Updated at 12pm ET to clarify that the points rebate earned after you spend $50,000 in a calendar year is capped at 20,000 points rebated annually.

In this article

Hyatt’s New World of Hyatt Business Credit Card

For the last few weeks, there has been quite the frenzy in the blogosphere over what Chase was cooking up. Was it going to be a luxury version of the World of Hyatt Credit Card? A business version? Nobody knew. I didn’t know…. until yesterday when Chase was kind enough to invite me to their media event to celebrate the launch of the….

World of Hyatt Business Credit Card

So, now we know what it is…. and it’s not the high end personal card 😉

Indeed, Chase and Hyatt have collaborated on this new business card for some time and you’ll see that they are definitely trying hard to make it a valuable card for Hyatt fans with small businesses.

World of Hyatt Business Credit Card Features

The following information is directly from Chase. I’ll dissect it in the following sections.

The new World of Hyatt Business Credit Card, a Visa Signature® Business Credit card, offers valuable benefits including:

More Bonus Points:

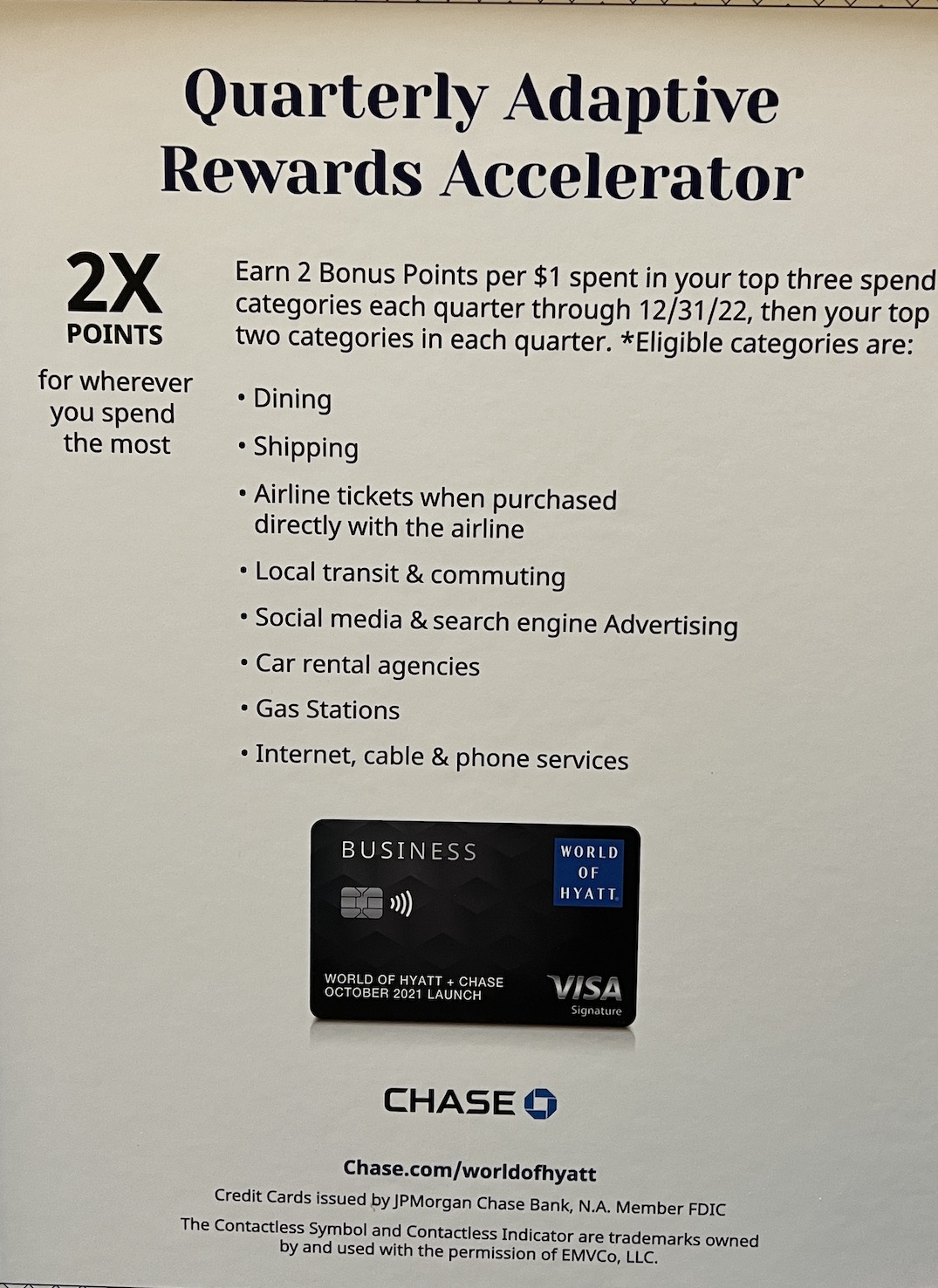

- Adaptive accelerator that rewards cardmembers with 2 Bonus Points per $1 spent for their top three of eight spend categories each calendar quarter through Dec. 31, 2022; and top two of eight spend categories in 2023 and beyond—with no cap on the Bonus Points they can earn

- Spend categories include dining; airline tickets purchased directly with the airline; car rental agencies; local transit and commuting; gas stations; internet, cable and phone services; social media and search engine advertising; and shipping

- 9x Points total on Hyatt stays and experiences – that is based on:

- 4 Bonus Points per $1 spent on the card at Hyatt hotels and resorts, including participating restaurants and spas

- Plus 5 Base Points from Hyatt per eligible $1 spent at Hyatt hotels and resorts as a World of Hyatt member

- 2x Bonus Points for fitness club and gym memberships

- 1 Bonus Point on all other purchases

- More ways to achieve higher status:

- Automatic Discoverist status in World of Hyatt (typically requires 10 Tier-Qualifying Nights or 25,000 Base Points)

- 5 Tier-qualifying night credits with each $10,000 in spend on the card in a calendar year

- With World of Hyatt’s 2021 reduced elite status criteria, World of Hyatt Business Credit cardmembers can earn top tier Globalist status with $60,000 in spend on the card now through Dec. 31, 2021.

- Additional ways to spend and earn:

- Spend $50,000 or more on the card in a calendar year and receive 10% of redeemed points back as Bonus Points for the remainder of the calendar year

- Earn $100 in Hyatt credit each anniversary year: Spend $50 or more at any Hyatt property and earn $50 in statement credits up to two times each anniversary year

- Additional benefits include:

- World of Hyatt Business Credit cardmembers can gift up to 5 Discoverist statuses to their company employees

- No fee for employee business cards

- No foreign transaction fees

- Complimentary roadside dispatch

- Primary rental car collision damage waiver

- Extended warranty protection

- Purchase protection

- Trip cancellation/travel interruption insurance

- Travel and emergency assistance services

- Access to Hyatt Leverage, Hyatt’s global business travel program that offers special rates to qualifying small and mid-sized enterprises at participating Hyatt hotels worldwide

For a limited time, new World of Hyatt Business Credit cardmembers also have access to the following cardmember bonuses:

- Earn 75,000 Bonus Points (equivalent of up to 15 free nights at a category 1 Hyatt hotel or 2 free nights at a category 7 Hyatt hotel or resort) after spending $7,500 within the first three months from account opening.

- Cardmembers who apply by Dec. 31, 2021, can receive a complimentary one-year Headspace subscription (valued at $69.99 per year); Headspace subscription must be redeemed by Dec. 31, 2022.

- This offering is an extension of Hyatt’s exclusive global wellbeing collaboration with Headspace, a global leader in mindfulness and meditation, and builds upon Hyatt’s holistic wellbeing strategy. This Headspace subscription is designed to help business owners prioritize mental health, thus building healthier, and more productive cultures and higher performing organizations. For more information about Headspace, please visit www.headspace.com.

Initial Thoughts

Like most people that are eligible for business credit cards, I’m thrilled to have this option. One problem I tend to have when trying to earn elite nights on my personal World of Hyatt Credit Card (which earns 2 for every $5,000 spent) is that I spend a good portion of my credit line and if I don’t pay some before the statement closes, it’s bad for my credit score. Business cards don’t report to personal credit and therefore don’t have this problem.

Once that cat was out of the bag, I started to really look over the card features and earn rate.

Annual Fee

$199. This is halfway offset by the two on property $50 credits, but there are no annual free nights included like with the $95 annual fee personal one. In that case, the annual fee is more than covered by the annual free night. In this case, you get $100 back but are still out of pocket $99 without any straight forward extra benefits to cover it. That doesn’t mean the card isn’t worth it, but it is going to be a factor for many. The Chase Ink Business Preferred, by comparison, has only has a $95 annual fee.

Bonus Offer

- Earn 75,000 Bonus Points (equivalent of up to 15 free nights at a category 1 Hyatt hotel or 2 free nights at a category 7 Hyatt hotel or resort) after spending $7,500 within the first three months from account opening.

It’s on par with the Ink Cash and Ink Unlimited bonus offers and I value it at $1,200.

You’ll be eligible if you are under 5/24. And yes, you can get the new World of Hyatt Business credit card even if you have a personal World of Hyatt Credit Card.

Bonus Categories

Instead of a bunch of bonus categories, they are going the route of the American Express Business Gold card, which gives you bonus multipliers on your top 2 categories each month.

The only flat bonus categories are gym memberships (2X total) and Hyatt stays (4X total).

Then you have the Accelerator. This will get you a total of 2 points per dollar on your top three categories until 2023, and 2 thereafter, each quarter. The categories are:

Dining; airline tickets purchased directly with the airline; car rental agencies; local transit and commuting; gas stations; internet, cable and phone services; social media and search engine advertising; and shipping

It’s a great list of bonus categories. But keep in mind that several of these (airline, car rental, internet, cable, phone, advertising, and shipping) would all earn 3X on a Chase Ink Business Preferred – although only up to $150,000 a year. And you could earn at 3X and transfer to Hyatt!

But, of course, Chase knows this. They are hoping they are adding enough value elsewhere to incentivize the spend on the Hyatt Business card. And maybe they do! So let’s continue…

Automatic Discoverist Status

This is nice, but it’s the lowest tier status and this card does not provide any automatic status elite nights like the personal version which offers 5 each year. Personally I think this is a bit of a miss as Discoverist takes just 10 nights at a Hyatt and doesn’t offer much on its own. You get a higher speed internet, daily bottles of water, a preferred room, and a non-guaranteed 2pm checkout.

Personally, I think that 10 elite nights (or even Discoverist + 5 elite nights) would have made for more of a slam dunk in terms of someone who already has Explorist or Globalist status getting excited to pay the annual fee each year.

Discoverist Status Gifts

One unusual benefit that many will appreciate is the ability to give Discoverist status to 5 people. In theory the people you gift to don’t have *any* status, so they will appreciate the modest benefits.

I like this idea and it clearly aims to bring more people onto the Hyatt train. Well done.

On Property Credits

Spend $50 or more at any Hyatt property and earn $50 in statement credits up to two times each anniversary year.

This is a nice and easy way to recoup roughly half the annual fee.

Spending Your Way to Elite Status

For each $10,000 you spend, you get 5 elite nights. This is 25% better in terms of earned elite nights than the personal card (and, for many, high spend on a business card is easier to achieve because businesses have lots of expenses!)

This alone may get you to get and keep the World of Hyatt Business card.

If you already have the personal Hyatt credit card, which gives you 5 elite nights annually, you need 55 more for Globalist. With $110,000 in annual spend on your business Hyatt card, you wouldn’t even need to stay a night to earn Globalist. Not a small figure, but not large for many, many businesses.

10% Rebate on Award Nights

Once you spend $50,000 in a calendar year, you will get 10% of all redemptions refunded (capped at 20,000 points rebated in a calendar year) through the end of the year. That could be a huge boon if the timing works out. Just note that if your stay is in the next calendar year, it won’t apply. You have to earn it and redeem it AND complete the stay in the same calendar year and in that order.

Still, for high spenders, it’s easy to see meeting this spend in the 1st quarter of the year and then getting the full points rebate (200,000 points redeemed would max out the 20,000 point rebate. You could easily justify the annual fee off this one benefit.

Hyatt Leverage Tie In

Hyatt Leverage is a business program that gives you your own corporate rate. When you have the World of Hyatt Business Credit Card, all requirements to stay in the Leverage program are waived.

Overall

There’s a lot to love about the new World of Hyatt Business Credit Card, but it also has several things I would have tweaked. I think the annual fee would have worked better around $100-$150 or I would have included a Cat 1-4 night like the personal card. And I would have liked to see the Accelerator offer you 3X total points, even if just on your top category each month, or even with a cap. I know with my advertising spend, I’ll struggle to decide between putting it on this card to earn elite nights or on my Ink Preferred to earn that extra point per dollar. But the elite nights for spend is a huge carrot that we can’t pretend isn’t there. The Ink cards may earn more on some categories, but they won’t get you those elite nights.

Overall, I plan to get this card. I suspect many of you will, too! The 75,000 point bonus offer for $7,500 in spend is on par with the Chase Ink Cash and Ink Unlimited – and it’s a nice one! I value 75,000 Hyatt points as being worth $1,200. Not too shabby!

What about you? Will you get this card?

(Please note: There are no affiliate links yet, but you can refer a friend using your personal Hyatt card – so if you do choose to apply now you can support me using this link.)

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

As an FYI, I applied/got the card in April 2022 and the Headspace offer still came my way.