Last fact checked: January 2024

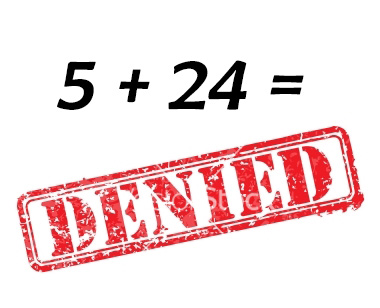

If you sign up for a lot of credit cards just to get the miles/points bonus (and why not?!), you need to know about the 5/24 rule from Chase, because it changes the rules of engagement.

In this article

What is Chase 5/24?

Chase is trying to get less people opening credit cards just for the bonus offers in favor of more spending. Makes sense, right?

So they are limiting the number of cards you can signup for in 24 months. It wouldn’t be so bad if it was a limit of 5 Chase cards per two years. But it’s not.

What it means is that if you have opened 5 new personal credit cards – from any issuer – in the last 24 months (plus any Capital One or Discover business cards, since those get reported to your personal credit profile) you will not be approved for a new Chase card.

Business cards (other than Capital One or Discover) you’ve applied for shouldn’t affect 5/24, since they don’t report to your personal credit file.

But it DOES apply to applying for a new Chase business card if you are over 5/24.

As well, if you are an authorized user on any personal card, that will count against you, however, if you have yourself removed as an AU and wait a few weeks, then it won’t count. As well, if you are declined and the AU account is what put you over the count, a reconsideration specialist can remove that and manually approve you (you have to apply online first and be denied to call). The Chase phone number in that case is 1-888-270-2127 for Chase personal card reconsideration or 1-800-453-9719 for Chase business card reconsideration.

What cards does this affect?

For a long time there were exceptions. For the most part, all Chase credit cards are included now.

What’s the strategy for dealing with Chase 5/24?

Obviously this one will depend on you, but my suggestion is to plot out what cards you want over the foreseeable future. Over a period of approx. 6 months, go for all the Chase Ink cards you would like. At the same time you may want one or two Chase personal cards – perhaps a Chase Sapphire Reserve or the Chase Sapphire Preferred.

Then go ahead and over the next 6 months apply for the remaining Chase cards you want. Don’t go too fast. One per month (let’s say 32 days) is safe. You may end up with 3-6 Chase cards in total over a year.

At the same time, you can safely open small business cards from other issuers as they won’t count. If you see an amazing bonus on a personal card you want, it’s more than OK to get that. Don’t sacrifice all just to max every possible Chase card. But keep track of your application dates so you know when you are hitting up against 5/24.

New: Chase 5/24 Now Seems to Apply to Credit Line Increases as well, meaning that if you ask for a CLI with Chase but are at/over 5/24, you’ll be denied the CLI.

New: Some Chase cards seem to no longer be subject to 5/24 restrictions (Southwest, Marriott, United, and Marriott cards)

Is anyone else doing this?

All the issuers are waking up in different ways. American Express, for example, is now limiting to one bonus per card product, per lifetime, and recently also started denying bonuses to people that, in its sole opinion, have opened and closed too many cards. That might even be worse, depending on your perspective. Citi, in most cases, will make you wait either 24 months for a new ThankYou card bonus or 48 months for Citi’s American Airlines credit cards.

Questions?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)

![[TODAY!] Amazon Prime Day July 16-17: Pay One Point Discounts! amazon prime day discount](https://milestalk.com/wp-content/uploads/2021/06/prime-day-discount-218x150.jpg)

![HUGE 120,000 Point Bonus Offer on Chase Ink Preferred® [Best Ever] Chase Ink Preferred 120,000 Point Bonus Offer](https://milestalk.com/wp-content/uploads/2024/07/cibp-120k-218x150.jpg)

[…] pages linked above, but truthfully, these cards are best suited for those that are already past 5/24, know the Best Ways to Spend Avianca LifeMiles, and could use a miles boost. Personally, I would […]

[…] Because of the Chase 5/24 rule which says that you won’t be approved for a new Chase card (with some exceptions) if you have […]

[…] never suggest getting them early in your card journey, as you wouldn’t want these taking up 5/24 slots, but once you are over 5/24 or have all the Chase cards you want, it’s worth thinking about […]

[…] you are over 5/24, though, and are looking for new cards, the combination of 25,000 bonus points and the $100 annual […]

[…] for over a year, you’d convert that to the Double Cash. If you don’t (and you are over 5/24 already) this would seem to be a case where you would want it in your wallet […]

[…] positive change for Amex cardholders, especially ones locked out of the Chase ecosystem due to its restrictive 5/24 rules. It also feels like a shot across the bow at Citi which just upped their game on the no-annual fee […]

[…] You won’t be approved if you are over 5/24. […]

[…] long as you are still under 5/24 (you’ve opened less than a total of 5 personal credit cards in the last 24 months, you can […]

[…] If you already have the old IHG card, you can get this one too, but you won’t be approved if you are over 5/24. […]

[…] apply for the Business card first and then the Personal card – just in case you are at 4/24 (of 5/24) with Chase already as the Business card won’t count against you. Remember to do this at all, […]

[…] know is that Chase issues some of the most popular credit cards and also has a policy, dubbed The 5/24 Rule, that will cause Chase to deny you for a new credit card if you have opened 5 or more personal […]

[…] you are eligible for the bonus after all restrictions, including 5/24, this is basically the best bonus we can expect to […]

[…] you got all three cards over time (keep in mind you can only get two Chase cards within 30 days and all three of these cards are subject to 5/24) you could earn 180,000 bonus points, worth from $1,800 – $2,700 or more, just from signup […]