It’s stimulus season, and more than miles and points right now, people are very focused on when they can expect to receive their $1,200 or more from Uncle Sam.

There are a few considerations that determine how, and when, you can expect to see your cash.

In this article

Stimulus Eligibility:

- You’ll get $1,200 per person, if you made less than $75,000 in 2019, or 2018 if you haven’t filed for 2019 yet. Your Adjusted Gross Income is the figure they will use.

- Your payout decreases by $50 per every $1,000 you are over $75,000 and if you earned over $99,000 you won’t get anything.

- Married couples get $2,400 if total AGI is less than $150,000

- You’ll get $500 per dependent age 16 or younger

- You need s Social Security Number

- If someone is claiming you as a dependent, you are not eligible

You don’t have to do anything if you have filed a return (2018 or 2019) and E-filed using direct deposit for your payments and/or refunds.

When to expect your refund

April 17th is when the government is saying to expect electronic payments, though they have already started landing in people’s bank accounts. However, if you aren’t set up for direct deposit it’s expected to take weeks or months longer.

Can you check the status or your stimulus or add direct deposit info if you have always paid by check?

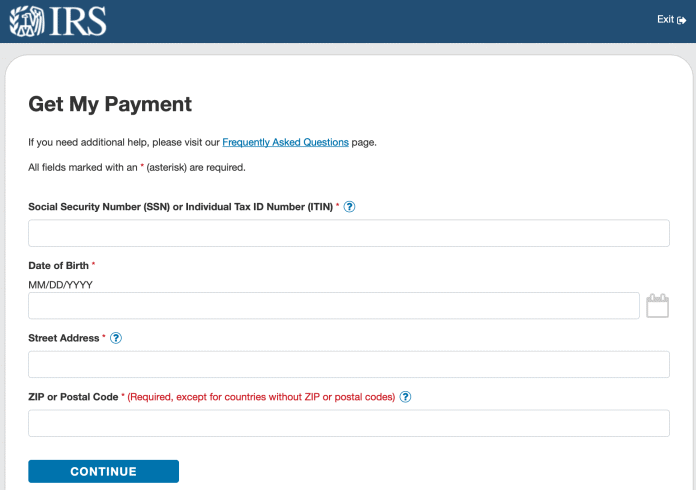

Yes. Go here and click on Get My Payment. It may take a while for the site to let you in due to traffic volume.

What if I don’t file taxes?

You can use this link to access the system using your SSN and then the IRS will know to send you a stimulus payment. You can add a bank for direct deposit, else you’ll get a check (eventually).

What if it says “Payment Status Not Available”

Well, that happened to me and I have no answer. Just letting you know that you are not alone 😉

Got an email about your stimulus?

Sounds like a scam. Don’t click on any links in emails from anyone seeking to advise you in any way about your stimulus. Scams may try to tell you there is a problem or to click a link to get your payment. Asking for your SSN will then not seem unusual and…. there goes your identity.

Only use the official irs.gov website.

Did you get your payment yet?

Let me know here, on Twitter, or in the private MilesTalk Facebook group.

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? The MilesTalk “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![Amazon “Pay One Point” Deal Links (Compilation) [UPDATED] amazon pay one point pay 1 point links amex chase citi discover](https://milestalk.com/wp-content/uploads/2023/11/payonepoint-218x150.png)

![[Ends May 12th!] Capital One Brings Back Up to $1,000 Bonus Offer on Venture capital one venture limited time offer $250 credit 75,000 miles](https://milestalk.com/wp-content/uploads/2024/07/venture-218x150.jpg)

![[OFFER ENDS by 9am ET on May 15th] 100,000 Point Chase Sapphire Preferred Offer is BACK! Best Offer This Year!](https://milestalk.com/wp-content/uploads/2025/04/chase-csp-100k-sapphire-2-218x150.png)