When I launched YourBestCreditCards.com back in March, my focus was 100% on the rewards optimization tool, where you can enter your spend and find out which cards would earn you the most total rewards on your spend. While well received, the feedback I’ve been getting has been that you all want the information, but want to do less work to receive it – and I get that!

With that in mind, I’ve spend the last 2 months refreshing all of the content pages on the site to make more information accessible at a glance.

In this article

But the biggest announcement is the addition of a new section called “Best Credit Cards By Bonus Category“

It’s exactly what you think – except better.

Since I conceived this project last year, my goal has always been to first sort out building a massive database of every card and all the information about that card – like each bonus category and what the annual limit is on that bonus category, when applicable. The rewards optimization tool on the site already takes all that into account. Now I’m developing “at a glance” pages that simply allow you to see what you are looking for with zero effort.

All new pages on the site now list card annual fees right on the category list page and the ability to filter for only business or personal cards. Of course you can still click to get all the information on the card, but if you don’t have the time, this new format will get you in and out quicker.

Best Credit Cards By Bonus Category

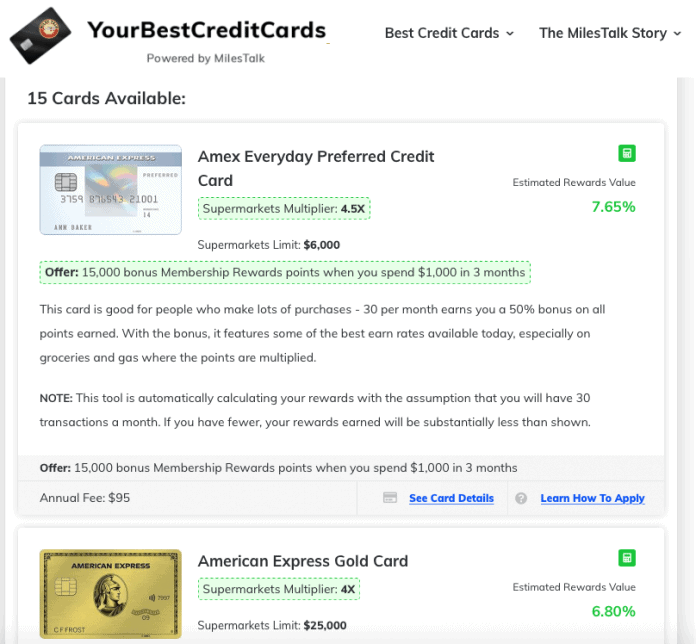

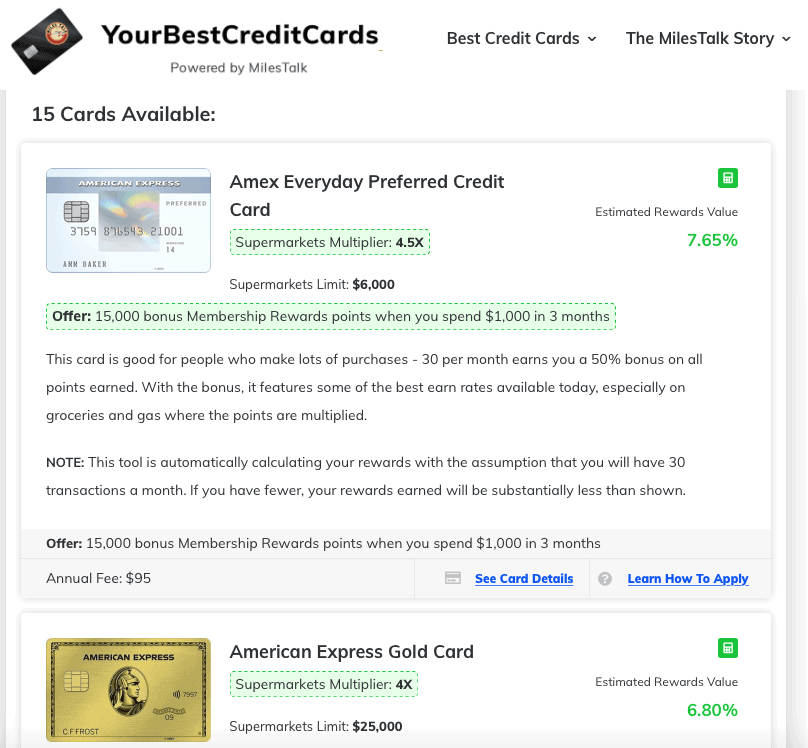

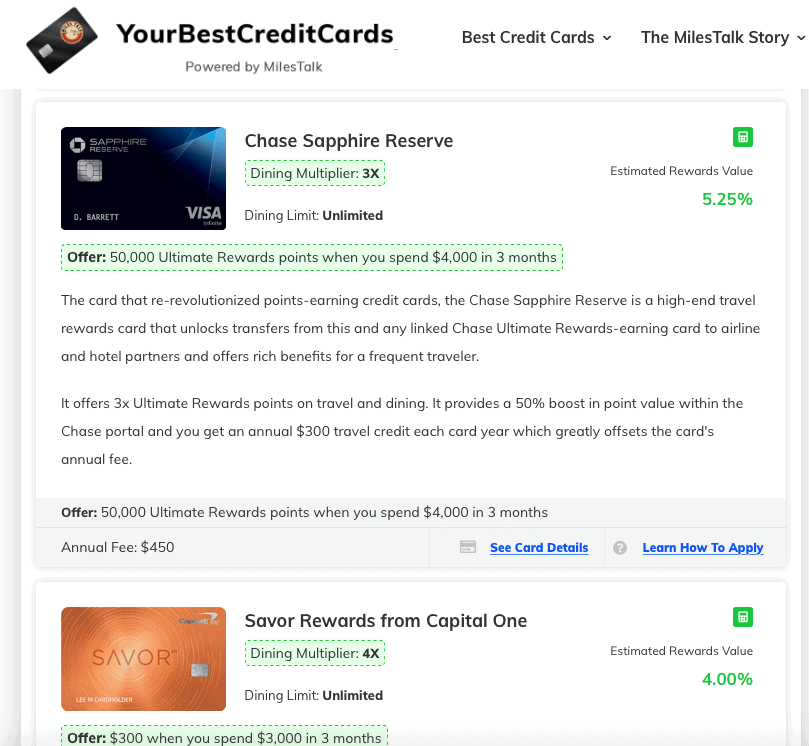

On these new pages, you can see at a glance which cards offer the best “Estimated Rewards Value” for that category. They are based on the bonus multiplier X the MilesTalk/YourBestCredit Cards Point and Mile Valuations. Of course you should always bear in mind that these values are based on the return one can expect by taking a little bit of time to understand programs and program sweet spots and will not be the “minimum return possible” since all programs give you ways to burn your points for a 1 cent per point or even less.

These pages are not just for finding a new credit card. You can use this list to cross-reference which cards you already have will be best for whatever purchases you are about to make.

And if you can’t keep that straight, don’t forget that you can get free credit card bonus category label stickers.

Here is an example from the Best Credit Cards for Supermarkets:

And here’s a sample from Best Credit Cards for Dining

(Note that these are cards #4 and $5 – Citi Prestige ranks #1)

And what about spend where there is no bonus category?

I’ve got that covered by Best Credit Cards for Expenses Not in Any Other Category

Here is a list of the top “Best Credit Cards For” categories:

I have lots more on tap, but you can see that I’ve taken all of your feedback into account since I launched this just 6 months ago and so I have one ask of you:

Please keep giving me feedback!

My project roadmap for YourBestCreditCards.com is to make it the only place you need to reference for managing all of your cards and at some point, you’ll be able to store that information and get more customized information. In the meantime, though, I’ve now got a very robust database and can manipulate that in any way that you all feel would be useful.

So please, as always, I would greatly appreciate and value your feedback.

As well, if you find the new pages useful, please share them with your friends!

(There are “share” links on all of those pages…)

What do you think of these new features?

Let me know here, on Twitter, or in the private MilesTalk Facebook group.

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.