In this article

Last week, I wrote about a major upcoming change to Bank Direct regarding the American Airlines AAdvantage Banking Accounts:

BankDirect Accounts for AA Miles Decimated – Will 1099 Miles

I dissected the value of the miles if you had to pay tax on the miles at 1 cent – or possibly even more – as the Bank didn’t immediately disclose the value.

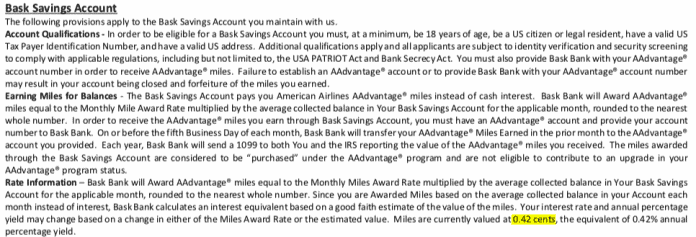

But two readers commented on that post, thank you @Jared and @Anonymous, that the Terms and Conditions linked from the FAQ page on the Bask Bank website now show a preliminary value of 0.42 cents per mile.

I had to read the Terms & Conditions 4 times to find it, but here it is, highlighted:

Since you earn 1 mile per dollar on deposit per year, let’s run the math with this new detail, using the current generally available interest rate of 1.7%

$100,000 in a 1.7% account: $1,700 in interest (taxable)

$100,000 in Bask Bank / BankDirect: 100,000 miles. I currently value AA miles pretty high at 1.5 cents, due to the still pretty incredible ways to redeem for 1st and Business Class internationally on partners. But even at this value, which some may think high to begin with, you are getting $1,500 in value – but then paying tax on it.

Now that we know the planned 1099 rate, you would be 1099ed for $420 in this scenario.

This changes everything!

Even if you are in NYC paying a marginal 50% in tax, you’d pay just $210 to earn those 100,000 miles. Or you could have earned $1,700 and paid 50% and have $850. Valuing the AA miles at 1.5 cents, you’d be earning $1,290 with Bask Bank vs. $850 with a standard account.

You see, at an assumed 1 cent of more per mile, you’d lose. But this 0.42 cent value is very unexpected.

Did you already close your Bank Direct account?? Don’t worry – it gets better.

I used to say the optimal amount to have with Bank Direct was $50,000, because over that you started earning less miles.

It just so happens that $50,000 is the magic number for a new Bask Bank account – to the tune of 20,000 bonus AA miles!

Buried in the Terms and Conditions is this offer:

(Bolding mine)

Balance Bonus ($50,000): Bask Bank is offering at total of 20,000 AAdvantage® miles for customers that (i) meet Bask Bank’s qualifications to open an account; (ii) complete the online account opening process and establish a Bask Savings Account between August 1, 2019 and April 30, 2020; (iii) provide Bask Bank with an AAdvantage® account number in the same name as the subject Bask Savings Account within the first sixty (60) days of the initial account opening; and (v) maintain an average deposit balance of not less than $50,000 for twelve (12) consecutive thirty (30) day periods (each such 30 day period referred to hereafter as a “Qualifying Period”) out of the first fourteen (14) Qualifying Periods following initial account opening. The first Qualifying Period will begin on the day the account is opened and will conclude on the thirtieth day following the account opening. All Qualifying Periods subsequent to the initial Qualifying Period shall correspond to the initial Qualifying Period. Following completion of the first six (6) consecutive Qualifying Periods wherein an average balance of not less than $50,000 has been maintained, Customers that have met all other qualifications for the Balance Bonus ($50,000) will receive an initial Balance Bonus ($50,000) Award distribution of 10,000 AAdvantage® miles. The remaining Balance Bonus Award of 10,000 AAdvantage® miles will be awarded following completion of the twelfth (12) consecutive Qualifying Period. All Balance Bonus ($50,000) Miles Earned will be awarded within ten (10) days, once all of the conditions of offer have been met. This offer is exclusive of all other offers and may not be combined with or in addition to any other Bask Bank offers of Bonus Miles, with the exception of the Account Opening Bonus and/or the Feedback Bonus.

So, keep $50,000 in a new Bask Bank account for a year and you’ll get 20,000 bonus AAdvantage miles.

But wait, there’s more:

Account Opening Bonus: Bask Bank is offering 5,000 AAdvantage® miles for customers that (i) have not previously opened a Bask Savings Account; (ii) meet Bask Bank’s qualifications to open an account; (iii) complete the online account opening process between October 18, 2019 and February 29, 2020; (iv) maintain a minimum daily deposit balance of $1,000 for thirty (30) consecutive days out of the first sixty (60) days following the initial account opening; and (v) provide Bask Bank with an AAdvantage® account number in the same name as the subject Bask Savings Account within the first sixty (60) days of initial account opening. Bask Bank will award the Account Opening Bonus miles within ten (10) days, once all of the conditions of offer have been met. This offer is limited to one Account Opening Bonus Award for each customer. Customers that have previously opened a Bask Savings Account, whether the account is still open or if it has been closed, are not eligible for this Bonus Miles offer.

Feedback Bonus: Bask Bank is offering 1,000 AAdvantage® miles for customers that (i) successfully complete the online account opening process and establish a Bask Savings Account between August 1, 2019 and April 30, 2020; (ii) use the Bask Bank online banking portal or Bask Bank mobile application to provide feedback using the Give Feedback feature; and (iii) provide Bask Bank with an AAdvantage® account number in the same name as the subject Bask Savings Account within the first sixty (60) days following initial account opening. In order to qualify for this Bonus Miles offer, feedback must be provided through the Give Feedback feature on the Bask Bank online banking portal or Bask Bank mobile application. Feedback provided by letter, email, phone or any means other than the Bask Bank online banking portal or Bask Bank mobile application will not qualify. Bask Bank will award the Feedback Bonus miles within ten (10) days, once all of the conditions of offer have been met. This offer is limited to one Feedback Bonus Award for each customer.

I am not 100% sure if you can get both the 20,000 offer and the 5,000 offer (stackable) but even if you only get the 20,000 miles and the 1,000 feedback miles, it’s a hell of a deal for the first year.

The other thing you may be wondering – as I am:

Does having a Bank Direct account disqualify you from the above?

I don’t *think* so, because it specifically says you can’t already have a Bask Bank account, not an old Bank Direct account. I plan to close my old Bank Direct account as soon as my December miles hit and then open a fresh, new Bask Bank account for the bonus. Hopefully it works out as I think it will.

What do you think?

Tell me here, on Twitter, or in the private MilesTalk Facebook group.

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

[…] MilesTalk readers caught in the Bask Bank terms and conditions (caution: PDF link), Bask Bank is disclosing to account […]