Last Updated: Feb 2024

In this article

What are Capital One Miles?

Capital One Miles are the rewards currency for four Capital One consumer and small business credit cards. Capital One miles can currently be transferred to 17 airline and hotel partners, redeemed at 1 cent per mile to cover travel purchases, or redeemed other subpar redemption options (covered in detail below).

If you haven’t followed the recent changes to the Capital One Miles program, you may be familiar with the statement credit function. However, the ability to transfer Capital One Miles to airlines and hotels is a somewhat recent addition.

Over the years, you’ve surely seen ads for the Capital One Venture Card that advertised the ability to earn “two miles” per dollar spent on all purchases with no blackout dates. However, until the past few years, the Venture Card was simply a 2% travel cashback card; you could only redeem Capital One “miles” to erase travel purchases — or purchase travel through Capital One — at 1 cent per point.

Then, Capital One launched new airline transfer partnerships in 2018. Even then, at best, Capital One Miles transferred to airline partners at 2 Capital One Miles to 1.5 airline miles. But, it seems that advertising the ability to earn 1.5 airline miles per dollar spent didn’t have the same ring.

However, after several transfer partner improvements in 2021, Capital One has finally reached the promised land. Venture Card and Venture X cardholders can now truly earn 2 miles (or points) per dollar spent with 15 airline and hotel transfer partners.

With these changes, Capital One Miles earns its place alongside American Express Membership Rewards, Chase Ultimate Rewards, and Citi ThankYou Points as one of the major transferrable points programs.

What Credit Cards Earn Capital One Miles

Four Capital One credit cards directly earn Capital One Miles. These cards range from the $0 annual fee Capital One VentureOne Rewards Credit Card to the premium Capital One Venture X Credit Card.

Note that there’s a backdoor way to indirectly earn Capital One Miles using other Capital One cards — we will get to that later. However, you’ll need at least one of the following four cards to earn Capital One Miles.

Capital One Venture X Credit Card

The newest card in Capital One’s credit card portfolio is the one making the biggest splash: the Capital One Venture X Credit Card. Don’t let this card’s $395 annual fee scare you away. You can easily make up that annual fee with a couple of the card’s valuable (and easy-to-use) benefits.

The Venture X Card is currently offering the chance to earn 75,000 bonus miles when you spend $4,000 within your first 6 months.

Ongoing benefits of the Capital One Venture X Card include:

- 2X Capital One Miles base earning rate on all purchases.

- 10X Capital One Miles on hotels and car rentals when booked via Capital One Travel.

- 5X Capital One Miles on airfare booked via Capital One Travel.

- $300 travel credit per cardholder year for bookings made on Capital One Travel.

- 10,000 bonus miles each account anniversary. That’s slices (at least) $100 off the effective annual fee.

- Priority Pass Select membership plus access to Capital One’s own network of lounges.

- Hertz top-tier President’s Circle elite status.

- Up to $100 in statement credits for TSA PreCheck or Global Entry application fees.

- Travel and purchase protections such as primary Auto Rental Collision Damage Waiver, Return Protection, Extended Warranty, Travel Accident Insurance, Cell Phone Protection, and more.

- No additional annual fee for authorized users — and authorized users get perks like Priority Pass, Hertz President’s Circle, and access to Capital One Lounges.

- No foreign transaction fees.

Capital One Venture Card

The Venture X Card is the new card on the block, but the “OG” Venture Card is the Capital One Venture Card. Like the Venture X, the Venture Card earns 2X Capital One miles on all purchases. However, you’ll get fewer perks for the card’s much-lower $95 annual fee.

Benefits of the Venture Card include:

- 2X Capital One Miles on all purchases.

- 5X Capital One Miles on hotels and car rentals when booked via Capital One Travel.

- Up to $100 in statement credits for TSA PreCheck or Global Entry application fees.

- Two free Capital One lounge visits per calendar year, then $45 per visit.

- Hertz Five Star elite status.

- Travel and purchase protections such as secondary Auto Rental Collision Damage Waiver, Extended Warranty, Travel Accident Insurance, and more.

- No foreign transaction fees.

Capital One Venture X Business

Capital One Venture X Business benefits include:

- No Preset Spending Limit (great for high-spend business; pay in full( This is a charge card.

- 2X Capital One Miles base earning rate on all purchases.

- 10X Capital One Miles on hotels and car rentals when booked via Capital One Travel.

- 5X Capital One Miles on airfare booked via Capital One Travel.

- $300 travel credit per cardholder year for bookings made on Capital One Travel.

- 10,000 bonus miles each account anniversary. That’s slices (at least) $100 off the effective annual fee.

- Priority Pass Select membership plus access to Capital One’s own network of lounges.

- Up to $100 in statement credits for TSA PreCheck or Global Entry application fees.

- No additional annual fee for authorized users — and authorized users get perks like Priority Pass, and access to Capital One Lounges.

- No foreign transaction fees.

Capital One Spark Miles for Business

The only Capital One small business card that (directly) earns Capital One Miles is the Capital One Spark Miles for Business. Cardholders earn 2X Capital One Miles on all purchases, or 5X miles on hotel and rental car booked via Capital One Travel. $0 intro annual fee for the first year, then $95 after.

- 2X Capital One Miles on all purchases.

- 5X Capital One Miles on hotels and car rentals when booked via Capital One Travel.

- Up to $100 in statement credits for TSA PreCheck or Global Entry application fees.

- Two free Capital One lounge visits per year, then $45 per visit.

- No additional annual fee for employee cards.

- No foreign transaction fees.

There is also a no annual fee Capital One Spark Miles Select for Business, though at just 1.25 miles per dollar instead of 2, this would only be a better option for the smallest of spenders.

Capital One VentureOne Rewards Credit Card

The only no annual fee card that earns Capital One Miles is the Capital One VentureOne Reward Credit Card. In exchange for paying no annual fee, you’ll give up a lot of potential mileage earning. The Capital One VentureOne card earns just 1.25X miles on all purchases.

Despite this low earning rate, the Capital One VentureOne Rewards card could provide crucial access to the Capital One Miles program at no extra cost. New cardholders can earn 20,000 bonus miles after spending $500 within 3 months.

The card’s limited benefits include:

- 1.25X Capital One Miles on all purchases.

- 5X Capital One Miles on hotels and car rentals when booked via Capital One Travel.

- If approved for a Visa Signature card, get protections like Auto Rental Collision Damage Waiver, Extended Warranty, and Travel Accident Insurance.

- No foreign transaction fees.

Combine Capital One Rewards Between Multiple Capital One Cards

If you have multiple Capital One cards, you can transfer Capital One Miles — or cashback earnings — between eligible Capital One cards. This can be useful for moving rewards from a rarely-used account to an active account.

Capital One rewards transfers also open up the possibility of converting cashback rewards into Capital One Miles. In short, there are three ways you can transfer Capital One rewards between accounts:

- From one cashback card to another cashback card.

- From one Capital One Miles card to another Capital One Miles card.

- From a cashback card to a Capital One Miles card.

It’s that third option that can be especially lucrative. Say you have a Capital One Savor Rewards card. This card earns 4% cashback on dining, entertainment, and popular streaming services.

4% cashback is a great earning rate, but earning 4X Capital One Miles can be much more valuable. And, by converting your Savor Rewards cashback to a Capital One Miles earning card, you can effectively earn 4X Capital One Miles on these purchases.

The Capital One SavorOne is also an excellent choice as it has no annual fee. The 4% categories of the Savor drop to 3% in exchange. This is actually going to work out better for all but high spenders on the card.

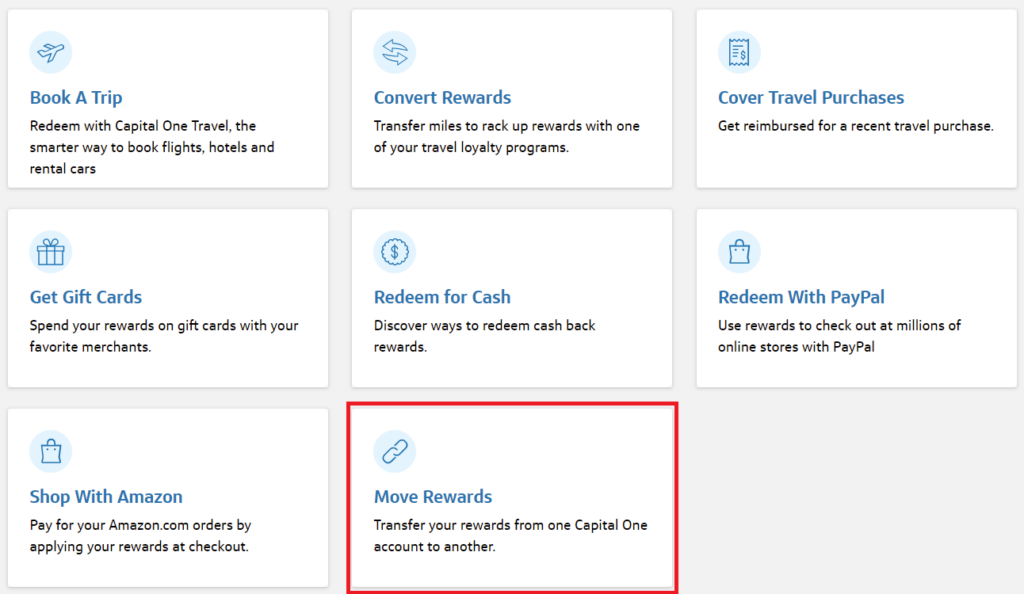

How to Combine Capital One Rewards Between Accounts

Here’s how to transfer Capital One rewards between your Capital One card accounts:

- Log into your Capital One account.

- Open the card you want to transfer from and click the “Explore Rewards” box.

- Scroll down and click the “Move Rewards” option.

- Choose an eligible card from the dropdown list.

- Enter how many rewards points you want to transfer.

- Click “Share” to process the transfer.

Capital One Rewards Transfers are Free

Some airline and hotel loyalty programs charge fees to transfer miles or points between accounts, but you don’t have to worry about that with Capital One. Capital One doesn’t charge a fee to move rewards between accounts.

Transferred Capital One Rewards Don’t Expire

When you transfer ThankYou Points between accounts, you only have 90 days to use the points before they expire. Again, you don’t have to worry about that with Capital One. Transferred Capital One rewards don’t expire.

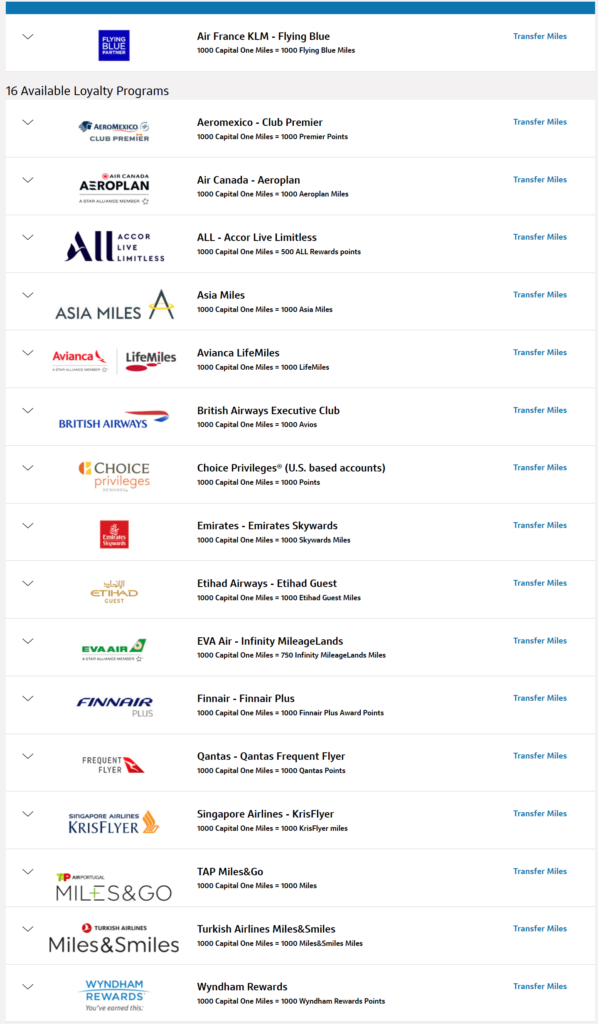

Capital One Transfer Partners (Airline and Hotel)

Here are the 17 airline transfer partners and hotel points programs to which you can transfer your Capital One miles. Capital One miles transfer to all partners at a 1:1 transfer ratio, unless noted:

| Capital One Miles | ||

|---|---|---|

| Transfer Ratio | Expected Transfer Time | |

| Air Canada (Aeroplan) | 1:1 | Instant |

| Air France / KLM Flying Blue | 1:1 | Instant |

| Avianca Lifemiles | 1:1 | Instant |

| Aeromexico | 1:1 | Instant |

| British Airways Avios | 1:1 | TBD |

| Cathay Pacific Asia Miles | 1:1 | Nearly instant |

| Choice Hotels | 1:1 | 1 day |

| Emirates Skywards | 1:1 | Instant |

| Etihad Guest | 1:1 | 1-2 days |

| Finnair | 1:1 | Instant |

| Qantas | 1:1 | 1-2 days |

| Singapore Airlines KrisFlyer | 1:1 | 1-2 days |

| TAP Air Portugal | 1:1 | TBD |

| Turkish Airlines Miles&Smiles | 1:1 | TBD |

| Wyndham Rewards Hotel Program | 1:1 | Instant |

| EVA | 2:1.5 | 1-2 days |

| Accor Live Limitless (ALL) Hotel Program | 2:1 | 1-2 days |

| Virgin Red | 1:1 | TBD |

These transfer rates and partners haven’t always been this way. Here’s a quick MilesTalk timeline on the development of the Capital One transfer program over the past few years:

- December 2018: Capital One Miles Transfer Go Live

- February 2020: Capital One Adds Accor and Wyndham as New Transfer Partners

- April 2021: Capital One Adds New Transfer Partners; Adds 1:1 Transfer Tier

- October 2021: Capital One Improves “Miles” Transfers – Most Now 1:1

- October 2021: Capital One Loses JetBlue as a Transfer Partner

Do Capital One Miles Transfer to United or Delta?

We’re often asked if you can transfer Capital One miles to United. You can’t – only Chase Ultimate Rewards [Guide] can transfer to United. Likewise, we’re asked if you can transfer Capital One Miles to Delta. Again, you cannot – only American Express Membership Rewards [Guide] can be transferred to Delta. Still, using Skyteam or Star Alliance partners, you can book flights on both Delta and United. For example, using Capital One miles transferred to Turkish to book United.

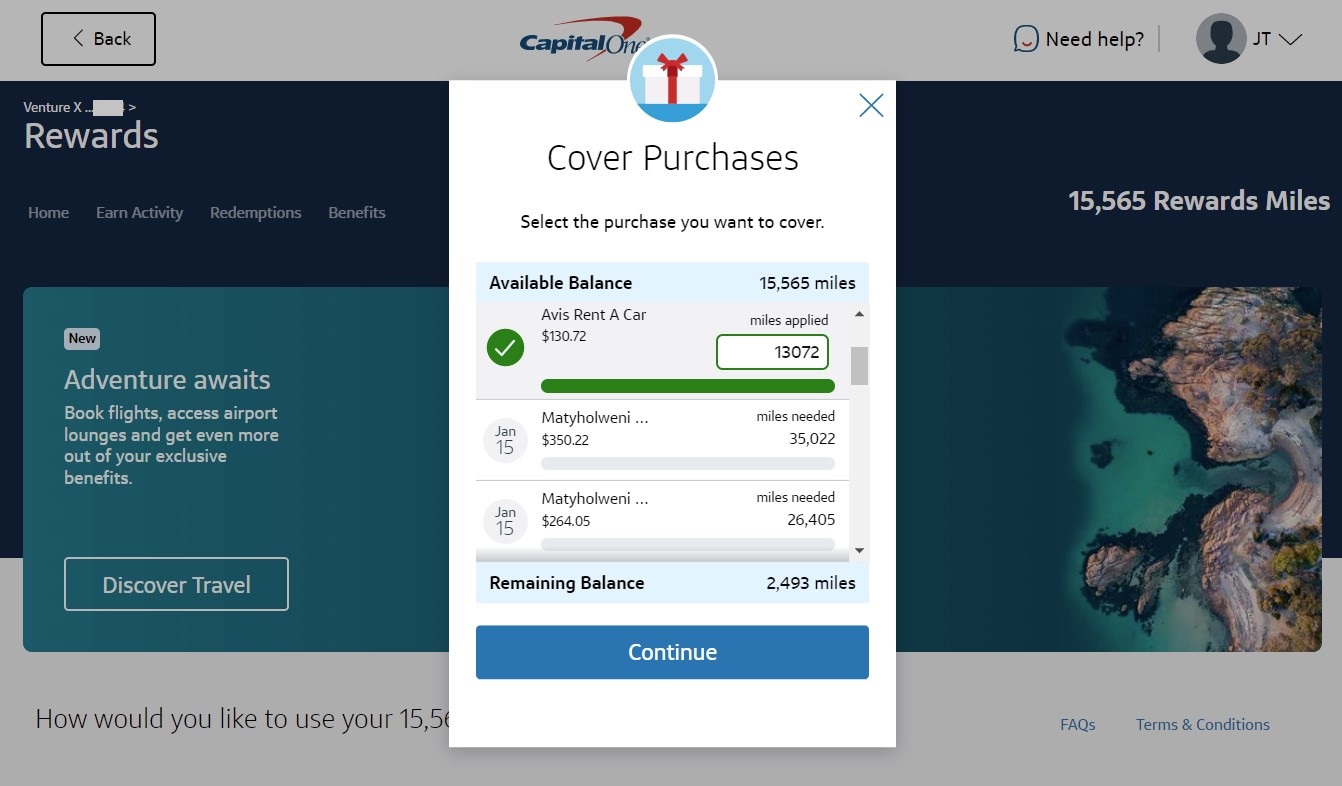

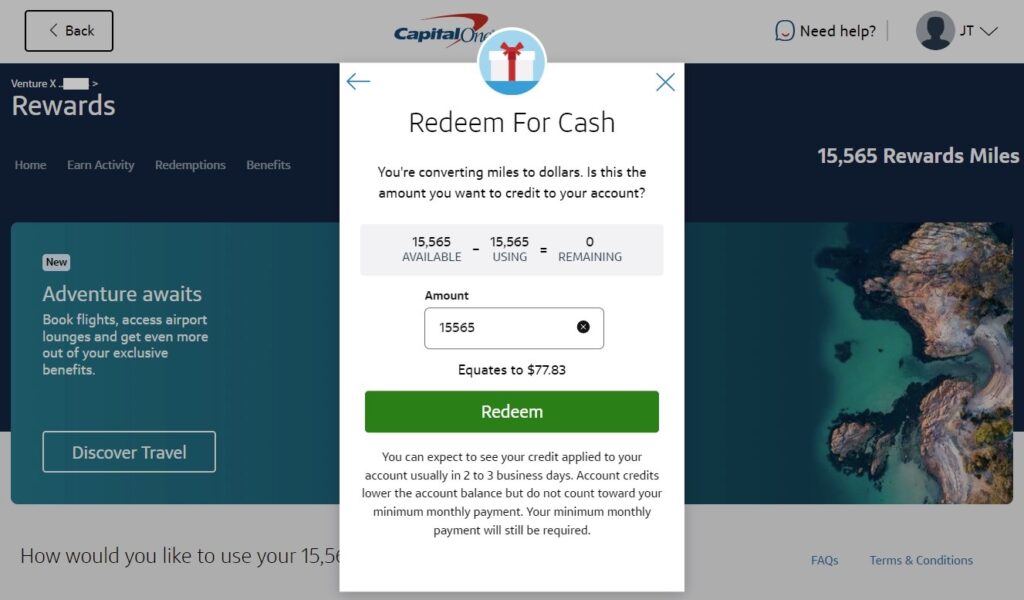

What are the Best Ways to Redeem Capital One Miles?

Capital One lists the eight ways to redeem your Capital One Miles. In descending order from most valuable to least valuable, those redemption options are:

- Convert Capital One Miles to 17 airline or hotel programs (mostly 1:1 transfers).

- Book a trip through Capital One Travel (1 cent per mile).

- Cover travel purchases recently charged to your card (1 cent per mile).

- Get gift cards (between 0.8 and 1 cent per mile).

- Redeem through PayPal (0.8 cents per mile).

- Shop with Amazon (0.8 cents per mile).

- Redeem for cash back rewards (0.5 cents per mile).

Last but not least, you can transfer rewards to another one of your Capital One accounts. You’ll get 1 Capital One mile per 1 Capital One mile transferred. Or, if your card earns cash back, you can transfer cashback earnings to another cashback card or to a miles-earning card. More on that option later.

How Much are Capital One Miles Worth?

As you can see from the above section, it’s a bit subjective and varies depending on how you choose to redeem. When used to book or be reimbursed for travel, they are worth just 1 cent, but when transferred to a partner like Turkish, you can get crazy value. On balance, we value Capital One miles at 1.6 cents each.

Sweetest Capital One Miles Sweet Spots

As mentioned above, the highest redemption value (or, the best way to redeem Capital One Miles) is found by transferring miles to airline and hotel partners.

However, unlike redeeming Capital One Miles for travel purchases at a flat rate, there’s a lot more variability to the redemption rate you can get from these redemptions. By transferring to the wrong partner or using miles for a low rate, you can end up with less than one cent per mile in value.

On the flip side, you can get multiple cents per Capital One Mile in value from the top redemption offers, which is why they are the best way to use Capital One Miles. Here are 10 of the best sweet spots of Capital One Miles transfer partners:

- Domestic U.S. flights (including to Hawaii) for 10,000 miles each way in economy or 15,000 miles in Business Class on United via Turkish Miles&Smiles. For just a few more miles, you can fly anywhere in Mexico, Canada or the Caribbean as well!

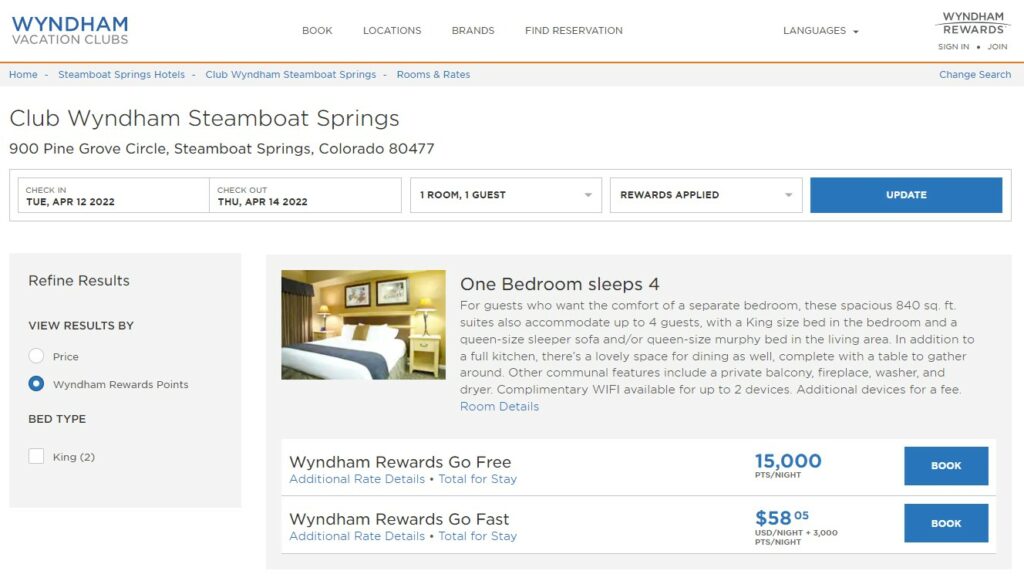

- Wyndham Rewards hotel nights from 7,500 points per night. One-bedroom villas from 15,000 points per night (price limits apply). Or redeem as few as 3,000 points plus cash using “Go Fast” rewards.

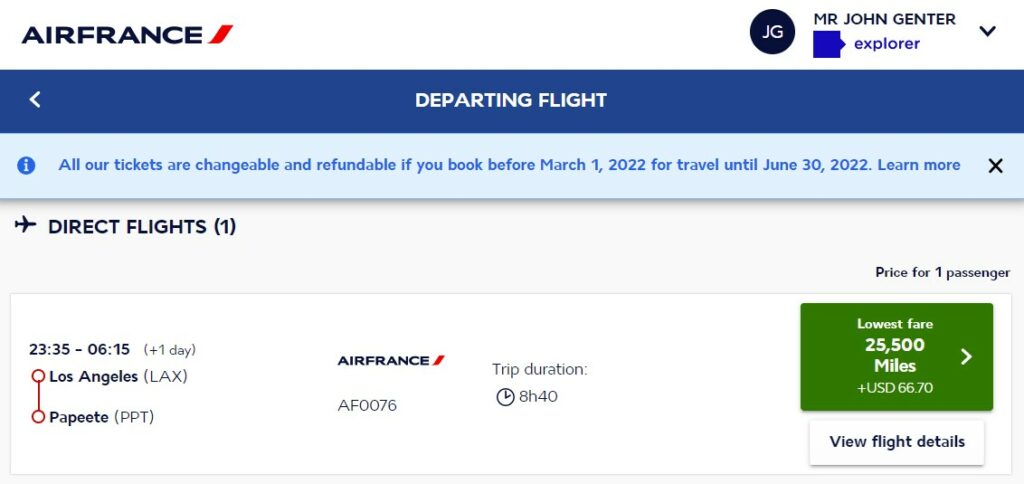

- Flights to Tahiti for 25,500 miles each way on Air France via Flying Blue.

- Business class to Brussels for 44,000 miles each way nonstop on Brussels Airways via Etihad Guest.

- Business class to Casablanca for 44,000 miles each way nonstop on Royal Air Maroc via Etihad Guest.

What Credit Bureaus are Pulled When Applying for a Capital One Card?

Capital One is one of a few banks that may pull your credit report from all three major credit bureaus (TransUnion, Experian, Equifax) when deciding whether or not to approve you for a new card.

This is important for a few reasons. First, Capital One may deny your application if you have a black mark on any of your credit bureau reports. Also, you’ll likely get a new hard credit inquiry reported to each of the credit bureaus. This means a likely, but temporary, credit score drop in all three major credit scores when you apply for a new Capital One credit card — whether or not you’re approved.

Capital One Airport Lounges

One of the newest perks of Venture X and Venture X Business cards is the ability to visit Capital One Lounges. The first location in this new network of airport lounges opened in Dallas/Fort Worth in November 2021.

Capital One cardholders have been blown away by the quality of this new Capital One Lounge — from fresh food and made-to-order cocktails to unique perks like an exercise room and yoga studio.

Capital One Lounge Locations and Hours

So far, Capital One has only opened one Capital One Lounge, with two more in the works. Here are the current and planned locations:

- Dallas/Fort Worth (DFW): near gate D2, opens at 6 a.m., closes at 9 p.m.

- Denver (DEN): open

- Washington Dulles (IAD): open

Capital One Lounge Access

Not all Capital One cardholders can free access to Capital One Lounges. Here’s how Capital One Lounge access breaks down by card:

- Capital One Venture X and Capital One Venture X Business: Unlimited access for cardholders (including authorized users) and up to two guests. Additional guests cost $45 each.

- All other Capital One cardholders and general public: $65 per person per visit.

- Kids under 2 are free.

Advanced Strategy: Spend on Spark Cash Plus; Convert Cashback to Capital One Miles

If you’re a big spender, you definitely want to give the Capital One Spark Cash Plus a closer look. In short, the Spark Cash Plus is an unlimited 2% cashback small business card.

However, unlike most Capital One credit cards, the Spark Cash Plus is a charge card — meaning it doesn’t have pre-set spending limits. So, big spenders won’t have to worry about making payments partway through the month to avoid running out of available credit.

Also, Capital One won’t report new Spark Cash Plus cards to your personal credit report. That means you won’t have to worry about a high credit utilization number dragging down your credit score.

Rather earn 2X miles on your huge business card spending instead? All you need is also get a Capital One Venture Card, Venture X Card, or Spark Miles Card. Then, move your Spark Cash Plus cashback earnings to one of these cards to effectively convert your earnings into transferable Capital One Miles.

Capital One Application Rules

Like all other card issuers, Capital One has some unofficial rules about who will be approved for a new card and how often you can get a new Capital One card. Here are the current application restrictions Capital One has in place:

Limit on number of cards: Capital One limits the number of Capital One-branded consumer cards you can have to just two. This limit doesn’t include Capital One’s co-branded cards (e.g. Walmart Store Card) or small business cards.

Timing of applications: Capital One will only approve you for one consumer or small business card every 6 months.

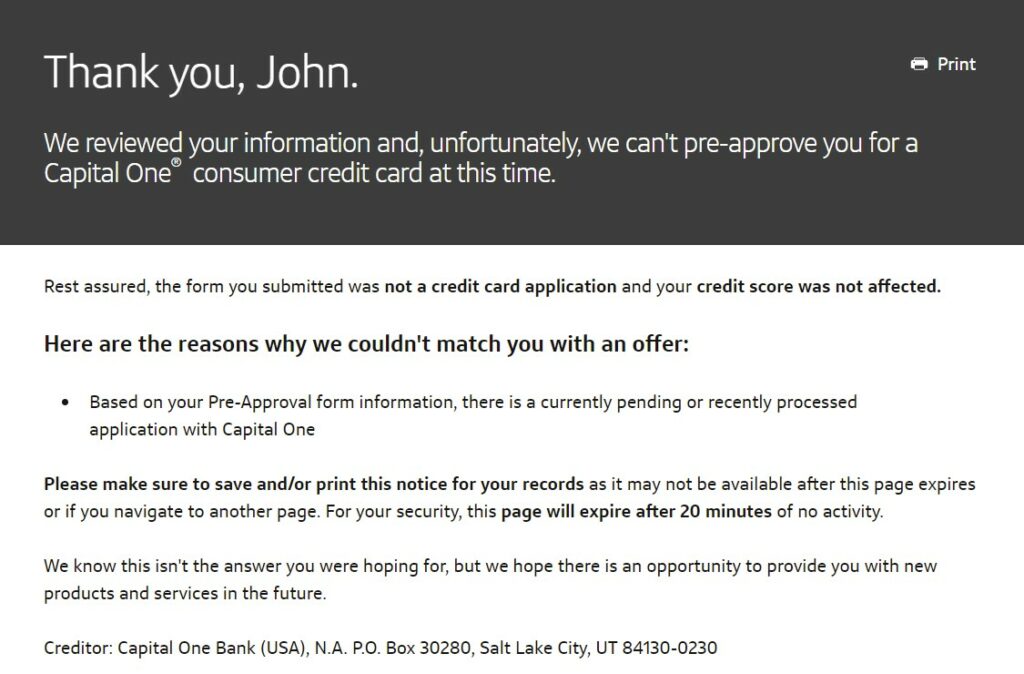

Pre-approval: Capital One offers a 9-step pre-approval form for you to see if you’re pre-approved for any Capital One cards. This can be a useful tool to see if you meet the Capital One application restrictions.

For example, I wasn’t pre-approved for any Capital One cards as I’ve opened the Capital One Venture X card within the last six months. In my case, the pre-approval form listed the reason for my rejection as: “there is a currently pending or recently processed application with Capital One.”

Capital One Upgrades, Downgrades, and Product Changes

The state of Capital One product changes is a bit in flux, especially with the recent addition of the new Capital One Venture X.

Capital One Venture cardholders can upgrade their card to the Venture X card. In fact, Capital One is offering some cardholders targeted offers of 50,000 bonus miles for doing so. The upside to upgrading like this is that you can avoid new credit inquiries and a new account on your credit report. However, you’ll miss out on the bonus currently being offered to new Capital One Venture X cardholders.

if you’re curious about your Capital One upgrade options, you can start by calling the number on the back of your card. Or, Doctor of Credit shared this link to check your upgrade options online.

Since Capital One checks all three credit bureaus when you apply, you might be wondering if Capital One will check your credit report before a product change. Thankfully, this isn’t the case. So, you won’t have to worry about a hard pull of your credit.

You can also call to downgrade a card from a premium version (with an annual fee) to a no-annual fee version, however you’ll give up a lot on your earn rate – in most cases you’ll earn enough less that you’d have been better off paying the annual fee!

If you’re downgrading to save on the annual fee, keep in mind that you need to downgrade your Capital One card 60 or more days before your annual fee posts. If you downgrade within 60 days or after the fee posts, you won’t get a refund of the annual fee that you paid.

Applying for a Credit Card that Earns Capital One Miles

You can use these links:

- Capital One Venture X Credit Card

- Capital One Venture Card

- Capital One Venture X Business

- Capital One Spark Miles for Business

Bottom Line

It used to be the case that Capital One Miles were nothing more than points you could rebate against travel purchases. But those days are long gone as Capital One has moved full on into the transferable points space, offering a ton of flexibility in redeeming your Capital One Miles.

Questions?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![Amazon “Pay One Point” Deal Links (Compilation) [UPDATED] amazon pay one point pay 1 point links amex chase citi discover](https://milestalk.com/wp-content/uploads/2023/11/payonepoint-218x150.png)