pass qualifying Rapid Rewards points after meeting minimum spend = earn the Companion Pass!

Or, combine the Southwest Performance Business Credit Card (80,000 bonus points after you spend $5,000 in 3 months = 85,000 points including the points earned while meeting the minimum spend) plus any personal card (Earn 50,000 Rapid Rewards points after spending $1,000 opening plus 1,000 points for meeting the minimum spend = 136,000 total Companion Pass qualifying points) to well more than meet your requirement to earn the Companion Pass! (And then some).

Alternatively, combine the Southwest Rapid Rewards Premier Business Credit Card (60,000 bonus points) plus any personal card base bonus (50,000 points) plus the 10,000 awarded for having any of these cards means you’d have 120,000 out of the 135,000 required and need to earn 15,000 more within the same calendar year.

If you were short, you could boost your balance with things like Rapid Rewards dining, Rapid Rewards eShopping, and even Rapid Rewards hotels – but as you can see with the math above, that won’t be necessary for this Companion Pass strategy unless you only got one of the cards = earn the Companion Pass!

Now, I know that got confusing, so let’s go step-by-step…

A Simple to Follow Plan to Earn the Southwest Companion Pass with Southwest Rapid Rewards Credit Cards

Step 1:

As soon as possible, apply for the Southwest Performance Business Credit Card so you can earn 80,000 points when you spend $5,000 within 3 months OR the Southwest Rapid Rewards Premier Business Credit Card, which is offering 60,000 bonus points when you spend $3,000 in 3 months.

If you aren’t eligible for a business card, you can grab 50,000 points (plus 1,000 from meeting minimum spend) off a personal card (51,000 total) and earn the balance from spend and flights, but you’d still need to earn 74,000 more CP qualifying points- so I urge you to read this post to see if you might actually be eligible for a Business credit card!

Step 2:

Then, depending on how long you’ll need to spend required amount for your bonus on the first card, apply for your second card, but I recommend waiting at least 31 days between applications (Chase rule!) if you get two business credit cards.

If you get a business and a personal, you don’t have to wait – but get the Business credit card first.

Again this can be the Business Premier or a personal card like the Southwest Plus:

Southwest Rapid Rewards Premier Business Credit Card (annual fee of $99, 60,000 bonus points when you spend $3,000 in 3 months) – OR the Southwest Performance Business Credit Card (80,000 Rapid Rewards points when you spend $5,000 in 3 months) if you started with the Southwest Rapid Rewards Premier Business Credit Card.

Southwest Airlines Rapid Rewards Plus Credit Card

Sign Up Bonus Offer:

- Earn 50,000 Rapid Rewards points after spending $1,000 in the first 3 months from account opening.

Now, under the current bonus offers, if you get a Southwest Performance Business Credit and any of the personal credit cards, you’ll earn Companion Pass through Dec 2025 from the signup bonuses alone.

Up until Dec 11, 2023, you could have earned 75,000 bonus points on the same personal card which is why it’s so important to be subscribed to Bonus Offer Notifications on this site (just go to any card and click where it says “Turn Bonus Offer Notifications on“)

I’ll recommend that you bookmark this post and send yourself a calendar invite to remind yourself when you are due to apply for that second card.

NOTE: You used to be able to open two personal cards. Chase will no longer approve you for a second personal Southwest card. So, you may have heard that is a thing, but it’s no longer a thing….

Step 3:

Step 3 is to meet your minimum spends for the first (and second, if applicable) card anytime after January 1, 2024, though before your bonus offer period ends.

Once you meet it (both bonuses – after January 1st!!) and your next statement closes, those points will be in your Rapid Rewards account and you’ll earn the Companion Pass.

At that point, you’ll have the Companion Pass for nearly two full years.

If you have ANY questions, please ask me before you begin this Companion Pass strategy.

You don’t want to make a mistake. It’s always better to ask for clarification than to make a mistake here. Visit the MilesTalk Facebook group to ask any questions you might have.