OK, maybe you know about one or two of these. But I’m quite sure you didn’t know about all 12. (And when I first posted this, it was 10. But now it’s 12.)

For those of you that are over Chase 5/24 (or even LOL/24), already have your Amex once-in-a-lifetime bonuses for all the cards you want, and perhaps have even run into the Citi 1/24 rule for any cards you want, it’s inevitable you want to hunt for more.

The reason you don’t know about the cards below?

Two main reasons. 1) Some of these are international and are not useful to most Americans. At least not those without advanced degrees in Frequent Flyer Miles. They serve niche purposes. 2) Most of these are not in affiliate programs. While it always stings to know that your favorite bloggers have bills to pay, we all do. Inevitably cards that are commissionable get a bit more airtime. #truth

But really, the biggest reason is that these are all, with the exception of the Barclay American Airlines Aviator card, very niche products. And it doesn’t make a ton of sense for blogs to spend too much time covering cards that only a very small segment of their readers care about.

But, you may care. So, I’m dedicating a post to 10 cards that don’t get much airtime, but you may want to know about. I’m not going to list card benefits for each one. If you care enough, you can click through to get that. I’ll just focus on the loyalty program, the bonus, and who may want them.

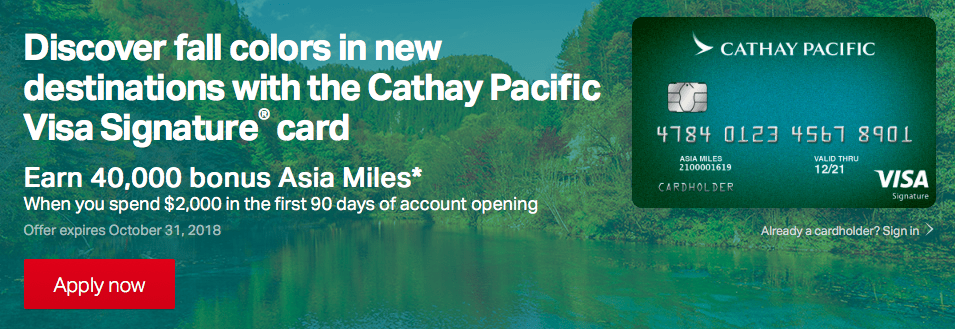

1. Bank of America Asiana card:

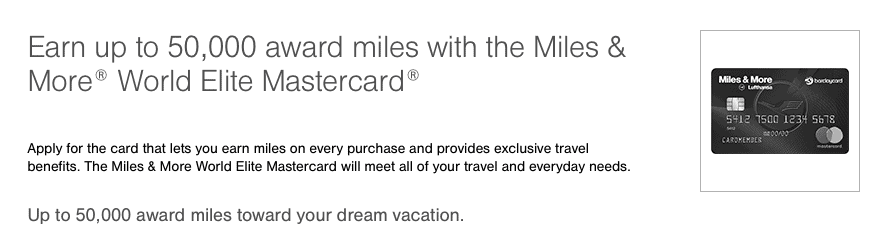

Asiana is a cult favorite Asian carrier frequent flyer program and, aside from crediting Star Alliance miles to Asiana, Marriott point transfers are the only way in. It’s famous for a 50,000-mile redemption for Lufthansa First Class between the US and Europe.

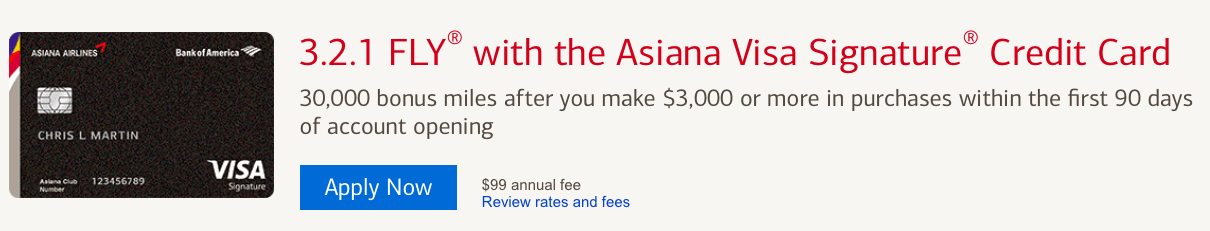

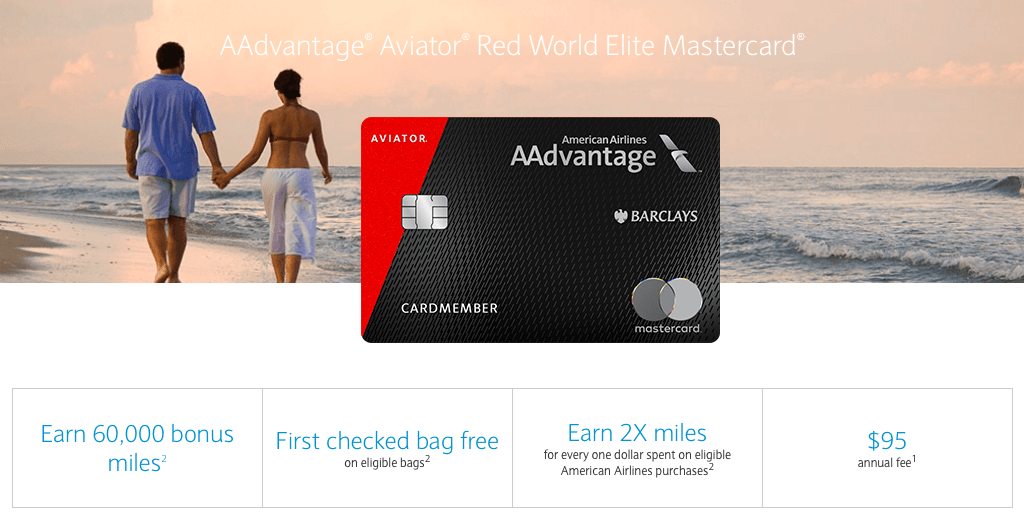

2. American Airlines Barclays American Airlines Aviator card

60,000-mile bonus

Pay the annual fee. Buy a cup of coffee. Get the bonus. Stacks super well with the Citi AAdvantage cards you can get.

3. American Airlines Barclays Business Aviator card:

60,000-mile bonus offer

As above, but the Business version of the Aviator card. Current bonus is 60,000 miles for one purchase and the annual fee payment. You can, of course, get both cards for a big redemption. The Business version is unlikely to report to your personal credit file.

4. Korean Air SkyPass Credit card

30,000 bonus miles + $50 discount

Missing the ability to transfer from Chase Ultimate Rewards? Did you use to take advantage of the ability to book cheap awards to Hawaii using KE miles? Here’s an easy 30,000 of them.

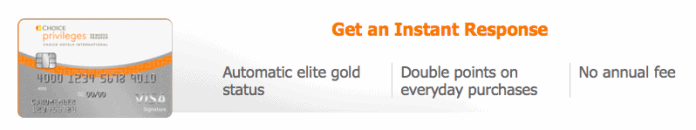

64,000 point bonus offer

If you stay at Choice Hotels, 64,000 bonus points + Gold status isn’t too shabby. These points can come in pretty handy when all the luxury chains in a city are ridiculous amounts of points. Thanks to Danny Deal Guru for this find.

6. Hawaiian Airlines Barclaycard

50,000 miles for one purchase + annual fee. Includes a 50% off companion discount.

Hawaiian miles are useful in a few ways, but the *most* useful in my opinion is for non-stop flights from the US mainland to Hawaii. While you can use AA miles to book Hawaiian outside of the US, you can’t for these flights, such as the 11 hour NYC to Hawaii nonstop. And I think you might prefer that up front in the comfy seats. Note, though, that saver availability for those Business class seats, even using Hawaiian miles, has gotten VERY difficult.

7. Hawaiian Airlines Business Barclaycard

As above, but the business version. You can, of course, get both. The Business version is unlikely to report to your personal credit file.

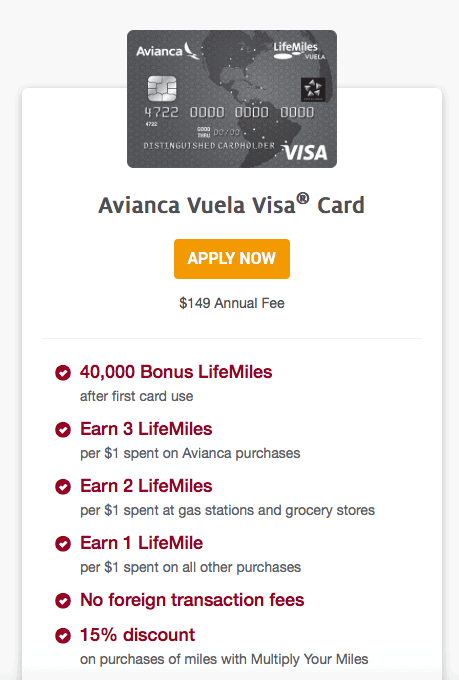

8. Avianca LifeMiles Credit Card

Questions about any of these? Let me know here, on Twitter, or in the private MilesTalk Facebook group.

New to all of this? My new “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available now.

![Chase Revamps Entire United Credit Card Lineup – See What’s Changed [COMPREHENSIVE] chase united credit card refresh](https://milestalk.com/wp-content/uploads/2025/03/united-refresh-218x150.jpg)

![[Matches Posting!] ITA Volare Status Match Opportunity](https://milestalk.com/wp-content/uploads/2024/07/ita-airways-airplane-980x600-1-218x150.jpg)