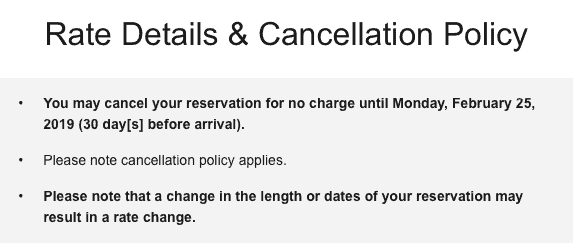

As everyone has been booking top end Marriott hotels in the Maldives and Bora Bora ahead of the Dec 31st deadline to get these for just 60,000 points a night, something to bear in mind is the cancellation policy, which is 30 days before travel in all reservations I’ve seen.

Under the new Marriott system, you no longer have the option to forfeit points in lieu of a cash cancellation policy as was the case under SPG where a simple email could convert that huge cancellation penalty into a simple loss of your points. This is something I really hope the bigger bloggers will make a big deal of and get Marriott to reconsider.

That’s because the cancellation penalties can be HUGE. How about $16,250 if you need to cancel a stay in the Maldives within 30 days for any reason? Yes, I had that written into a recent reservation and it was real. It seems to be based on Rack Rate. A lot can happen within 30 days of such a big trip. And in looking into trip cancellation coverage, a) many policies won’t cover penalty fees – only a lost prepaid rate. So your Chase Sapphire Reserve won’t help you here (I checked). And b) now that you can’t switch it to a loss of points, you could really be on the hook for this. Bear in mind that in extenuating circumstances, only the hotel can agree to waive that fee and Marriott can’t force anything no matter how loyal you are. Not only that, even if an insurance policy would cover the penalty, you’ll be looking at well over $1,000 to cover the $16,000.

Right now, there is a glitch in the system and the cancellation penalties are not being written into most confirmation emails (or showing at checkout). It says there IS one, but not how much. Don’t assume it’s negligible. The only way to find out until the glitch is fixed is to reach out to the property or ask SPG to do it for you.

Consider this a Public Service Announcement.

Have you had any experiences with these huge cancellation penalties? Let me know here, in the comments, on Twitter, or in the private MilesTalk Facebook group.

New to all of this? My new “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available now.

| Small Business Credit Cards | Bonus Offer | Best Features | More info |

|---|---|---|---|

Chase Ink Business Preferred Credit Card | 90,000 Ultimate Rewards points when you spend $8,000 in your first 3 months | Earns 3x points on travel, advertising, and shipping. This massive Welcome Bonus offer makes this card a great first business card. These points can be transferred to a range of Ultimate Rewards partners like United and Hyatt at a 1:1 ratio or spent in the Ultimate Rewards portal on travel with a value of 1.25 cents per point. Also provides complimentary cell phone insurance if you pay your monthly bill with the card. | Learn More |

Ink Business Unlimited® Credit Card | Get $750 in the form of 75,000 Ultimate Rewards points when you spend $6,000 in your first 3 months. Points are transferrable if you also hold a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred. | Best for small businesses with a lot of every day spend. This card earns 1.5x everywhere. If you don't spend a lot in the bonus categories of other cards, or want a second card to pair with one that you use in the bonus categories, this is a great card. No annual fee. Pair this with the Chase Ink Preferred for a killer 1-2 card combo. | Learn More |

Chase Ink Business Cash® Credit Card | Earn $350 in the form of 35,000 Ultimate Rewards points when you spend $3,000 on purchases in the first three months and an additional $400 in the form of 40,000 Ultimate Rewards points when you spend $6,000 on purchases in the first six months after account opening. Points are transferrable if you also hold a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred. | 5x points on up to $25,000 in office supplies, internet, cable, and phone annually. There are lots of ways to maximize this amazing 5x benefit. If you combine these points into a Chase Sapphire Reserve account to book travel, it's like 7.5% effective cash back. No annual fee. | Learn More |

The Business Platinum Card(R) from American Express | 120,000 Membership Rewards points when you spend $15,000 within 3 months. Terms apply. | Access to Centurion Lounges, Priority Pass lounges, Delta SkyClub lounges (with Delta ticket) $200 annual airline credit | Learn More |

Chase Southwest Airlines Rapid Rewards Premier Business Credit Card | 60,000 Rapid Rewards points when you spend $3,000 in 3 months | Those trying to get a Southwest Companion pass (the bonus points count). Read more about how to qualify for the Companion Pass here. | Learn More |

The Business Gold Card | 70,000 Membership Rewards points when you spend $10,000 in 3 months | Earns 4x Membership Rewards points on two categories that you spend the most on each statement cycle - up to $150,000 a year in spend). Other eligible purchases earn 1X. This card is a good choice IF you will spend heavily on at least one of the bonus categories, as this card has a moderately high annual fee. | Learn More |

Capital One Spark Miles for Business | You will earn a bonus of 50,000 miles when you spend $4,500 in the first 3 months of opening your account | This card earns 2 miles per dollar. These miles are transferable to 11 frequent flyer programs (0.75 airline miles per one Capital One mile for most partners). | Learn More |

![Chase Revamps Entire United Credit Card Lineup – See What’s Changed [COMPREHENSIVE] chase united credit card refresh](https://milestalk.com/wp-content/uploads/2025/03/united-refresh-218x150.jpg)