Last Updated: May 2024

Now that Citi has made cash back from the Citi® Double Cash Card – 18 month BT offer transferable to ThankYou points at a 1:1 ratio, you can now effectively earn 2 ThankYou points per dollar on all spend, with the optionality of converting to ThankYou points later – or redeeming for the cash whenever you choose.

In this article

The Citi cards in Play Are the Citi Strata Premier® Card, Citi Double Cash®, Citi Custom Cash℠ Card and Rewards+®

The Citi Strata Premier®: Unlocks 1:1 transfers of Citi ThankYou points to 15 airline partners.

The card earns 3x Citi ThankYou points on dining, groceries, air travel, hotels, and gas. That’s a lot of 3X categories!

With a large bonus for spending $4,000 in your first three months, we definitely recommend starting with the Citi Strata Premier®.

The Citi® Double Cash Card: Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. So, if you have the Premier, you would use the anything that isn’t travel, gas, entertainment or restaurants.

The Citi Rewards+®: Gives you a 10% rebate on redeemed ThankYou points up to 10,000 rebated points (on 100,000 redeemed) per year. Also rounds up small purchases to max out earned points on small transactions.

The Citi Custom Cash℠ card, which earns 5% on your top bonus category each month, up to $500 in spend, and features some unique bonus categories like Home Improvement Stores, Drugstores, and Live Entertainment (Concerts ad Shows).

The bonus offer on the Citi Custom Cash is not related to the Citi Premier eligibility rules – meaning you can get the bonus offer on both. You cannot Rewards+ and Premier within the same 24 month period.

Citi Quadfecta or Citi Trifecta?

Now that the Citi Prestige has both a higher annual fee, at $495, and no longer allows concierge bookings, it’s not as much of a “no brainer” card as before. Many will balk at the small signup bonuses on the Citi Double Cash card (generally no bonus) and the Citi Rewards+, but keep in mind that you should be able to product change nearly any open Citi card to either of these. Many of us have older, potentially dormant, Citi cards we stopped using and those are perfect conversion candidates.

So at a minimum, you’d want the Citi Double Cash, for 2X points on all non-bonused spend, and a Citi Strata Premier or Citi Prestige (no longer available) for the ability to transfer these points to airlines (assuming this all pans out such that Double Cash-earned points are transferable. I guess that would simply be a Citi Bifecta.

The Citi Rewards+ will earn you back 10,000 points a year if you max the 100,000 in ThankYou point redemptions each year, which is “worth” about $160 based on my valuations for ThankYou points. That would be the Citi Trifecta.

Quinfecta?!

I don’t know if Quinfecta is a word, but once I add the new Citi Custom Cash card to my wallet, I’ll have 5 cards in the Citi ThankYou ecosystem all working together.

Essentially nothing changes in the Quadfecta above, but by adding in the Custom Cash as my fifth card, I will be able to earn 5X ThankYou points on any of these bonus categories.

- Restaurants

- Gas Stations

- Grocery Stores

- Select Travel

- Select Transit

- Select Streaming Services

- Drugstores

- Home Improvement Stores

- Fitness Clubs

- Live Entertainment

Just note that it’s whatever category you spend the most on each billing cycle and it’s capped at $500 per month. It’s easy to see why this is a great addition.

Where Can You Transfer Citi ThankYou points?

| Citi ThankYou Transfer Partners | Last updated: June 2024 | |

|---|---|---|

| Transfer Ratio | Approximate Transfer Time * | |

| AeroMexico | 1:1 | Generally instant |

| Air France Flying Blue | 1:1 | Instant |

| Avianca LifeMiles | 1:1 | Instant. |

| Cathay Pacific AsiaMiles | 1:1 | Instant |

| Etihad Guest | 1:1 | Instant |

| Emirates | 1:! | Instant |

| Eva Air | 1:1 | ~1-3 days |

| JetBlue TrueBlue | 1:1 | Instant |

| Qantas | 1:1 | Instant to 1 day |

| Qatar Privilege Club | 1:1 | ~2 days |

| Singapore Airlines | 1:1 | ~1-2 days |

| Thai Orchid Plus | 1:1 | ~3-7 days |

| Turkish Airlines Miles&Smiles | 1:1 | 1-2 days |

| Virgin Atlantic | 1:1 | Instant to 2 days |

| Hotels | ||

| Choice Hotels | 1:2 (Citi Prestige / Premier / Chairman cards) 1:1.5 (No fee Citi ThankYou cards) | Instant |

| Wyndham Rewards | 1:1 (Citi Prestige / Premier / Chairman cards) 1:0.8 (No fee Citi ThankYou cards) | TBD |

| Accor Live Limitless | 1:0.5 | TBD |

What are the Best Citi ThankYou partners?

It certainly depends on your personal travel goals. Here are a few of mine:

Turkish Airlines

Turkish Miles&Smiles represents a sort of “hidden” opportunity. It’s part of Star Alliance and offers some incredible deals like 12,500 miles to fly NYC-LAX/SFO in United Business Class or 45,000 miles from the US to Europe in Business Class. The award booking engine online, however, can be buggy and if the trip you want can’t be booked online for whatever reason, you are left trying to email a ticket office which can work – or not work.

Needless to say, it’s also great for booking award flights on Turkish, whose Business Class is highly regarded, especially for the onboard food and service.

The real golden sweet spot, though, is in flying to/from anywhere in North America including Mexico, Hawaii, Alaska, Canada, Bermuda and even the Netherlands Antilles for 15,000 points or less in Business Class. We’ve got a guide to booking these Turkish Airlines awards here.

Avianca LifeMiles

Read this post for the best uses of Avianca LifeMiles. In short, 63,000 miles from the US to Europe in Business Class or 87,000 miles from the US to Europe in First Class with no carrier surcharges is why some people love using LifeMiles. That can save several hundred dollars when booking Lufthansa First Class.

Be sure to also read LifeMiles Awards – Changes and Cancellations: What You Need to Know as there are downsides to the program.

Cathay Pacific AsiaMiles

AsiaMiles is the best way to redeem Citi ThankYou points on Oneworld carriers. They have stopped charging carrier imposed surcharges on their own award flights, but they will still pass them on from carriers that charge them like British Airways, Qantas, and Qatar. Much like you can redeem British Airways Avios effectively on short domestic trips on American Airlines, AsiaMiles can do the same for just a drop more miles.

Virgin Atlantic Flying Club

Virgin’s miles can be incredibly useful. My favorite uses are for a round trip in First or Business Class to Japan on ANA (just 145,000 – 170,000 miles round trip) or to fly on Delta-operated flights like US – Europe in Business Class (excluding the UK) for 50,000 Virgin miles each way (Delta would charge 80,000 SkyMiles minimum each way).

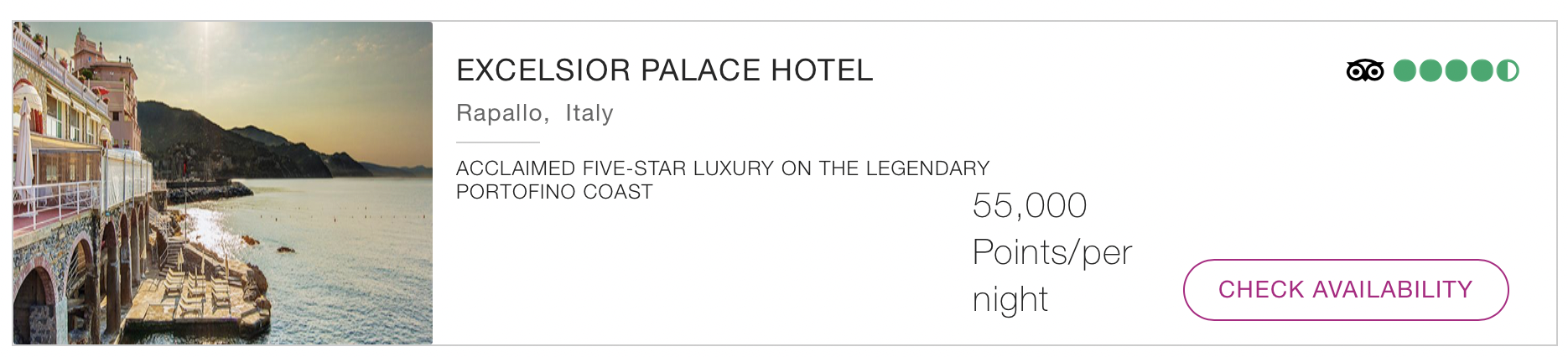

Choice Hotels

You might not instantly recognize the value of Choice Hotels as a new part of the Citi ThankYou arsenal, but that doesn’t mean you can’t find some significant value here.

In fact, if you have a Citi Premier or Citi Prestige, you’ll get 2 Choice Privileges points for every 1 Citi ThankYou point transferred.

Now, of course you can use this to simply book Choice Hotels properties, which include Comfort Inn, Sleep Inn, Quality Inn, EconoLodge, Rodeway Inn, Ascend, and Cambria, among others. And you can find some solid value there on the discount side of hotel offerings.

But if you are like me, you like a bit more upscale for your points. And that is where the Choice Hotels partnership with Preferred Hotels and Resorts comes in.

You can search the above link to see all of the options, but I’ll give you two examples to whet your whistle.

The Excelsior Palace Hotel on the Portofino Coast in Italy can easily exceed 400 Euros per night. But it can be booked for 55,000 Choice Privileges points which is just 27,500 Citi ThankYou points. That’s about 2 cents per point in value.

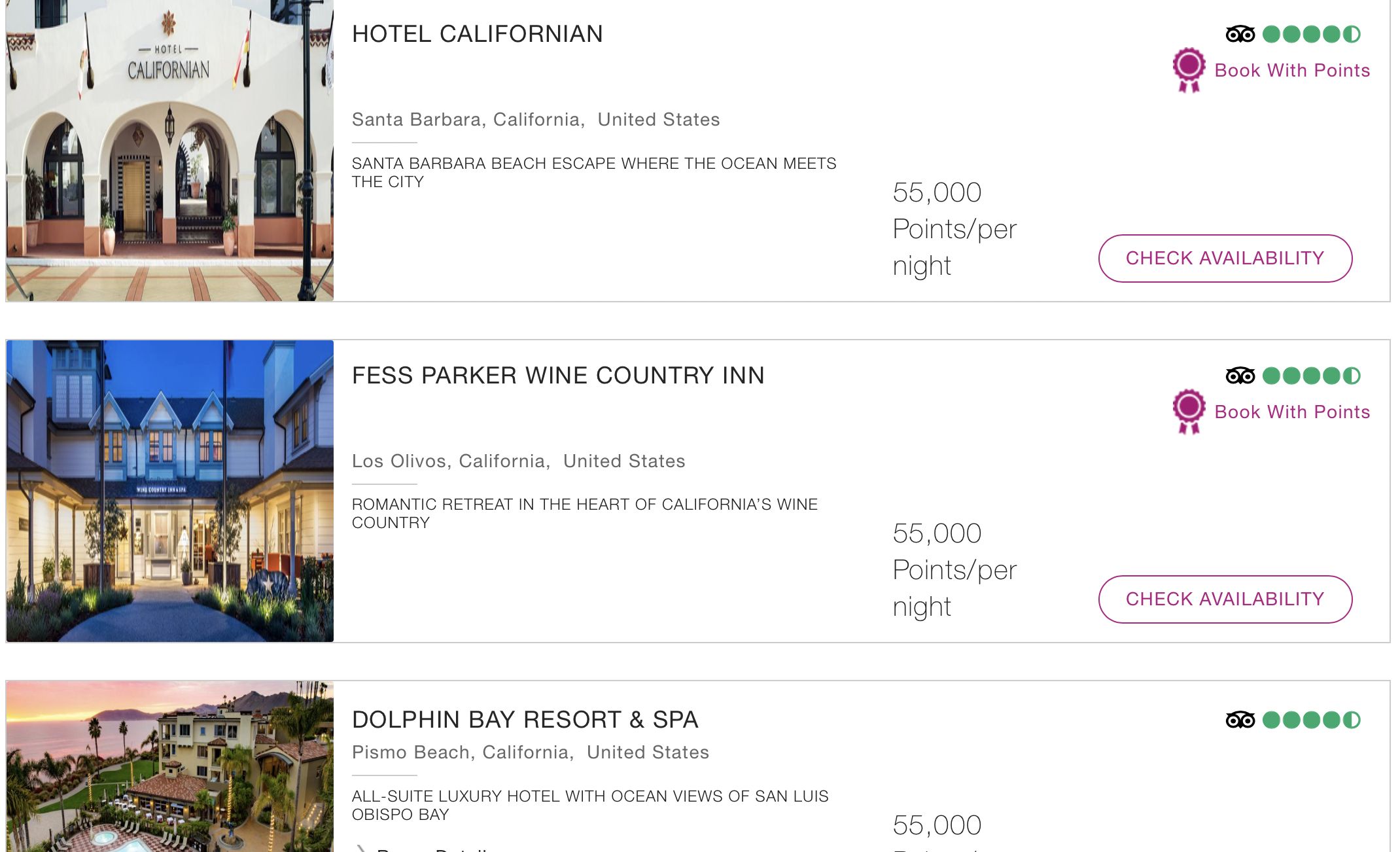

Closer to home, check out these hotels in California for 55,000 points (27,500 Citi) that can run north of $500 a night.

Another great way to use Choice points is at Nordic Choice Hotels (you can’t book using points here, but you can browse), which operates in Sweden, Norway, Finland, and Denmark. Starting at just 10,000 Choice points (which is just 5,000 Citi ThankYou points from Premier/Prestige cards), you can get rooms that cost over $200. Yes, you can get 4 cents per Citi ThankYou point in value this way!

Wyndham Rewards

While this isn’t exclusive to Citi, and Wyndham Rewards isn’t insanely special at a 1:1 transfer rate, it’s worth knowing about. For one, if you are on the Status Match Merry Go Round and need some Caesars Rewards credits (for example, to access Laurel Lounges), you can transfer from Wyndham to Caesars. Just bear in mind this transfer can take up to a week, so you can’t do this once you are on property.

A better use is on Vacassa vacation rentals. While you do need to book by phone (866-996-7937) and you may have trouble finding an agent that even knows how to do it, the value can be pretty sweet. That’s because you will pay 15,000 points per bedroom. That could mean you pay 30,000 points for a nice two bedroom cabin somewhere – or it could mean a house with just one “technical” bedroom could be a huge value at 15,000 points. But you’ll have to also be aware that you cannot cancel a Vacassa reservation within 30 days of travel (yes, that kind of stinks!) and you seem to not be able to book a base rate over about $325 per bedroom (per Frequent Miler).

Lastly, you can book Wyndham properties (of course!) directly online with a range of 7,5000 to 30,000 points per night (all hotels are 7,500, 15,000 or 30,000 points per night).

A Reminder About Citi Card Benefits

Bear in mind that Citi has removed the following benefits from all of these cards:

- Worldwide Car Rental Insurance

- Trip Cancellation & Interruption Protection

- Worldwide Travel Accident Insurance

- Trip Delay Protection

- Baggage Delay Protection

- Lost Baggage Protection

- Medical Evacuation

- Price Rewind

- 90 Day Return Protection

- Missed Event Ticket Protection

- Roadside Assistance Dispatch Service

- Travel & Emergency Assistance

The Citi Double Cash also lost Extended Warranty and Purchase Protection.

If you want, you can see which Citi Cards still offer Extended Warranty as a benefit.

It’s up to you if that moves the needle for you on these cards versus cards that still have those benefits like Chase credit cards that earn Chase Ultimate Rewards points.

Applying for these cards:

If you apply for the Citi Strata Premier, Citi Double Cash, Citi Rewards+, or Custom Cash through these links, MilesTalk earns a commission for which we are extremely grateful.

Will this change impact the mix of cards in your wallet?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)

[…] for Citi Double Cash “points” to become transferable and speculated it might make a Citi Trifecta or Quadfecta a thing. The news was first reported via Reddit and Doctor of Credit and surfaced as a notice on a […]

[…] – Will the “Citi Trifecta / Quadfecta” be a thing come Sept 23? […]

[…] month, I wrote about the new Citi Trifecta / Quadfecta that exists now that the Citi Double Cash credit card has points convertible to Citi ThankYou […]

[…] It’s not very exciting to me, but Citi has added Aeromexico as a transfer partner for the Citi ThankYou program. What does excite me, though, and why I think this warrants a post is that it’s great to see Cit continuing to invest in the ThankYou program and working to make it stronger – especially now that we have an official “Citi Trifecta” card combo. […]

[…] Citi Trifecta, which is comprised of the Citi Premier, Citi Double Cash, and the Citi […]