Update Dec 5: Now shows in the mobile app…

An interesting new feature popped up in my Citi account today that will probably be of some interest. Citi seems to now have a card-linked merchant offers section, a la Amex Offers and Chase Offers, appearing on some Citi credit cards. It isn’t quite like either of them, though.

In this article

Citi Offers

I’ve only played around a little bit so far, but the Offers section is clearly still in a kind of Beta stage. It only comes up “sometimes” when I login.

That said, you should be able to access it at https://online.citi.com/US/ag/merchantoffers if any of your cards are eligible.

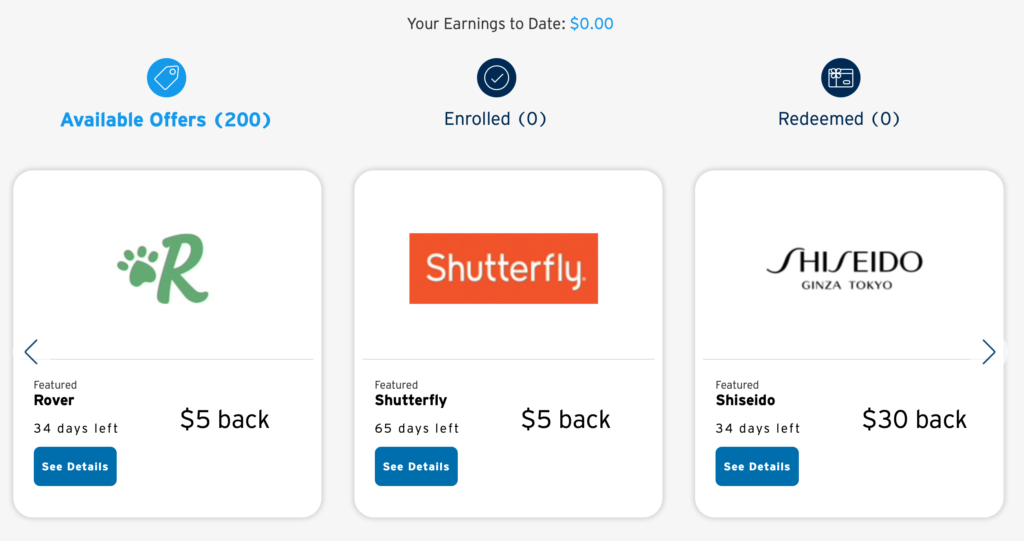

That’s the next interesting bit. Of the 7 Citi cards I have, two have the Offers on them (200 offers each) while the other 5 have zero offers available. I’m assuming it’s being rolled out in increments to card holders and not to all cards of any one card holder at once. In fact, although I have two Double Cash cards, only one was targeted. So it’s not by card product.

As of Dec 5th, its now also available in the App. But, a bit confusingly, you must go to the Services tab at the bottom of the app, then click Products and Offers, then look at the bottom of the screen and then click See All to choose by card.

How are Citi Offers Like Amex and Chase Offers?

The concept is similar. You add an offer to your card and then when you pay, the credit is added to your card. This means you should have no issue stacking this with shopping portals just like with Amex and Chase. And like those, you must add the offer before you shop.

That seems to be the extent of similarities.

How are Citi Offers Different than Amex and Chase Offers?

In so many ways…

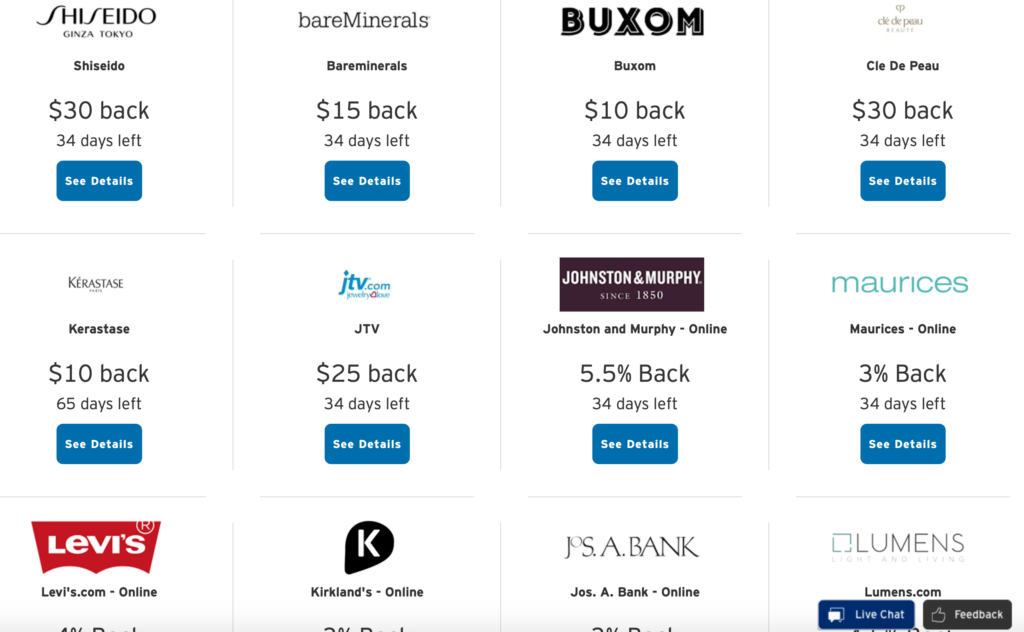

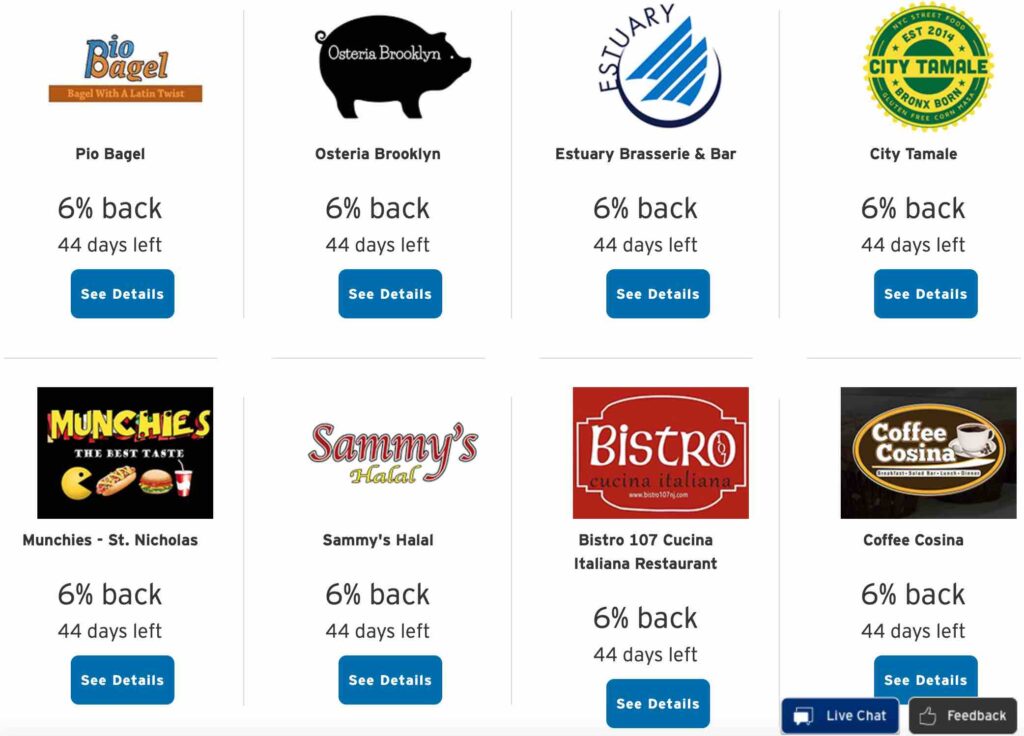

- Citi divides offers into 4 categories: Travel, Dining and Entertainment, Retail, and Other

- 200 offers appear. Amex gives you 100 at a time (though you can add and get more offers while Chase has very few (a few dozen at a time).

- Many Citi offers are HYPER local. I’ve never seen so many offers for restaurants that are in NYC but nowhere near me. Of course I’m within X miles so it seems very locally targeted, I just doubt I’ll be heading to any of these restaurants.

Citi Offers – Local Restaurants - These offers specify that the offers are either in store or online. Make sure you know which.

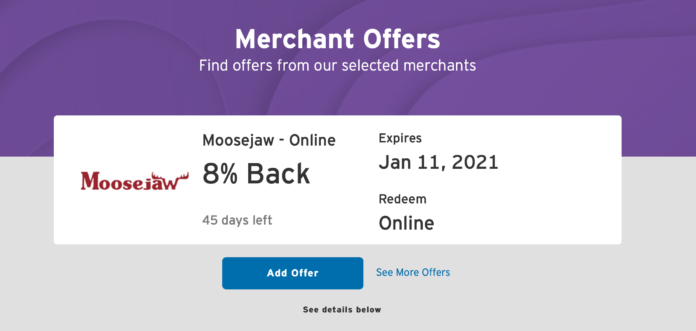

- The biggest “pro” I see is that there don’t seem to be limits. The biggest failure with Chase Offers and why I almost never bother to even check is the laughably low limits. I mean, who wouldn’t be excited by a deal to save up to a maximum of $1.00 at Rite Aid?! The offers I checked didn’t seem to have a limit. So let’s say I was buying a coat at MooseJaw. I could activate this offer for 8% back and then click through Rakuten for 4.5% back, stacking both. At least I don’t see why that wouldn’t work.

- The offers do seem to vary between the two cards I got them on, but not wildly. They are definitely not identical, though.

- The site is clunky as could be. I’m a bit surprised they would roll it out so incomplete, but, you know…

Have you seen Citi Offers yet? How do you like them vs. your other options?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group.

And if this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![Use or Lose These Annual Credit Card Credits and Perks [2025] credits expiring dec 31](https://milestalk.com/wp-content/uploads/2020/12/useorlose-218x150.jpg)

![Amazon “Pay One Point” Deal Links (Compilation) [UPDATED] amazon pay one point pay 1 point links amex chase citi discover](https://milestalk.com/wp-content/uploads/2023/11/payonepoint-218x150.png)

Nope, not on any of my 3 cards.

I have the offers available on my Premier card. Glad to see it. I have used this type of offer on my AmEx and Chase cards.