When Capital One shopping came on the scene in 2022 it quickly became a sort of underground but highly lucrative shopping portal.

I first discovered it when Nick at Frequent Miler covered it. And I followed along when he posted deals, but didn’t want to give up earning POINTS. You see, the Capital One Shopping portal – which is also a browser extension – both doesn’t require a Capital One card and doesn’t earn Capital One Miles. It’s a cash back portal plain and simple as the cash earned can only be cashed out with gift cards.

This is not to be confused with the recent addition of miles based portal earnings through a Capital One card. You have to log into your Capital One card and click through that offer to earn Capital One Miles (which can have some great deals as well, but not generally anywhere near the obscene levels of cash back Capital One Shopping offers).

(Being extra clear, this is not a criticism of Cap One cards, which I have 4 of and no issues whatsoever!)

It took me until December of 2024 to finally join Capital One Shopping. I downloaded both the desktop and mobile browsers for a promised total of $60 and I figured – why not? Incidentally, these bonuses not being paid within the stated timeframe should have been my first warning things might not go as smooth as hoped.

I’m used to Rakuten. Things *almost* always track and pay when expected. The rare times they don’t, I find a ticket to support has full and satisfactory resolution the same day. And you can opt to earn either cash back oR American Express Membership Rewards points which makes it even more valuable as the rate is 1:1 cash to points.

But Capital One Shopping has some INCREDIBLY lucrative offers. I mean, insanely good. They use the browser extension to see what sites you visit (yes, some privacy concerns no doubt – but you know that going in when you put an extension like this on your browser).

I started to understand Nick’s love affair with the portal. I started getting emails targeting me for just tremendously good deals like 13% at Walmart, 20% at IHG, 33% at Hilton, 25% at Dell, and 30% at Klook (a European attractions ticketing site, mostly). It goes on and on. All offers cap at $250 in rewards and most have a list of exclusions. So you do have to read the exclusions.

And I’d been seeing how this all worked both for myself and for a planned article on the portal which I expected would be titled something along the lines of “The Best Shopping Portal You Aren’t Using.”

And if this were the end of the story, that article would have been coming soon.

But using Capital One Shopping has become SO frustrating, that I’m pretty much done with it. I’m not saying “hold the door open while I announce my departure” or whatever that phrase goes when people angrily announce their dissatisfaction with a business. I am saying that it will no longer be my go to portal, and here’s why in two bullets:

- Things don’t properly track a LOT of the time.

- Their support team absolutely could not care less about that.

That’s the short version.

The longer version of each is this…

Tracking is super wonky. I have used Walmart the most and buy mostly the same types of goods. Sometimes they show as eligible in the portal after purchase, sometimes they are marked as ineligible. There’s no reason given but they are small amounts and so I didn’t care that much especially since I don’t know another portal with 10% back at Walmart and I have free Walmart+ through my American Express Business Gold Card anyway.

But when a purchase was big enough to both be obviously valid and marked ineligible, I had my first real interaction with support (I say “real” as I *also* didn’t properly get my extension download bonuses but support did eventually post those).

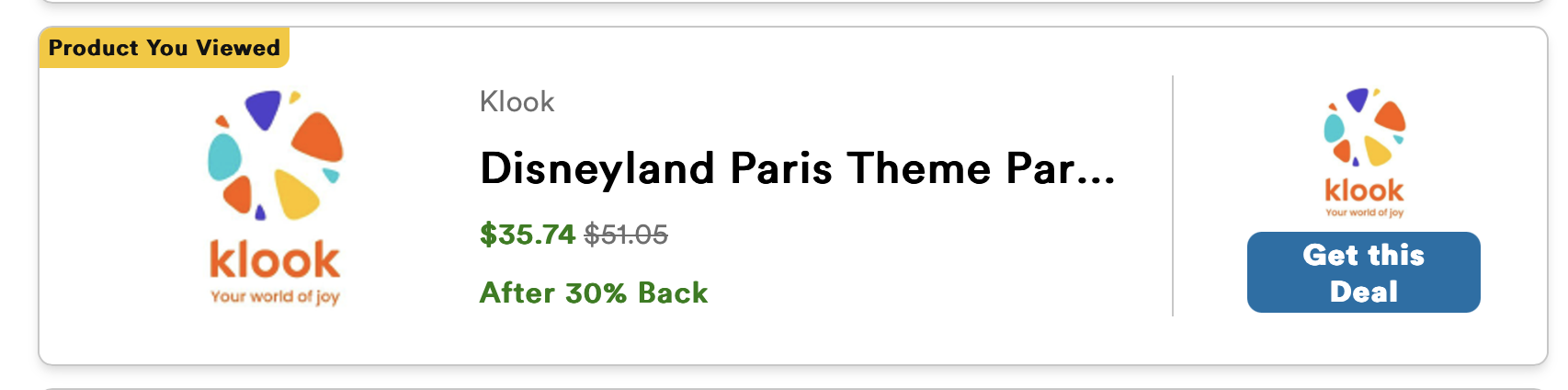

First, I was looking for Disneyland Paris tickets. I happened to visit Klook but didn’t book.

The next day, logged into my Capital One Shopping account, was this:

Wow!

This would be over $100 cash back as I was booking multi park passes for multiple people. I clicked on the deal and looked for any exclusions. None were listed. (I looked extra hard given that other portals often exclude theme park tickets!) And again, look at the image – it’s clearly saying “30% cash back buying Disneyland Paris Theme Park tickets.”

So, I clicked through the deal specifically and checked back in the portal a couple of days later.

Wait, what?! Now, I could have still cancelled the order, but I wanted to see what support said. After all, my case was rock solid but I even gave them the out of “if this was in error, let me know so I can cancel.”

The support was worse than you can imagine. Here was the first reply:

Welcome to Capital One Shopping and thanks for bringing this to our attention!

The “ineligible” status typically means the retailer reported one of the following:

- The order was modified, canceled, or partially returned.

- An excluded item was purchased.

- A coupon not provided by Capital One Shopping was used.

- An ineligible payment method (e.g. gift cards, rewards, or store credit) was used.

- For events or travel, eligibility may not be confirmed until the event or travel is completed.

For more details on eligibility, please refer to our exclusions FAQ.

Please note, we cannot review your order details until the retailer’s processing time is complete. If you believe your order qualifies for Shopping Rewards but have not received them after 30 days from the purchase date (or event completion), please send us a copy of your itemized receipt. This should include:

- A clear description of purchased items.

- Coupons used and payment method.

- The retailer’s name and purchase date.

Now, I had already included the exact transaction ID from the portal. They had all they needed to look at the purchase.

But they wanted me to wait until 30 days from event completion to file a new ticket. Meaning that if I was denied then, I was just out of luck. It should be simple enough to check eligibility, no? It’s either “Yes, I see you meet the terms and you’ll get paid. You have my word” OR even “It’s not eligible, I don’t know why but it’s not” would have even been acceptable enough.

I replied that I couldn’t just wait and see. I need to know yes or no! I said that and got back this:

Shopping Rewards are typically processed after 30 days, or when the merchant’s return period has completed. Once confirmed by the merchant, you can view your pending Shopping Rewards in the Rewards & Savings Dashboard. To confirm your successful Shopping Rewards activation, visit the Shopping Trips page.

We are unable to review your order details until the merchant processing time is complete. If your purchase rewards’ status doesn’t update on your dashboard within 30 days, please reach back out to us with an itemized receipt so we can further assist you.

So, another non-answer. I start getting a bit frustrated. It’s YOUR system. I can’t see any more than I can see. You can! Please help!

She says she understands my concern and then gives me a really weird reply:

Our orders are typically updated with eligibility status by the merchant. Some merchants label orders ineligible during the return policy and update after the 30-60 days period. As of right now, we would need to wait the 30 days to confirm eligibility of rewards.

Wait, what? So now I’m supposed to rely on the statement that your system may FLIP from ineligible to eligible after the fact but I (again) won’t know until later. (And I have to say this seemed unlikely as it should just show pending if terms are met.)

And I said that! Last and final answer?

Hello,

We are always looking for ways to improve your experience, and rely on the opinions of users, like you, to guide us in that effort.

We’ve genuinely put our best efforts into assisting you, and while we wish we could do more, we’ve reached a point where our customer service team can’t proceed further. Your feedback has been valuable.

(Bolding mine.)

So, frustrated, I took a shot at Capital One’s Twitter channel where, in DMs, a VERY nice agent listened to my issue and despite not working directly with Shopping, took ownership of the situation. She escalated, kept me updated, and after a few days I got an email back from Capital One Shopping starting that they had added the $106.17 to my account. Massive kudos to them for their assistance and true customer service. Professional through and through.

I was satisfied that I got resolution, but I knew that I couldn’t handle going through this again for another order. Trust was pretty much lost.

So my next thought was… I’ll just keep going until another transaction fails, try support once more if it does, and if it fails, that’s the end of it.

And that opportunity came much quicker than expected. I was going to need a car rental for my speaking engagement at CardCon in Florida last week.

Like the mind reader that the extension is, I quickly got this:

My rental wasn’t going to be much but 45% back sealed the deal! I booked the car and returned it last Thursday, May 8.

Except the transaction never appeared in my account. At all. Not Pending, not Ineligible – just… not there.

So I emailed support with the date and time I clicked and even found a click ID which I shared (I can’t even find that now since it’s located somewhere else in their system).

The reply?

We are unable to review your order details until the merchant processing time is complete. If your purchase doesn’t show on your dashboard within 90 days, please reach back out to us with an itemized receipt.

So now, the onus is on me to remember to follow up in NINETY DAYS just to start the frustrating email process again? The car was returned already. (i.e. it’s not a purchase I can later return which would reverse the rebate). Forget it…

Last night I messaged Nick at Frequent Miller to see how his experiences have been. He said he hasn’t had as much trouble as me, but has had transactions he needs to follow up because they were marked ineligible and he doesn’t know why. He also mentioned their group members reporting similar frustrations.

And that is when I decided that I’d take the time to spell this all out for MilesTalkers in excruciating detail and hopefully raise awareness – not to “call out” Capital One as to hopefully spark them into doing something about both their tracking system and support system (the support should be a portal where you click into a transaction and open a case that is easily trackable as it progresses – not back and forth emails that go nowhere). And I did also very politely get back to the nice Twitter rep about this second failed experience and my hope they could work on all of this. I even said I didn’t want to chase this 45% for Sixt because I just didn’t want to think about it anymore.

So that’s it – that’s the deal.

I’d like to know for those of you that have been using Capital One Shopping, have you had similar experiences? I’d truly like to know if I’ve just had absolutely horrible luck or if this is the norm – although either way, the lack of customer support kills my own confidence either way.

Let me know here or in the MilesTalk Facebook Group.

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Ends Monday, October 27, 2025] Huge New Southwest Business Card Offer… southwest companion pass](https://milestalk.com/wp-content/uploads/2020/09/southwest-plane-218x150.jpg)

![[Extended to Oct 31 + Webinar Rescheduled] Rove Miles Adds “Loyalty Eligible” Bookings + Get 1,500 Rove Miles with Promo Code Rove Miles - Loyalty Eligible Hotel Bookings](https://milestalk.com/wp-content/uploads/2025/10/Loyalty-Eligible-Room-Selection-218x150.jpg)

I actually have a negative balance with Capital One Shopping. I have several Viator purchases that I was paid for roughly about $200 USD plus one other that I don’t even know what it is and they have now marked them as ineligible and my account reflects a $287.85 negative balance.

How can they come back after the fact and attempt to re-claim.

I assume they won’t do anything unless you earn new cash back, but that sure is ridiculous!!

They got rid of all the gift card options I like. 🙁

I’ve had identical issues with Sixt offers on C1 Shopping. I let it slide the first time. The next time I screen recorded my booking as proof of the offer mad and that I did everything “right.”

The Sixt purchases have never appeared in my C1 dashboard, even after 180 days.

My rentals are coming up this summer and we’ll see if Sixt and C1 follow through on their promise of 45% back.

Fortunately, I have indisputable video proof to back any necessary claim.

Interestingly, my Sixt actually credited magically about a week post trip. Weird it never showed as tracked, but it’s there and pending now!

I’ve been using them about two years and made over 5k in cash back but in the last month, I’ve had horrible issues with tracking. While the visits are present in the visited sites list, they just aren’t hitting the dashboard at all.

I may try moving exclusively to the app.

I had several issues and even with visit tracking numbers and email receipts matching the exact date and time of the purchase C1S gave me the run around. I started taking screenshots but it sucks having to wait for the return window to pass before you get your day in C1S court. I have also noticed the gift cards that are now offered are so limited it’s really not worth it. Citibank has a similar program, might check it out.

I just started using and am waiting for the promised reward to show up in Cap One website.Was promised $50 back on $50 plus purchase.I thought it was too good to be true.I am keeping the product purchased from Walmart unused,to get a refund if the reward never shows up.Walmart has a 90 day return window,so will refund if I don’t see reward a few days before 90 days is up.

I had a horrible experience with Capital One and Walmart on a $1,200 purchase. I purchased from Walmart because Capital One specifically offered an ad for the exact item I purchased of 12% cash back. Then marked ineligible. Then when I followed up, had to wait past the return window. Then they they took additional weeks to respond. They eventually did credit my account but acted like they did me a special one time favor. What a joke!

Yep, I had a recent Klook order and Goldbelly, both inside the C1 Shopping app for purchase, both definitely qualifying, and both showed unavailable. Emailed for each after 30 days and got the $ but like you, was like they were doing me a favor to fix the mistake that was on their end….

I’m so glad I found this post. I have had to contact Capital One Shopping about many occasions my transactions not being rewarded. I learned to save screenshots and emails as evidence. In my most recent problem, i had purchased an HP printer from Best Buy for $219 with a promise of 30 percent rewards. I was expecting $65 and received $2.64 because “the retailer’s base rewards of 1.5 percent ” had been activated. How? The email link and screen said up to 30 percent, and HP was eligible for 30 percent. And 1.5 percent of $220 is $3.30, so their math doesn’t work. I inquired several times and was told that I had “received all of the courtesy adjustments ” I was eligible for. Meaning I called them out on too many errors. It seems every inquiry I made was what I was earning more than $5 in rewards. If they ever offer a decent gift card option again, I’ll cash out first and send one final inquiry. I expect they will cancel my account.

Wow, that is next level that they told you that you’re reached the limit of how many times they will fix their own problems…I’m probably not far off with my last two offers both not crediting. I do think it is probably wise to redeem at your next available opportunity. The gift card options are definitely (generally) lackluster these days. I have unreal offers in my account for $50 off $50 at eBay, etc and don’t even want to do them because I feel it is most likely that I won’t get the $50 without waiting 30 days and emailing.

Were you able to escalate and get anymore further help? Same thing has happened to me where they give me the cookie cutter response of nothing able to help me further as they’ve given all the courtesy credits the can. But it’s ther dusty as their system was not tracking properly even though i’ve sent them screenshots. It’s so unfair. Twitter/X said they can’t help me either as they don’t have access to anything and told me to email [email protected] even though they’re not helping me.

Bobby & Dave – UPDATE: Yes, I received $66 rewards last night! I received a survey about this issue (twice, because of the number of emails & responses) and filled it out with one star both times, reiterating my issue. Then I received another cookie cutter message that they couldn’t help. I responded with something along the lines of, “thank you for your AI bot response, explain the deceptive promotion in the screenshots, and please learn how to calculate percentages.” Lo and behold, a human answered that she had given me the $66 rewards! BUT …. the email also said not to expect any future adjustments. I had already cashed out my $90 in rewards and will cash out again today (I just looked, but my $66 has changed to $63 – I guess they took back the $2.67 already credited, but whatever, I’m still ahead of where I was).

I have $26 still pending from recent purchases and plan to cash those out immediately. I was holding out for REI to get offered again, but I can live with Eddie Bauer, LLBean and Athleta/Gap – those are the best options in my account at this time. The others are useless to me – Guess, Tommy John, Yankee Candle, a jewerly site I’ve never heard of, Celebrity X Cruises. I earned $680 in gift cards and MAY still give this site a shot. But I won’t be sending out the referral bonus link they keep showing me (which doesn’t appear to work anyway)!

I have been using Capital One Shopping for years with success until recently. In the past, sometimes purchases were not captured and when writing in with screenshots and invoices, they would make the correction immediately. In the last month however, their whole support has changed where you cannot email them directly anymore, and have to submit a ticket. The last couple of issues I reported were turned down with various canned responses. When I pushed, my case was escalated for review by two levels of managers, and they stood their ground.

Issue 1: I made a small purchase on eBay and I had evidence that I clicked on their 9% offer through an email from Capital One Savings. However, they credited me less than .5%! They claimed after review that the offer expired, despite it showed in my screenshot that I activated 9% cash back. I gave up on this when the managers provided this info as the amount was small.

Issue 2: I made two purchases through Capital One shopping at walmart.com on two separate orders of similar items. One went through and I got the 10% cash back; the other order was recorded, but marked ineligible. When I reported the issue, I was asked for the invoice. Then they sent me the same canned response for reasons why it might not count as eligible. I responded that I did none of those things, and I had a successful transaction that same day with no issues. I’m still waiting on their reply. The only reason I purchased through Capital One at Walmart was because the extra 10% brought the price down below Amazon sale pricing.

Issue 3: I made several larger orders at Lego.com where I activated a 20% cash back offer. I see all the activations I made that day. I took screenshots capturing my activations. I order from Lego all the time and even in the past I have had zero luck with Lego.com purchases registering with C1S at all, but I knew if I contacted support they used to make the corrections upon providing the proof of purchases. However, since the merger with Discover, and the past few issues I’ve had with contacting support with zero positive resolution, I’m afraid I will not get the $150 cash back I’m owed from all my recent purchases. Going forward, I might just stop using C1S altogether as it is proving to be more stress and frustration than it’s worth.

I used to be such a fan of Capital One shopping and Capital One in general, but it has simply gone down hill. Their debit cards are now part of the Discover network, and despite being a fan of Discover, I had relied on their old Mastercard debit for travel. I have now switched my debit to another financial institution because of this.