In this article

Do I Need a Business to Apply for a Business Credit Card?

The answer is “not really.”

Now, don’t take that too liberally either. Let me be specific. You don’t need to have a registered business with its own business name. You don’t need an EIN (Employer Identification Number). If you have a full time business and an EIN, of course you are eligible. But you didn’t need to Google this article to find that out.

Assuming you don’t have a full time business, what is the criteria to apply for and be approved for Business Credit Cards? And why do you care?

First, you care because realizing that you are eligible for Business Credit Cards is a game changer with regards to the various new cards, new card bonus offers, and spending bonus categories that are available to you.

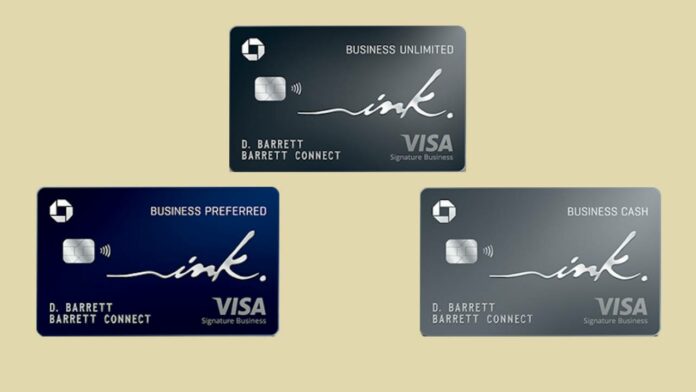

But I also love the fee-free Chase Ink Unlimited (1.5X on everything) and the Chase Ink Cash (5X at office supply stores).

Just keep in mind that you need a Chase Sapphire Reserve, Chase Sapphire Preferred or Chase Ink Business Preferred in order to be able to transfer points from the fee free cards to transfer partners.

Sounds great – but back to the story….

Do I Qualify for a Business Credit Card?

1) You do need to conduct business outside of a day job. You are not eligible if you have a salaried position and no other income.

2) A side business /gig / whatever…. DOES count. If you consult on the side, you qualify. If you sell things on eBay.com, you qualify. If you sell your crafts on Etsy, you qualify! As you can see, any side income – and there are many possible ways you might have that – counts!

3) If you do not have an official business name and an EIN (Employer Identification Number), you must apply in a very specific way. Do not mess this up or you will be declined.

Here’s how to apply correctly

- Your business name is simply your own name. If you are “John Paul Smith” on your personal credit cards, then put “John Paul Smith” as your name and “John Paul Smith” again as your Business name. If you use “John Smith” (i.e. if you don’t normally use a middle name) then use “John Smith” as your name and “John Smith” again as your Business name.

- Your Tax ID number will be your SSN (Social Security Number).

- Your business income will be the amount you are making or will earn from your side business (anything not salary).

- You would *not* include investment income etc, except if it is part of your business income.

If you meet the criteria above, my favorite small business cards are below. Different benefits for different preferences, so scan them all before choosing one.

You can also find the Best Business Credit Card Bonuses at Your Best Credit Cards.

| Small Business Credit Cards | Bonus Offer | Best Features | More info |

|---|---|---|---|

Chase Ink Business Preferred Credit Card | 120,000 Ultimate Rewards points when you spend $8,000 in your first 3 months | Earns 3x points on travel, advertising, and shipping. This massive Welcome Bonus offer makes this card a great first business card. These points can be transferred to a range of Ultimate Rewards partners like United and Hyatt at a 1:1 ratio or spent in Chase Travel(SM) on travel with a value of 1.25 cents per point. Also provides complimentary cell phone insurance if you pay your monthly bill with the card. $95 annual fee waived the first year. | Learn More |

Chase Ink Business Unlimited | Get $750 in the form of 75,000 Ultimate Rewards points when you spend $6,000 in your first 3 months. Points are transferrable if you also hold a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred. | Best for small businesses with a lot of every day spend. This card earns 1.5x everywhere. If you don't spend a lot in the bonus categories of other cards, or want a second card to pair with one that you use in the bonus categories, this is a great card. No annual fee. Pair this with the Chase Ink Preferred for a killer 1-2 card combo. | Learn More |

Chase Ink Business Cash Credit Card | Earn $350 in the form of 35,000 Ultimate Rewards points when you spend $3,000 on purchases in the first three months and an additional $400 in the form of 40,000 Ultimate Rewards points when you spend $6,000 on purchases in the first six months after account opening. Points are transferrable if you also hold a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred. | 5x points on up to $25,000 in office supplies, internet, cable, and phone annually. There are lots of ways to maximize this amazing 5x benefit. If you combine these points into a Chase Sapphire Reserve account to book travel, it's like 7.5% effective cash back. No annual fee. | Learn More |

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)

![Chase Ultimate Rewards Points [Complete Guide] chase ultimate rewards guide](https://milestalk.com/wp-content/uploads/2020/01/chase-ultimate-rewards-guide-218x150.jpg)

[…] long as you can qualify for a business credit card (See: Do You Need a Business to Qualify and Apply for a Business Credit Card?), then there is a very easy […]

[…] second thing you will need to determine is if you are eligible for Business credit cards. Read that page to see if you are (it will open in a new window) as that will impact your strategy. […]

[…] If you are just getting started in miles and points, it may not be immediately obvious why your first card should in most cases be a Chase Ink Business Preferred card. You might initially be thinking that you can’t even get a business credit card, but there’s also a good chance that’s an incorrect assumption and that is why you should also read this article on the topic: Do You Need a Business to Qualify and Apply for a Business Credit Card? […]

My side jobs are not consistent (tutor every now and then) and it’s all cash payment. Will this be a problem in qualifying for a business card?

As long as you have at least a little revenue in your year, you are good to go 🙂

How little is “a little revenue?” My side gig made 2.2K last year. Is there a minimum amount of business income the cards will typically approve?

Hey Lindsey! There’s not really a set minimum but I probably wouldn’t apply with less than $5,000 in side income. If you are on track for that this year, then you should be all set.

@Dave I canceled my SW Premier Business card in October 2020. I’d like to reapply now. I have the option to reapply and use my name as the business name (as you suggest) rather than the name of my side gig/business (which is what I used for the card I canceled in 2020).

Do you think approval of my new application is more or less likely using my name instead of the business name I used on the canceled card? Does it matter? I realize I’m asking you to speculate on the vagaries of Chase’s card approval process. Thanks for your thoughts.

Anecdotally, I think that when you have an EIN and business entity, that’s the better path unless applying for a second card (that you currently have).

Thanks very much Dave. I used my business LLC name and SSN (as I did on my original application several years ago on the canceled business card) and my new application was approved within minutes. I don’t have an EIN. Thanks again for your guidance.

A note for others: don’t forget to temporarily unfreeze or unlock your credit file during the application process (if you’ve locked it). It shouldn’t need to be unfrozen for more than a few minutes/hours, or a day at most, if all is good.

Hi there,

If we sell on Etsy and have an LLC, but don’t have $3K-$5K expenses, I’m thinking this wouldn’t work correct? Because it needs to be business expenses?