In Delta’s never ending drive to #KeepDescending, I can’t understand why they make the few worthwhile ways to spend money (partner awards) so difficult. Sure, this post is a bit of a rant. But there’s also some knowledge to be had. With persistence, you can book valid award routings that Delta.com insists you cannot. But it will wear you down to your last nerve….

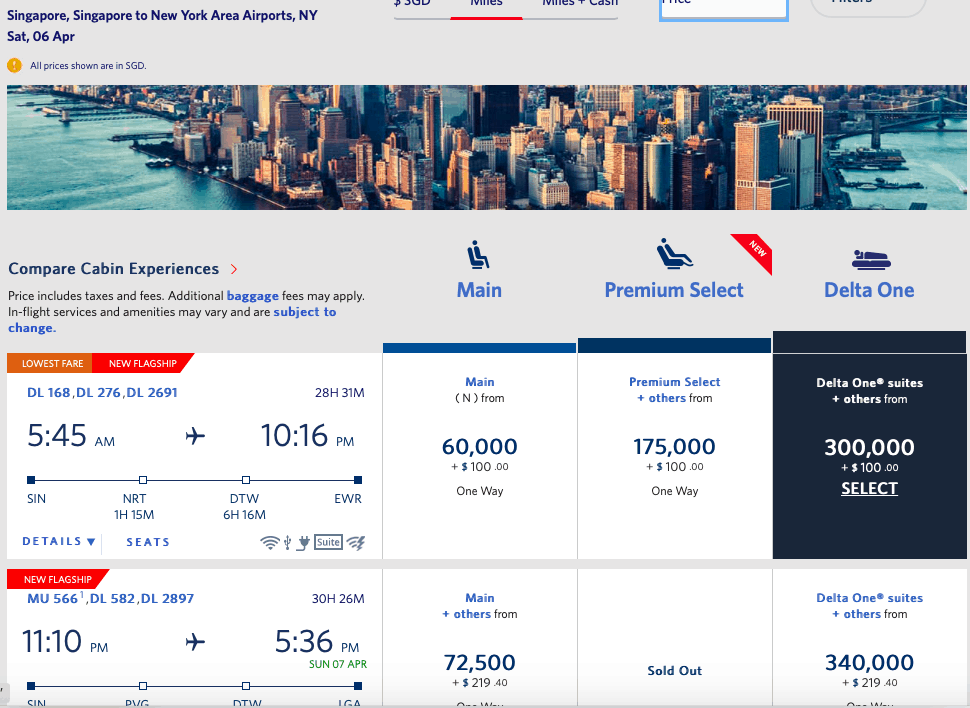

Yesterday, I was looking to ticket a flight from Singapore to New York. The only options Delta show available in Business Class are at a whopping 300,000 miles, connecting in NRT and DTW on Delta metal. Even if you accept the 1 cent a mile value that Delta wants us to, spending $3,000 worth of miles for a one way ticket (anywhere) is hardly aspirational. Extortion, perhaps.

I used Expert Flyer to suss out all of my SkyTeam options. I was able to find an itinerary on China Eastern (MU) connecting in Shanghai (PVG). I then fired up my Air France Flying Blue account and confirmed that yes, this is a valid itinerary.

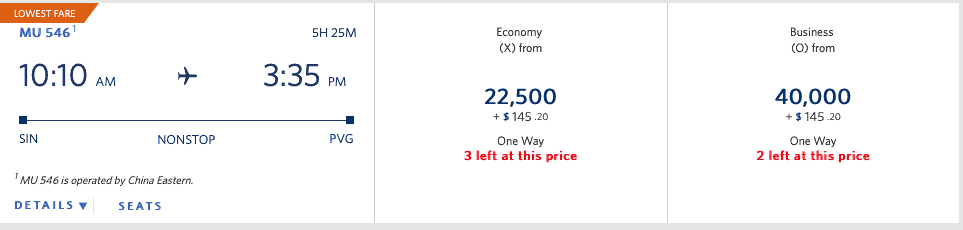

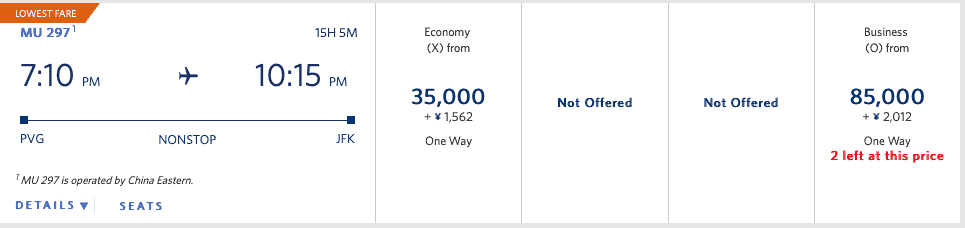

I went back to Delta.com and searched segment by segment.

SIN-PVG was available with 2 seats in Business Class.

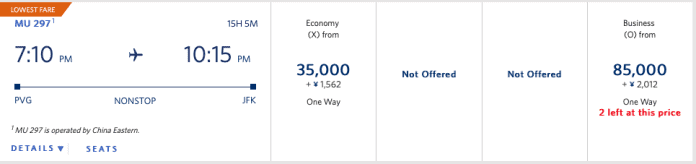

PVG-JFK was available with 2 seats in Business Class.

I could ticket either, but not together. I even attempted a multi-city ticket. Nope, Deltamatic would not show it.

For those asking “How do you know you know this is valid when Delta.com says it isn’t?”

Great question, because we aren’t meant to know. Honestly, if you don’t live and breathe miles I have no idea how you’d know. I can’t think of an answer besides to research online or ask me.

But, in short, despite not being published anywhere, a SkyMiles partner award in Business Class from Asia to the US is 85,000 miles (for now, anyway!) and I know it’s a valid one award booking because the connection is less than 24 hours. That’s just the rules and I guess you have to trust me on that as much as Delta wants you to trust whatever their agents tell you. The only difference is that I know their award routings rules and 95% of their agents do not.

Knowing this would mean having a phone agent issue it manually, I called. The front line agent was super frustrating. Completely untrained on manual ticketing, he insisted that what I wanted was impossible and if I saw an online discount (what?) I’d have to book online. I calmly thanked him and asked for a supervisor. The supervisor was lovely and understood what I was trying to do. More important she knew how to manually ticket it. She agreed it was a valid routing and should indeed price at 85,000 miles per ticket plus taxes and fees. After a bit of work on her end, she was able to ticket it for 85,000 miles and $237 per ticket.

While that call took awhile, I was able to get it done.

Fast forward to today.

We decided, within the 24 hour risk free cancelation period, that we’d prefer one more day in Singapore. And I was able to confirm, again via Air France’s website, and then segment by segment on Delta.com, that both segments had enough O Class (Business) inventory available. I called in again and got a lovely agent that understood what I wanted, but could not get it to price. After it failed a few times, I asked if she was using the “old system” and she said she was not. She agreed to try and was able to find all the inventory. But again, it wouldn’t price. It’s basically the same routing, just with a 5 hour layover instead of 3. So it’s still a valid connecting routing that should be 85,000 miles.

She then got her ticketing desk to take a look and after 10-15 minutes she came back with great news: They were able to confirm the space, for 110,000 miles and over $450 in fees per ticket. I knew what happened immediately – they priced it as two separate flights in one itinerary, rather than as one connecting flight. (Actually, I’m not 100% how that additive pricing worked – as the two segments separately should have been 125,000 miles. All I knew was that it *should* be 85,000 miles.)

I asked her to please call a different ticketing support agent. She was super friendly and agreed. 10 minutes or so later, she came back with the flights correctly booked for 170,000 miles (85,000 each) but with much more tax than my previous flight. I asked her to refresh that, which she did and then it priced correctly. Over two hours later, I had the ticket. 85,000 miles and $237 per ticket. (Or at least I think I do… I’m actually still not sure why my ticket says “ARPT” (airport control) in the status column where my first ticket sad OPEN – the expected status. I’ll call China Eastern to confirm the ticket tomorrow.)

Then, when the agent’s help desk refunded my original ticket, they refunded ALL of my tickets, including the new one. Luckily the agent was, I think, able to get it all back in the same PNR. I guess I’ll find out tomorrow. It shows as being there in my account.

Now, I want to be very clear that this agent was AMAZING. She did the best thing any agent can do – listen to the customer and try her best. She never got the least bit annoyed when I asked if she could double check or try a different way. (Side note: When you encounter an agent that you know doesn’t know what they are doing and gets annoyed about you trying to help, that’s a good time to politely disconnect the call by thanking them for their time – and calling back to get a new agent).

The problem lies squarely with Delta. First Delta removed award charts. Sure, I know that a partner award from Asia to the US should price on a partner at 85,000 miles. But does the average consumer? We all know the answer is no.

So we have Delta first saying “Don’t worry about award charts… the price is the price!” Then their system can’t handle a simple one connection itinerary. And they don’t train most of their agents to be able to handle it either. Meanwhile, the price wasn’t the right price over and over. And if I didn’t know it, I’d have overpaid.

In short, the best uses of SkyMiles are, by far, partner awards in Premium cabins. Any other use and you will rarely exceed 1.5 cents per mile and, more often, you’ll get closer to one cent.

Even this one way award from Asia only netted me about 2 cents a mile as China Eastern has one of the least expensive business classed of the Asian carriers, but at least that nets out at where I’m happy to, at a minimum, spend my hard earned miles. This flight in cash was about $1,900 each.

Whether Delta intentionally blocks certain partner awards to avoid paying partners for them or just has terrible IT and agent training, I’m not sure.

But I *am* sure that it’s the prime reason I’m letting my Medallion status lapse after over a decade. Delta does provide a nice on-board experience – probably the most consistent of the Big Three – and complimentary medallion upgrades are great. But SkyMiles? I don’t want them anymore. Look at all this effort just to get rid of 170,000 of them….

Anecdotally, I was dreading a second call I had to make last night, only because I was worn out, to American Airlines. I wanted to book a flight in a fare class that I could use a BusinessExtraa BXP1 upgrade certificate on. AA.com would only sell the cheaper fares. I knew I needed to “upfare” but AA.com won’t let you. And I had two gift cards to use as well (thanks to my American Express Platinum annual travel credits which I used for two $100 AA gift cards).

Well, after the Delta debacle, I had low expectations but as soon as I explained to Leslie, the AAgent, what I wanted to do she let me know it would be no problem. She quickly found me a valid G fare, took my gift cards, waived the phone ticketing fee, pushed it through ticketing, and conference called meeting services who applied my BXP1 in about 5 minutes. (I’d used Expert Flyer to check C class upgrade availability in advance….)

That anecdote is just to point out the difference I find in competency of Delta phone agents in the various complexities of their program vs AA, which, while also quite complex, tends to have long time agents that at least know how to use the system properly. It’s clearly a training issue, on top of the unnecessary built-in program complexities, of course.. I simply don’t know if they are intentionally untrained at Delta or if Delta simply doesn’t care.

Have you ever thought you could book a partner award on Delta.com only to be shut down? Did you ever get it ticketed? Let me know here, in the comments, on Twitter, or in the private MilesTalk Facebook group.

New to all of this? My new “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available now.

| Small Business Credit Cards | Bonus Offer | Best Features | More info |

|---|---|---|---|

Chase Ink Business Preferred Credit Card | 90,000 Ultimate Rewards points when you spend $8,000 in your first 3 months | Earns 3x points on travel, advertising, and shipping. This massive Welcome Bonus offer makes this card a great first business card. These points can be transferred to a range of Ultimate Rewards partners like United and Hyatt at a 1:1 ratio or spent in the Ultimate Rewards portal on travel with a value of 1.25 cents per point. Also provides complimentary cell phone insurance if you pay your monthly bill with the card. | Learn More |

Ink Business Unlimited® Credit Card | Get $750 in the form of 75,000 Ultimate Rewards points when you spend $6,000 in your first 3 months. Points are transferrable if you also hold a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred. | Best for small businesses with a lot of every day spend. This card earns 1.5x everywhere. If you don't spend a lot in the bonus categories of other cards, or want a second card to pair with one that you use in the bonus categories, this is a great card. No annual fee. Pair this with the Chase Ink Preferred for a killer 1-2 card combo. | Learn More |

Chase Ink Business Cash® Credit Card | Earn $350 in the form of 35,000 Ultimate Rewards points when you spend $3,000 on purchases in the first three months and an additional $400 in the form of 40,000 Ultimate Rewards points when you spend $6,000 on purchases in the first six months after account opening. Points are transferrable if you also hold a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred. | 5x points on up to $25,000 in office supplies, internet, cable, and phone annually. There are lots of ways to maximize this amazing 5x benefit. If you combine these points into a Chase Sapphire Reserve account to book travel, it's like 7.5% effective cash back. No annual fee. | Learn More |

The Business Platinum Card(R) from American Express | 120,000 Membership Rewards points when you spend $15,000 within 3 months. Terms apply. | Access to Centurion Lounges, Priority Pass lounges, Delta SkyClub lounges (with Delta ticket) $200 annual airline credit | Learn More |

Chase Southwest Airlines Rapid Rewards Premier Business Credit Card | 60,000 Rapid Rewards points when you spend $3,000 in 3 months | Those trying to get a Southwest Companion pass (the bonus points count). Read more about how to qualify for the Companion Pass here. | Learn More |

The Business Gold Card | 70,000 Membership Rewards points when you spend $10,000 in 3 months | Earns 4x Membership Rewards points on two categories that you spend the most on each statement cycle - up to $150,000 a year in spend). Other eligible purchases earn 1X. This card is a good choice IF you will spend heavily on at least one of the bonus categories, as this card has a moderately high annual fee. | Learn More |

Capital One Spark Miles for Business | You will earn a bonus of 50,000 miles when you spend $4,500 in the first 3 months of opening your account | This card earns 2 miles per dollar. These miles are transferable to 11 frequent flyer programs (0.75 airline miles per one Capital One mile for most partners). | Learn More |

![[Matches Posting!] ITA Volare Status Match Opportunity](https://milestalk.com/wp-content/uploads/2024/07/ita-airways-airplane-980x600-1-218x150.jpg)