In this article

The New Chase Ink Business Premier Card

The blogosphere has been a bit lit up the last few weeks of rumors about a new Chase business card product called the Chase Ink Business Premier. The news was broke by 10X Travel and Phi Cao of the Chase Ultimate Rewards Facebook Group.

The charge card, which earns 2% cash back on everything and 2.5% on purchases over $5,000, soft-launched yesterday in Chase branches only and you need to have an existing Chase Business account.

Ink Premier Bonus Offer

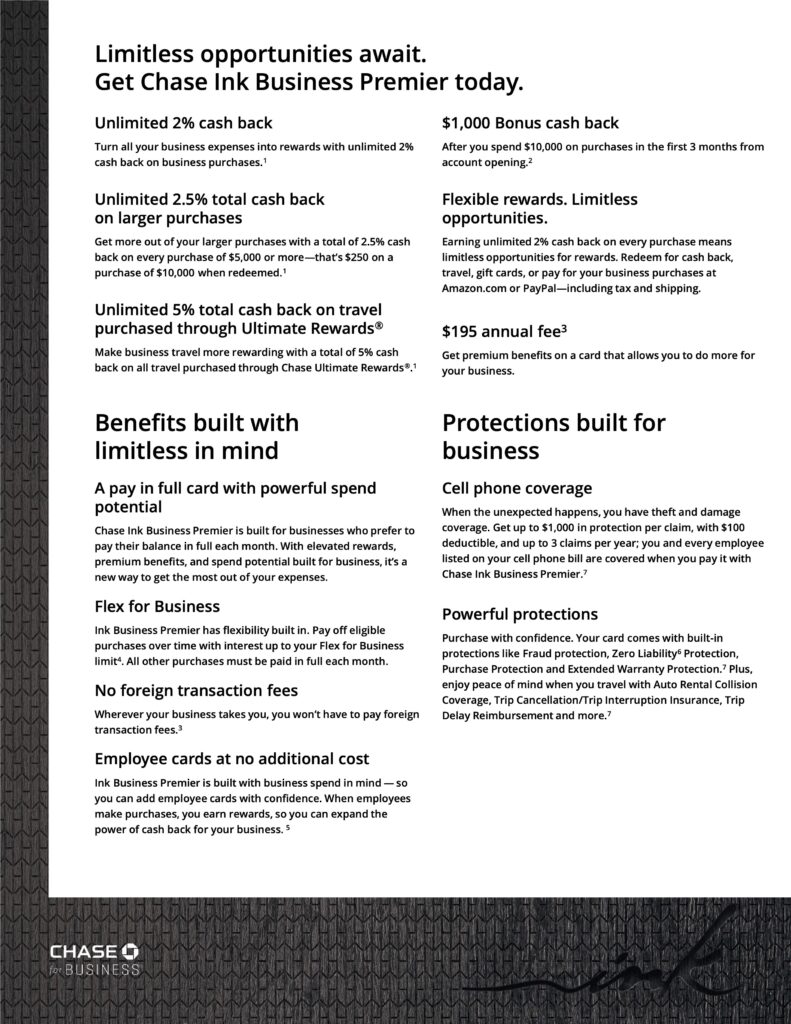

The bonus offer is $1,000 when you spend $10,000 in three months.

Wait, did you say $1,000? Don’t you mean 100,000 Chase Ultimate Rewards points?

Nope! Surprisingly, this card will earn straight-up cash back, not points. Well, technically you WILL earn points, but these are not UR points and cannot be converted to UR points or redeemed for anything other than cash or for travel via the Chase portal (at just 1 cent per point).

Beyond that, here are the Chase Ink Business Premier card features:

- $195 annual fee, not waived the first year

- Earn 2% cash back on all purchases

- Earn a bonus 0.5% back (2.5% total) when you make a purchase of $5,000 or more in one transaction

- Earn 5% cash back when you book travel through the Chase Travel Portal

- No foreign transaction fees

- No fees for authorized users

- Cell phone protection with a $100 deductible

- The Chase Ink Business Premier is a “charge card” meaning that you are expected to pay in full each month, however . It won’t have “No Preset Spending Limit” as we are used to with charge cards, however, but it will be similar as this product is intended for very high spenders. You’ll have a limit, but you’ll also be able to exceed the limit. The limit will be based on your financials. Chase will also (similar to Amex’s Pay Over Time) have. “Flex for Business” which says “We may assign a portion of your Credit Access Line for use with Flex for Business. Flex for Business allows a portion of your Credit Access Line to be used for qualifying purchases over time, with interest.”

Where does the Chase Ink Business Premier Compete?

It seems to compete with a few cards.

The most direct competitor is the Capital One Spark Cash Plus. That is a charge card with a $150 annual fee that also has No Preset Spending Limit and earns straight cash. That earns 2% cash on everything. It lacks the 0.5% bump for larger purchases over $5,000, but the annual fee is $45 less. You’d have to spend $9,000 additional annually on the >$5,000 purchases to even out the extra annual fee on the Chase card.

Depending on how often you charge $5,000+ at once, you could be better off with a Capital One Spark Cash Plus than this card.

The American Express Blue Business Cash earns 2% on everything, but only up to $50,000 a year. The Blue Business Cash is also a credit card with a conventional limit, so it only “sort of” competes there.

And you could say it competes against the American Express Business Platinum (which earns 1.5X Membership Rewards on purchases greater than $5,000 but has a $695 annual fee) or the American Business Gold with a $250 annual fee in terms of No Preset Spending Limits, but the annual fees make that playing field quite uneven as does the fact that neither earn 2X on everything.

How to Apply for the Chase Ink Business Premier

Right now, you can only apply with a Chase Business Relationship banker. Specifically, I want to note that isn’t the same as a standard business banker at Chase. You need one that specifically manages their own business portfolios like business bank accounts. If you don’t live near a Chase branch, want the card, and have solid financials, please email me and I will make an intro for you.

The card is expected to launch for online applications in early 2022.

Ink Premier Brochure

If I missed anything pertinent, it should be covered here:

Bottom Line

This card is not aimed at us points junkies. Miles and points fans would welcome a new “2X on everything” product with open arms if it earned Ultimate Rewards points (which can always be redeemed for 1 cent or better anyway), but cash back is, well, a bit boring!

And I think that for a $195 fee, you really need some sort of additional benefit. If the card earned Ultimate Rewards, a 10,000 point yearly renewal credit would have been the easy answer. However, again, we are not the target.

Maybe the in-branch-only soft launch is to give them a bit of time to gauge reaction and potentially make tweaks before a wider online launch?

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.