I’ve been somewhat obsessively trying to book top end Suite Spot hotels and resorts with Marriott while they are fixed at the Cat 7 60,000 point a night rate. (In peak season, these will rise to 100k/night). We’ve been told we’d have until the end of December this year to get our bookings in and at some point in the next week or two, we should have the ability to do a Points Advance for all brands (meaning that you can reserve the room without the points in hand… just mind those cancellation penalties!!

Well, it’s possible we may now have an extra 2 months (or 3?) because the Marriott website now shows that March is when the Category 8 will go live. It’s not clear if this also means Peak Pricing will be delayed 2 or so months as well.

This would be pretty amazing as it would mean the chance to book some great resorts well through the end of 2019.

I’m not 1,000% sure this is confirmed but I don’t know how else to read the website. I’m sure we’ll see more chatter soon confirming.

Update: Since I posted this, as I expected, other bloggers have confirmed this is definitely true. No more “?”

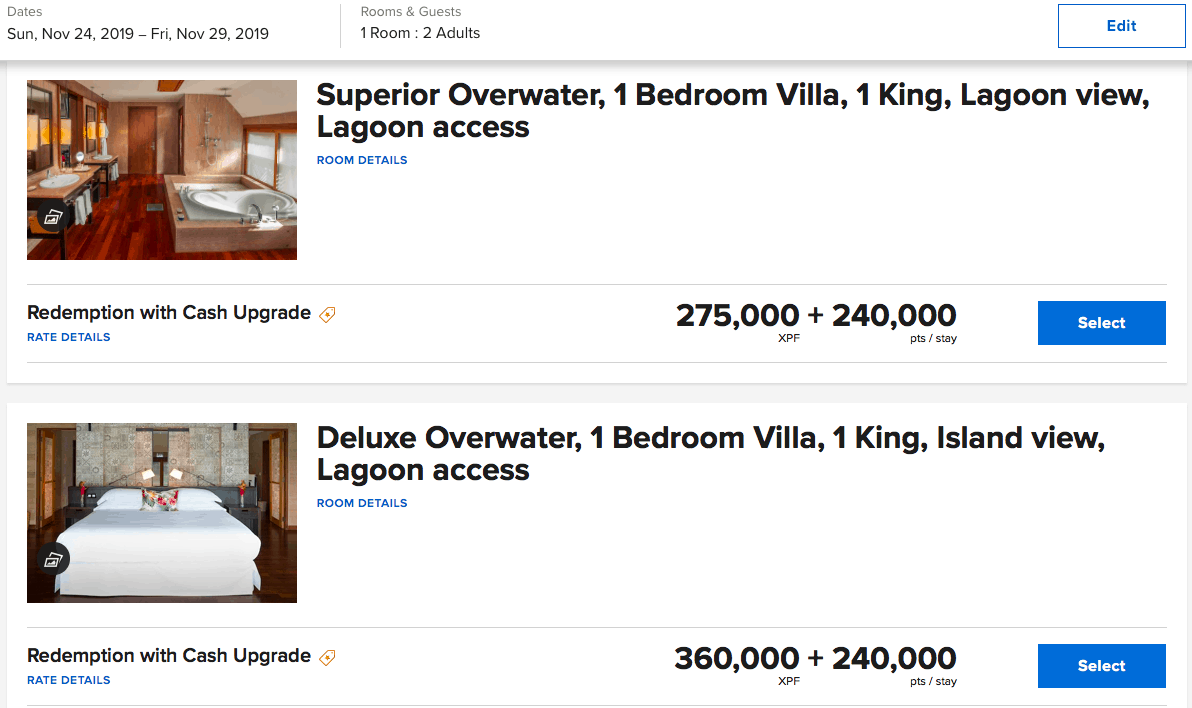

This is also a good time to mention that I noticed a couple of days ago that Bora Bora is flush with availability now through the end of the schedule, HOWEVER I cannot find any dates with a base room at St Regis (plenty with a cash component of $2,000 plus over a 5 night stay) and the base room at Le Meridien Bora Bora is available but is literally a room – not a villa.

Here’s an example of the rates at the St Regis Bora Bora:

Some of you may find this more palatable than me. I’ve been looking a lot at the Maldives and have an upcoming stay in March. I think for the money and length of trip, the Maldives appear nicer than Bora Bora, though I’d love to hear your pros and cons in the comments.

Thoughts? Let me know here, in the comments, on Twitter, or in the private MilesTalk Facebook group.

New to all of this? My new “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available now.

| Small Business Credit Cards | Bonus Offer | Best Features | More info |

|---|---|---|---|

Chase Ink Business Preferred Credit Card | 90,000 Ultimate Rewards points when you spend $8,000 in your first 3 months | Earns 3x points on travel, advertising, and shipping. This massive Welcome Bonus offer makes this card a great first business card. These points can be transferred to a range of Ultimate Rewards partners like United and Hyatt at a 1:1 ratio or spent in the Ultimate Rewards portal on travel with a value of 1.25 cents per point. Also provides complimentary cell phone insurance if you pay your monthly bill with the card. | Learn More |

Ink Business Unlimited® Credit Card | Get $750 in the form of 75,000 Ultimate Rewards points when you spend $6,000 in your first 3 months. Points are transferrable if you also hold a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred. | Best for small businesses with a lot of every day spend. This card earns 1.5x everywhere. If you don't spend a lot in the bonus categories of other cards, or want a second card to pair with one that you use in the bonus categories, this is a great card. No annual fee. Pair this with the Chase Ink Preferred for a killer 1-2 card combo. | Learn More |

Chase Ink Business Cash® Credit Card | Earn $350 in the form of 35,000 Ultimate Rewards points when you spend $3,000 on purchases in the first three months and an additional $400 in the form of 40,000 Ultimate Rewards points when you spend $6,000 on purchases in the first six months after account opening. Points are transferrable if you also hold a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred. | 5x points on up to $25,000 in office supplies, internet, cable, and phone annually. There are lots of ways to maximize this amazing 5x benefit. If you combine these points into a Chase Sapphire Reserve account to book travel, it's like 7.5% effective cash back. No annual fee. | Learn More |

The Business Platinum Card(R) from American Express | 120,000 Membership Rewards points when you spend $15,000 within 3 months. Terms apply. | Access to Centurion Lounges, Priority Pass lounges, Delta SkyClub lounges (with Delta ticket) $200 annual airline credit | Learn More |

Chase Southwest Airlines Rapid Rewards Premier Business Credit Card | 60,000 Rapid Rewards points when you spend $3,000 in 3 months | Those trying to get a Southwest Companion pass (the bonus points count). Read more about how to qualify for the Companion Pass here. | Learn More |

The Business Gold Card | 70,000 Membership Rewards points when you spend $10,000 in 3 months | Earns 4x Membership Rewards points on two categories that you spend the most on each statement cycle - up to $150,000 a year in spend). Other eligible purchases earn 1X. This card is a good choice IF you will spend heavily on at least one of the bonus categories, as this card has a moderately high annual fee. | Learn More |

Capital One Spark Miles for Business | You will earn a bonus of 50,000 miles when you spend $4,500 in the first 3 months of opening your account | This card earns 2 miles per dollar. These miles are transferable to 11 frequent flyer programs (0.75 airline miles per one Capital One mile for most partners). | Learn More |

![Chase Revamps Entire United Credit Card Lineup – See What’s Changed [COMPREHENSIVE] chase united credit card refresh](https://milestalk.com/wp-content/uploads/2025/03/united-refresh-218x150.jpg)

I have been to the The Thalasso and Le Moana in Bora Bora as well as the Holiday Inn Resort in Maldives. I can honestly say that you can not go wrong with either stay. Other than the flights you will not see much price difference between Bora Bora and the Maldives. You will find beautiful sand and water at each location. The people are equally friendly at both locations. I would return to either place in a heart beat. Enjoy!!