Back in mid-December I wrote about the new Ink Business PremierSM Credit Card. It’s a new “charge card” offering from Chase, meaning no preset spending limit.

However, it’s a PURE CASH BACK card as you’ll see below and $1,000 a signup bonus isn’t bad!

You can learn how to apply for the Ink Business Premier here. (Supports MilesTalk if you are approved).

In this article

Details: The Chase Ink Business Premier Card

The charge card, which earns 2% cash back on everything and 2.5% on purchases over $5,000 is now available to apply for online. It was previously in-branch only, which meant you couldn’t get it if you didn’t have a Chase bank branch around.

Ink Premier Bonus Offer

The bonus offer is $1,000 when you spend $10,000 in three months.

Wait, did you say $1,000? Don’t you mean 100,000 Chase Ultimate Rewards points?

Nope! Surprisingly, this card earns straight-up cash back, not points. Well, technically you WILL earn points, but these are not UR points and cannot be converted to UR points or redeemed for anything other than cash or for travel via the Chase portal (at just 1 cent per point).

I hoped when they transitioned to online signups, they might have reconsidered allowing transfers to other cards to have full Ultimate Rewards points transfer capability, but I have triple confirmed they are still not transferable.

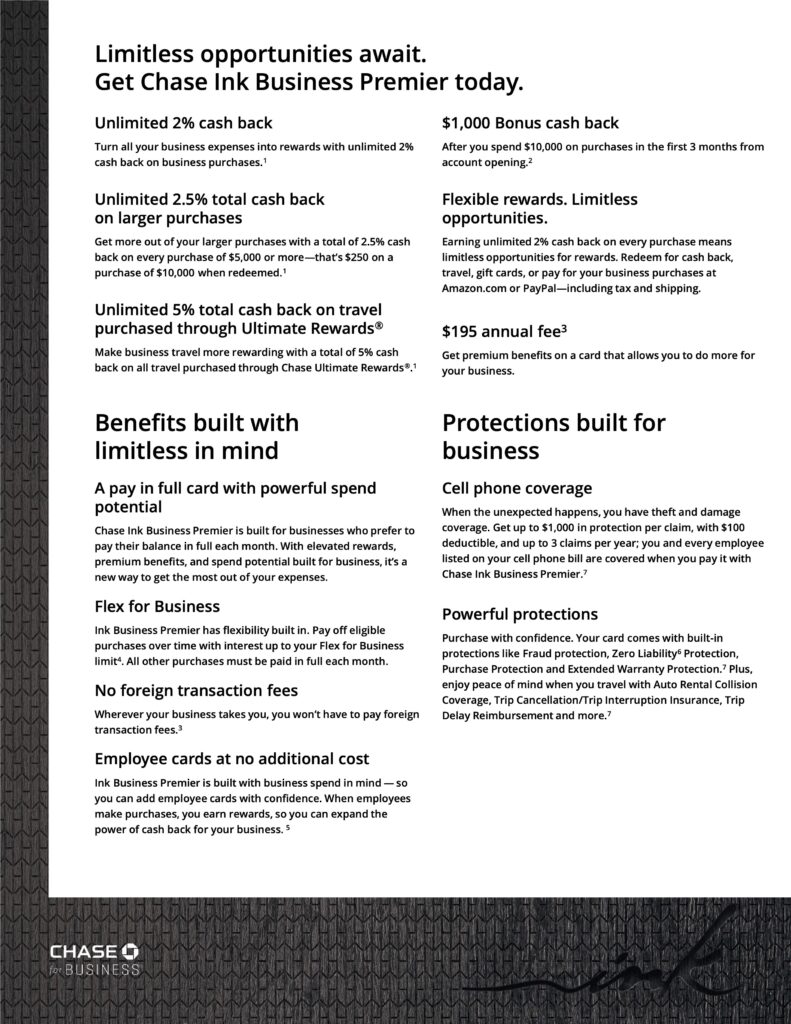

Beyond that, here are the Chase Ink Business Premier card features:

- $195 annual fee, not waived the first year

- Earn 2% cash back on all purchases

- Earn a bonus 0.5% back (2.5% total) when you make a purchase of $5,000 or more in one transaction

- Earn 5% cash back when you book travel through the Chase Travel Portal

- No foreign transaction fees

- No fees for authorized users

- Trip Cancellation/Trip Interruption Insurance

- Extended Warranty Protection

- Purchase Protection

- Cell phone protection with a $100 deductible

- The Chase Ink Business Premier is a “charge card” meaning that you are expected to pay in full each month, however . It won’t have “No Preset Spending Limit” as we are used to with charge cards, however, but it will be similar as this product is intended for very high spenders. You’ll have a limit, but you’ll also be able to exceed the limit. The limit will be based on your financials. Chase will also (similar to Amex’s Pay Over Time) have. “Flex for Business” which says “We may assign a portion of your Credit Access Line for use with Flex for Business. Flex for Business allows a portion of your Credit Access Line to be used for qualifying purchases over time, with interest.”

Where does the Chase Ink Business Premier Compete?

It seems to compete with a few cards.

The most direct competitor is the Capital One Spark Cash Plus. That is a charge card with a $150 annual fee that also has No Preset Spending Limit and earns straight cash. That earns 2% cash on everything. It lacks the 0.5% bump for larger purchases over $5,000, but the annual fee is $45 less. You’d have to spend $9,000 additional annually on the >$5,000 purchases to even out the extra annual fee on the Chase card.

Depending on how often you charge $5,000+ at once, you could be better off with a Capital One Spark Cash Plus than this card. Not to mention that if you have a card that earns Capital One miles, you can transfer your Spark Cash “cash” points to miles by moving them to your miles-earning card. But if you have a lot of $5,000+ charges, this is certainly a compelling choice.

The American Express Blue Business Cash earns 2% on everything, but only up to $50,000 a year. The Blue Business Cash is also a credit card with a conventional limit, so it only “sort of” competes there.

And you could say it competes against the American Express Business Platinum (which earns 1.5X Membership Rewards on purchases greater than $5,000 but has a $695 annual fee) or the American Business Gold with a $250 annual fee in terms of No Preset Spending Limits, but the annual fees make that playing field quite uneven as does the fact that neither earn 2X on everything.

How to Apply for the Chase Ink Business Premier

Click here to learn how to apply.

Ink Premier Brochure

If I missed anything pertinent, it should be covered here:

Bottom Line

This card is not aimed at us points junkies. Miles and points fans would welcome a new “2X on everything” product with open arms if it earned Ultimate Rewards points (which can always be redeemed for 1 cent or better anyway), but cash back is, well, a bit boring!

And I think that for a $195 fee, you really need some sort of additional benefit. If the card earned Ultimate Rewards, a 10,000 point yearly renewal credit would have been the easy answer. However, again, we are not the target.

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Launch Offer Ends by 7 AM EST on 8/21/2025] The New Chase Sapphire Reserve® – A Complete Transformation The New Chase Sapphire Reserve](https://milestalk.com/wp-content/uploads/2025/06/new-chase-sapphire-reserve-feature2-218x150.jpg)

The other reason the Capital One Spark Cash Plus may be much better is that if you also have a Spark Miles card, you can convert your cash from this card into Capital One miles by transferring your rewards over to the Spark Miles card. I know you mention this in the Spark Cash+ post, but I think it’s also worth mentioning here for comparison purposes.

As far as the $1K bonus and ongoing 2/2.5%, how does this work in practice? You mention “points” so it doesn’t sound like they come in the form of statement credits, but not sure how you actually cash these points out. Do you just login and convert the points to statement credits or is there something else?

I may just apply for the card and put a single $10K purchase on it and net $1,055 after deducting the annual fee. Then again, no reason to keep the card through the anniversary date unless they have a change of heart on the ability to transfer these “points” to actual UR points.

Hey Jonathan. That’s a great point about CapOne cash to point transfers – I’ve added that in above.

As far as the cash back, you can get it one of three ways: 1) Redeem as Statement Credit, 2) Have deposited into a bank account (any bank account – your Chase accounts are auto-linked or you can add another), 3) use in the Chase portal for travel at 1cpp.