Update: for whatever reason, the IRS payment sites code this as credit even though it is debit. So what is below will no longer work.

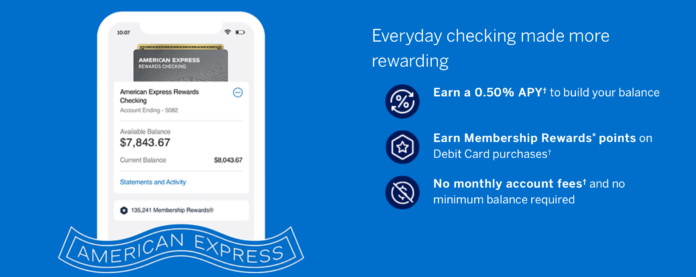

Amex launched a new online checking account today and before you wonder if this is a shill piece for Amex or a few hot tips in how to best earn some extra Membership Rewards points, it’s the latter.

You see, the new checking account comes with a debit card that earns 0.5 Membership Rewards points for every dollar spent. More on this in a second…

First off, you’ll need at least one consumer American Express credit card in your wallet. That’s to open the account. Specifically, you’ll need an American Express Card that earns Membership Rewards. The account is currently earning 0.5%, which lags both Marcus at 0.6% when you have AARP linked or 0.7% at Bask Bank. So, we aren’t thinking about leaving tons on deposit here. Of course, you’ll need to deposit enough to fund your debit card spending.

That should be it for qualifying…. so why would you want this account?

Again, it’s the debit card.

We used to have lots of debit cards that earned miles and points, until the Durbin amendment killed off almost all of them. Now, I can’t think of a single national account that earns points.

And there are some clutch ways to capitalize on this. Here are a few:

- Pay taxes! Oh man, you know some people wind up owing tens of thousands (or more) on taxes. I’ve written about the best credit card option for paying taxes, which nets you a 0.13% guaranteed win or more if you know how to use ThankYou points well.

But this is much, much better. You’ll pay just a couple of bucks in fees for as much as you need to pay in taxes. Imagine you owe $50,000 in tax. If you pay with this debit card, you’ll pay around $2.20 in fees and earn 25,000 Membership Rewards points which I would value at $425.

- Get cash back at the grocery store. Sure, you should have one of the best credit cards for grocery spend, like an Amex Gold Card. But if you don’t, or if you just want to divide transactions, consider that many grocery stores and some drugstores will give you cash back when you pay. If you debit $20 in groceries and $100 in cash, you get points on $120 in spend.

One more…

- Anywhere you can pay with a debit card no fee. Venmo is a great example.

Anywhere you can pay with debit no fee, but not with a credit card, is also a prime use for this over paying with cash or check.

Perhaps you have some more ideas? Let me know below!

Note that this isn’t a review of the actual debit card / bank account product. It does not seem to have the best range of acceptance and is not fee-free overseas. Something like a Schwab account or other card that gives you ATM withdrawals with fees reimbursed and no foreign transaction/ withdrawal fees abroad is still the way to go there.

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![Chase Revamps Entire United Credit Card Lineup – See What’s Changed [COMPREHENSIVE] chase united credit card refresh](https://milestalk.com/wp-content/uploads/2025/03/united-refresh-218x150.jpg)

![[LAST DAY to BOOK OLD RATES] Hyatt’s Annual Category Change is March 25th: What You Need to Know Grand Hyatt Kauai - Lobby](https://milestalk.com/wp-content/uploads/2021/04/IMG_1291-2-218x150.jpg)

Denied on both mine and p2. Weird.

Could you payoff credit card bills with this debit card?

Not sure if technically possibly but I wouldn’t go near that. Prime shutdown bait.

Dave, do you know whether there is a daily or monthly spend limit? The thread on Doctor of Credit had someone saying that there is a $5000 daily limit, in your tax example, that would mean that one would need to pay ten days in a row, still a good deal fees wise, but kinda a lot of work..

I would 1,000% defer to DoC on limits as that wasn’t known the day of launch.