In this article

The White Gold Card is discontinued as of Nov 7 2024

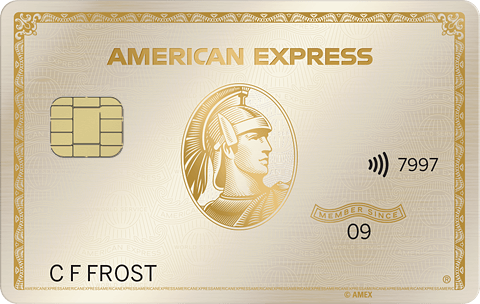

American Express Refreshes The Gold Card (New White Gold Card Option)

American Express has been refreshing cards like crazy lately (and yes, raising the annual fees along the way) and the latest card refresh is the American Express® Gold Card – a fan favorite (and mine!) for a dining and supermarket spend combo.

The most exciting thing has to be the addition of the White Gold Card color option. In addition to and not replacing the traditional Gold or the popular Rose Gold color options, you can now elect to receive a White Gold Card (shown below). Note that this color isn’t *entirely* new. If you get a no-fee authorized user card on The Platinum Card® from American Express, that comes in a white gold color, although not Metal white gold, so it’s not the same.

If you have a Gold Card already, you can go online to get a replacement card and request White Gold.

New Gold Card Annual Fee

The annual fee rises from $250 a year to $325 (up $75). It’s unclear if the rebate in the Corporate Advantage program will increase as well.

For new Cardmembers, this is effective today. For existing Cardmembers, October is the month that renewals will begin seeing the new annual fee.

New Welcome Bonus Offer

OK, read carefully. The new affiliate offer I’m required to mention is: 60,000 bonus Membership Rewards points when you spend $6,000 within 3 months + 20% back on dining (up to $100) within your first 6 months.

However, I already see offers on the Amex site (and it changes on different browsers, devices, incognito, etc, of 90,000 and 100,000 points plus the dining credit.

If that fails, I would go to the Amex website using all the various browsers / devices and private/incognito browsers.

New and Modified Statement Credits

Offsetting the extra $75 in annual fees is up to $184 in new statement credits (Enrollment required; Terms Apply.)

The new credits are:

Up to $100 in annual Resy credits: $50 to use January to June and $50 to use July to December at restaurants on the Resy platform (you do not need to book the reservation with Resy – just pay with your enrolled card.

Up to $84 in annual Dunkin’ Donuts credits: $7 per month

Whether or not these additional credits make you feel like you are getting even more for the extra $75 annual fee or not depends on your usage of Resy or Dunkin’. Resy is definitely only prevalent in urban areas and many won’t be able to use that at all. And Dunkin’s value depends on if you enjoy Dunkin’ – obviously.

So there is definitely added value for many, but not for everyone.

Additionally, the $10 dining credit (enrollment required, terms apply) good for Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations has changed slightly with Shake Shack and Milk Bar removed and 5 Guys added.

I personally find Grubhub to be the easiest way by far to redeem this.

The Uber credit ($10/month; enrollment required, terms apply) is unchanged.

Limit on Annual 4X Dining Spend

- 4X American Express Membership Rewards points per dollar spent at restaurants worldwide plus U.S. takeout and delivery – now capped at $50,000 per calendar year.

What do you think. Are you grabbing the card right now (White, of course!)? If you have the card, will you be renewing?

Rates and Fees for the American Express Gold CardThoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Ends Monday, October 27, 2025] Huge New Southwest Business Card Offer… southwest companion pass](https://milestalk.com/wp-content/uploads/2020/09/southwest-plane-218x150.jpg)