In this article

These Citi Credit Cards Still Have Extended Warranty Coverage

In September 2019, Citi removed some benefits on many of its cards in a surprising way – eliminating things like their popular Price Rewind, car rental insurance, return protection and extended warranty coverage.

But you may be surprised to learn that several Citi credit cards still have an Extended Warranty coverage benefit.

And you may be even more surprised to know that, for the cards that still offer the benefit, it’s industry leading with a Citi credit card adding not 1 year like American Express, but a full 2 years to the original manufacturer’s warranty coverage.

Citi Credit Cards With Extended Warranty

These Citi credit cards still have the 24 month Extended Warranty coverage benefit:

- Citi Strata Premier® ($95 annual fee)

- Citi Rewards+® (no annual fee)

- Citi Prestige® ($495 annual fee – no longer available to new applicants)

- Citi® / AAdvantage® Platinum Select World Elite Mastercard

- Citi® / AAdvantage® Executive World Elite MasterCard®

- American Airlines AAdvantage Mileup Card (no annual fee)

- AT&T Access Card from Citi (no annual fee)

- Citi ThankYou Preferred Card (no annual fee)

Citi Costco Visa (Ended Jan 22, 2023)

The following two cards offer Extended Warranty again as of November 2024, however, they offer a slightly less rich benefit as described further down on this page.

- Citi Double Cash® (no annual fee)

- Citi Custom Cash℠ Card (no annual fee)

Citi Extended Warranty Coverage Terms – All Eligible Cards – Except the Double Cash and Custom Cash

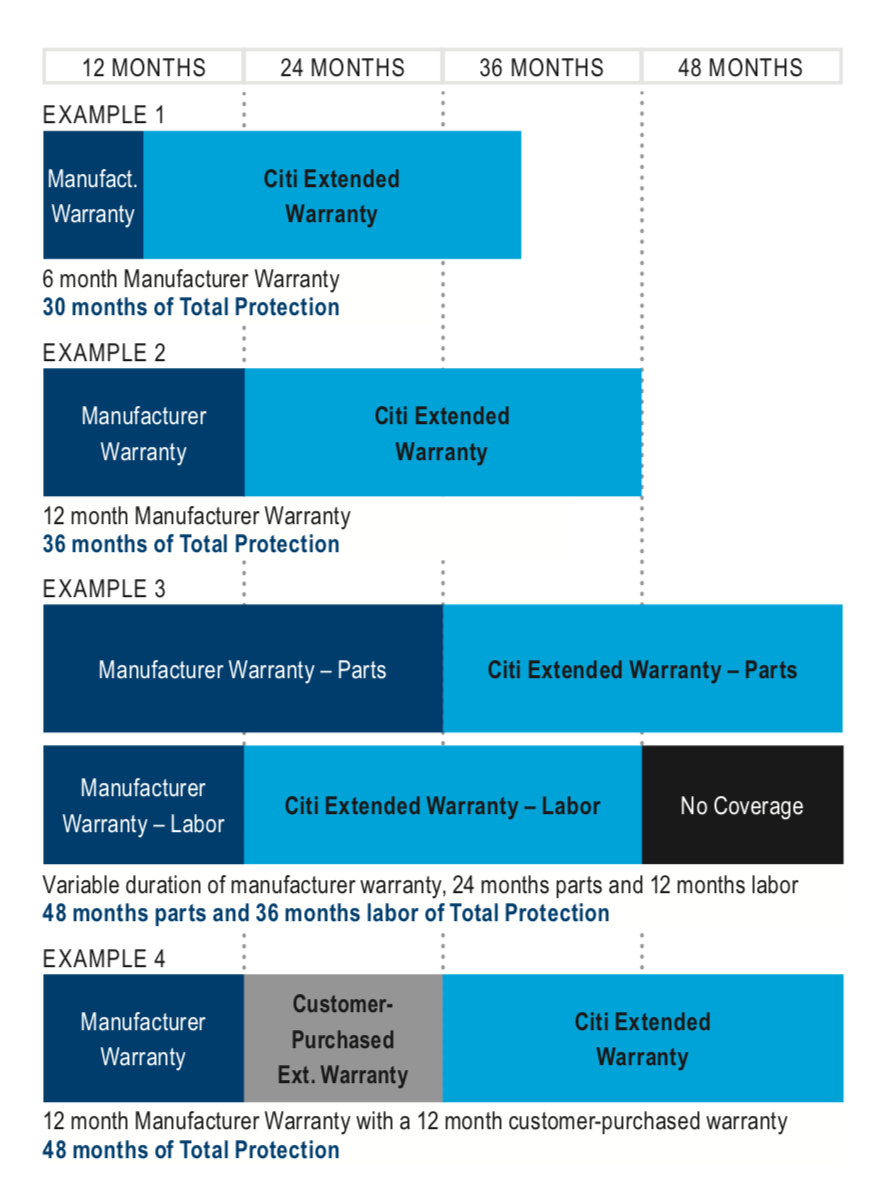

What’s amazing about this Extended Warranty benefit is that you get a full two extra years added to your warranty (Amex and Chase add just one). So if your purchase has a standard 1 year warranty, this Extended Warranty benefit means you are covered for 3 full years if you put it on one of the above Citi credit cards. However, it’s important to note that the Extended Warranty on the Double Cash and Custom Cash are not the same, offering a bit less. See the next section for details.

- Get an extra 24 months added to your warranty when you purchase items at least in part with your Citi card and/or ThankYou® Points. If your eligible item breaks, we’ll repair, reimburse or replace it, up to the amount charged on your Citi card and/or ThankYou® Points or up to $10,000 per item, whichever is less.

- Extended Warranty Coverage begins when the manufacturer’s warranty, or an extended warranty you bought, expires.

- In no event will total Extended Warranty coverage exceed seven years from the purchase date.

- Covered: Purchases made with your Citi card and/or ThankYou® Points that come with a manufacturer’s warranty.

- Not Covered: Cars, boats, aircraft or any motorized land, air or water vehicles and their original equipment. Tires are not covered. Items that do not come with a manufacturer’s warranty are not covered.

This Extended Warranty coverage benefit is an extremely generous credit card benefit, especially on the no annual fee cards. See how it works in tandem with the manufacturer’s warranty:

As you can see, if you buy an extended warranty, the Citi benefit will start after that one ends.

Citi Extended Warranty Coverage Terms – for the Double Cash and Custom Cash

Whereas all the cards except these two (that offer Extended Warranty at all) add 24 months to your warranty, the Double Cash and Custom Cash Extended Warranty benefit does not straight up add 24 months; rather it doubles your warranty up to 24 months.

“Extended Warranty may double the time period of your covered purchase’s original Manufacturer’s Warranty or Store Warranty up to a maximum of twenty-four (24) months following the day that the Manufacturer’s Warranty or Store Warranty expires.”

Pretty important distinction as the warranties on the Double Cash and Custom Cash are more similar to extended warranties from other card issuers whereas the ones on the other cards listed above are truly best in industry.

To File an Extended Warranty Claim

The Citi website directs you to call 1-866-918-4670 or download and return the completed claim form as soon as possible after the item fails. When calling, you will be asked a few questions and advised what documents should be submitted to support your extended warranty claim.

Return all required documents within 180 days of the incident. You will be notified of the decision once your claim is processed.

You can check your Citi credit card benefits guide for yourself right here.

MilesTalk Musings

For some reason, I’d assumed that when Citi removed so many credit card benefits in 2019, this was removed from most cards.

Since I was surprised to see that it actually still has extended warranty coverage on most of its credit cards, including several cards with no annual fee, I thought you might have also missed this.

And while I knew that Citi’s extended warranty coverage was 2 years, my mind still thinks that American Express offers two years of extended warranty. It used to, but they recently reduced their extended warranty coverage to just 1 additional year, making Citi the king of extended warranties. Chase also offers just one additional year.

Questions?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[INSANE] Get up to 25 Years of JetBlue Mosaic Status and 350,000 TrueBlue Points – and it’s not THAT Hard!](https://milestalk.com/wp-content/uploads/2025/06/jetblue-25years-218x150.png)

![Ocean Casino’s New Cruise Partner is…. [Updated]](https://milestalk.com/wp-content/uploads/2024/05/virgincruisematch-218x150.jpg)

![[NOW LIVE] The New Chase Sapphire Reserve® – A Complete Transformation The New Chase Sapphire Reserve](https://milestalk.com/wp-content/uploads/2025/06/new-chase-sapphire-reserve-feature2-218x150.jpg)

![Chase Ultimate Rewards Points [Complete Guide] chase ultimate rewards guide](https://milestalk.com/wp-content/uploads/2020/01/chase-ultimate-rewards-guide-218x150.jpg)

![Amazon “Pay One Point” Deal Links (Compilation) [UPDATED] amazon pay one point pay 1 point links amex chase citi discover](https://milestalk.com/wp-content/uploads/2023/11/payonepoint-218x150.png)

I’d love to get a good extended warranty credit card, but Citi is giving me mixed messages. The AT&T card application page’s benefits doesn’t mention any warranty benefit, and that might be the case for all the cards too (I checked the Premier page, same deal). When I contacted Citi chat, I was told to check… that same application page. Is there any way to make sure the benefit exists before I get a hard pull applying for it?

It’s a great question. I cannot locate that information on the application pages. I wrote this article by logging in to my own accounts to check benefits along with some outside research, but cannot specifically point to any corresponding info on their non-logged in pages.

I just called their benefits number (866-918-4670) and confirmed that my recently opened Citi Premier does have extended warranty and purchase protection benefits. That was comforting as I have read recent reviews of the card which claimed that it did not come with those benefits.

I have returned with a data point! A Citi Rewards+ credit card I opened on June 9, 2022 came with 2-year extended warranty benefits. I know this because A) the card’s information mail came with a booklet of benefits that includes the extended warranty, and B) once I activated the card, the extended warranty was also listed under my card on the Citi benefits site.

P.S. I want to add that on the cover of my benefits booklet it says “Effective Date: September 2019.” Which gives me the impression benefits are not modified or removed very often. So knowing that, it feels unlikely that extended warranty would ever be axed for new applicants without any announcement on Citi’s part. (Just my speculation, could be wrong)

I’m glad to see that the Citibank credit cards still have an extended warranty! This is a great feature to have and I’m sure that I’ll be using it a lot in the future.

What about the Shop Your Way card?

Great breakdown of Citi’s extended warranty options! I didn’t realize some cards still offer this benefit. This information is super helpful for making an informed choice when applying for a new credit card. Thanks for sharing!

This was an incredibly helpful post! I had no idea some Citi credit cards offered extended warranty benefits. I’ll definitely be checking my card details to see if I’m eligible. Thanks for breaking it down!

Great post! I had no idea some Citi credit cards offered extended warranty benefits. I always thought this feature was limited to a few premium cards. I’ll have to check if my card is one of them. Thanks for the info!

Great breakdown of Citi credit cards and their extended warranty features! I had no idea some of them offered such valuable protection. Definitely going to consider the Citi Double Cash card for my future purchases. Thanks for sharing this info!

Great post! I didn’t realize there were still Citi credit cards offering extended warranty benefits. It’s super helpful to know which ones to look for. Thanks for the detailed info!

Great post! I didn’t realize some Citi credit cards still offer extended warranty benefits. This information is super helpful as I consider which card to use for my next big purchase. Thanks for breaking it down!