In this article

Three Ways to Maximize American Airlines AAdvantage® Miles Booking First and Business Class Partner Awards

If you are going to earn American Airlines AAdvantage® miles instead of interest with a Bask Savings Account, it makes sense to have a strategy for how you will redeem those miles later with a value that far exceeds what you could have earned in a conventional savings account.

In my recent articles on Bask Bank, I first discussed the concept behind Bask Bank, then I did a direct comparison of cash in a typical savings account vs. using a Bask Savings Account to earn miles instead of interest.

This post will focus entirely on redeeming AAdvantage® miles for First and Business Class awards, to show you how premium redemptions can handily beat what you’d earn from interest.

As a reminder, I firmly believe that a Bask Savings Account should be used as a supplement to the cash savings account you currently use for your cash-on-hand liquid savings. I don’t advocate earning miles instead of a long-term stock/bond portfolio. But one should always have liquid savings available, whether for a rainy day or to have available for opportunistic investments. And that is where you can use Bask Bank instead of a liquid savings account, such as Marcus by Goldman Sachs, that would pay you (at the time of this post) a 1.7% APY.

You may be surprised how many fellow points and miles collectors have plenty of available cash-on-hand and are in the “miles game” for exactly this – strategic redemptions for premium travel. I accumulated nearly one million AAdvantage®miles in BankDirect (from the same parent company) since 2011 precisely because I knew I’d get outsized value from my strategic redemptions. And I have.

Here are three great ways to redeem AAdvantage® miles along with the current cash price, how much cash you’d need to have on deposit for a year to earn enough from a Bask Bank account, and what that would be worth in interest.

Comparison Methodology

To accurately compare earning cash interest to pay for flights against earning AAdvantage® miles to earn the miles needed for the flights, I’ll use a standard methodology.

Cash prices fluctuate wildly, so I’ll be using a round trip flight using Google Flights for July 8 – July 15 for all examples (on Wednesdays so I’m getting the lowest possible fares) and dividing by two (because a one-way international flight paid for with cash can cost more than a round trip, and I want to be sure not to distort the numbers).

Each cost in points is one way and the flexibility of two one-way awards is part of the appeal of award travel.

I’ll also use Los Angeles or New York as the departure point for each. As I did in my previous post, I’ll assume an income tax rate of 40% on all calculations. Recall that Bask Bank will issue a 1099 tax form for the miles earned, and we expect that rate will be at 0.42 cents per mile earned.

Redemption #3: Business Class to Tahiti from Los Angeles on Air Tahiti Nui

AAdvantage® miles needed for a one-way business class flight: 80,000 + $5.60

One-way (half of round trip) cost with cash: $2,327

Value per mile: 2.9 cents

Approximate Bask Savings Account Balance for one year to earn 80,000 miles: $54,000

What $54,000 would earn at 1.7% APY: $918

Tax on $918 of interest if you earned cash interest at 40%: $367.20

Total money in your pocket on that 1.7% Cash Savings account for $54,000 on deposit for one year: $550.80

Tax you’d pay on the miles earned at Bask Bank (Assuming a 0.42 cent value per mile): $226.80

Totals:

Pay $1,776 in cash using bank interest as a discount ($2,327 cash minus $550.80 in interest income after tax) using a 1.7% savings account.

-or-

Pay an effective $783.20 ($226.80 in income tax on the miles plus the “opportunity cost” of that $550.80 in after-tax interest income plus the $5.60 in tax on the award ticket) by putting the same money in Bask Bank for one year.

In this example, it is $1,000 cheaper per ticket putting the same $54,000 to work in a Bask Savings Account vs. in a 1.7% APY high-yield savings.

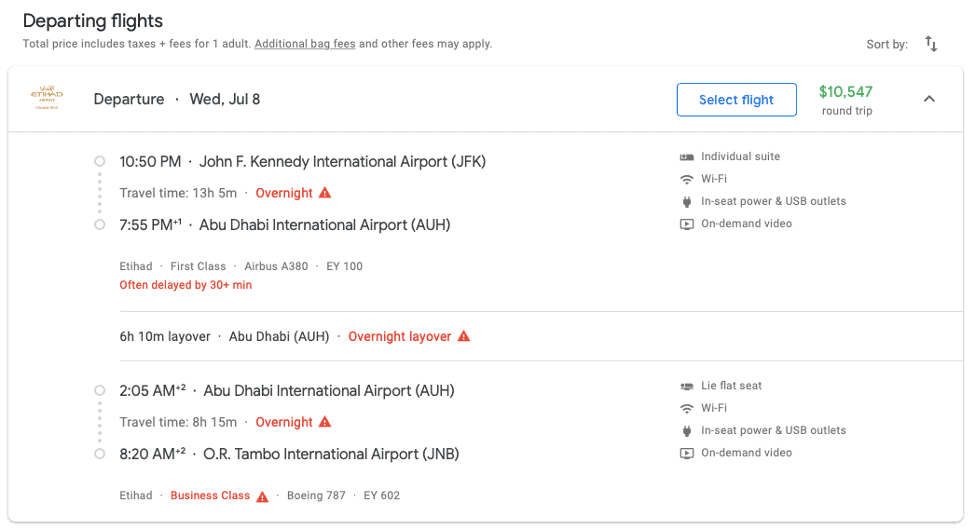

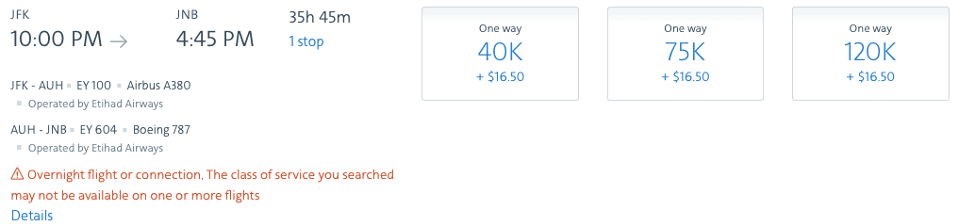

Redemption #2: The Etihad First Class Apartment to the Middle East or Africa

Did you know that when using AAdvantage® miles you can route via Doha on Qatar Airways or via Abu Dhabi on Etihad to Africa? When you are flying up front, it’s not a bad way to do.

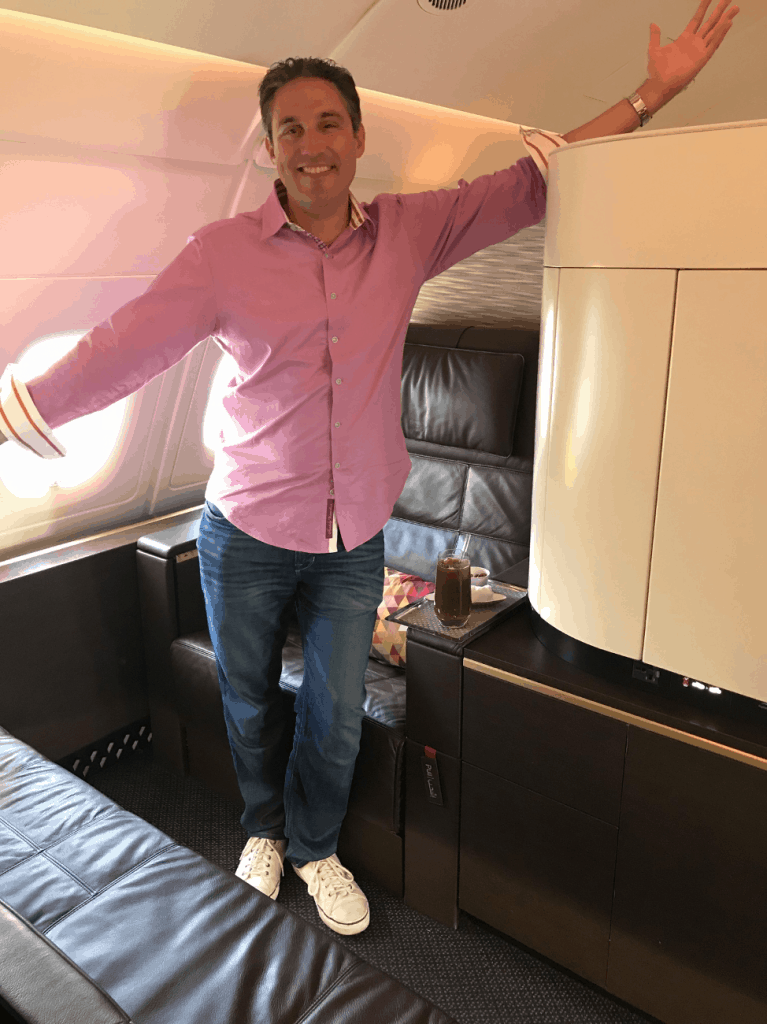

If you want to see just how opulent the experience is, please see my review of the Etihad First Class Apartment.

If you leave from JFK on one of Etihad’s A380 aircraft with a First Class Apartment, you’d enjoy that for the 13-hour flight to Abu Dhabi.

You’d then continue on to Africa in Business Class. In this example to Johannesburg, South Africa, that continuing leg will be on a very nice 787 with a flatbed seat.

You’d get over 20 hours in premium cabins and enjoy the much talked about “Shower in the Sky” during your New York to Abu Dhabi leg inside the First Class Apartment.

Paying cash on our July 8 – July 15 dates, you’d see a round trip fare of $10,547, meaning a one-way flight cost of $5,273.50.

Believe it or not, this is one of the cheapest ways to enjoy the First Class Apartment. If you took a round trip to and from Abu Dhabi, you’d actually pay about $4,000 more round trip despite having 16 hours less flying time.

It would cost 120,000 miles + $16.50 to redeem this flight using AAdvantage® miles.

Let’s break this down against earning cash interest and using that to book this flight:

AAdvantage® miles needed for a one-way business class flight: 120,000 + $16.50

One-way (half of round trip) cost with cash: $5,273.50

Value per mile: 4.4 cents

Approximate Bask Savings Account Balance for one year to earn 120,000 miles: $94,000

What $94,000 would earn at 1.7% APY: $1,598

Tax on $1,598 of interest if you earned cash interest at 40%: $639.20

Total money in your pocket on that 1.7% Cash Savings account for $94,000 on deposit for one year: $958.80

Tax you’d pay on the miles earned at Bask Bank: $504

Totals:

Pay $4,314.17 in cash using bank interest as a discount ($5,273.50 cash minus $958.80 in interest income after tax) using a 1.7% savings account.

-or-

Pay an effective $1,479.30 ($504 in income tax on the miles plus the “opportunity cost” of that $958.80 in after-tax interest income plus the $16.50 in tax on the award ticket) by putting the same money in Bask Bank for one year.

In this example, it is $2,834.87 cheaper per ticket putting the same $94,000 to work in a Bask Savings Account vs. in a 1.7% APY high-yield savings.

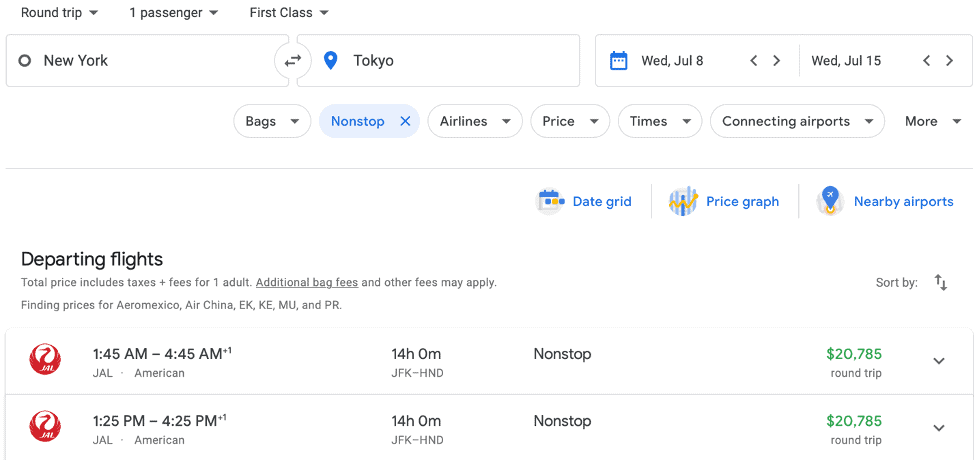

Redemption #1: Japan Airlines (JAL) First Class to Japan

I’ve written about and reviewed my fantastic experience flying Japan Airlines in First Class to Japan. For 80,000 and $5.60 outbound, you can sip the finest champagne and eat the finest Wagyu steak in the comfort of your giant seat up front.

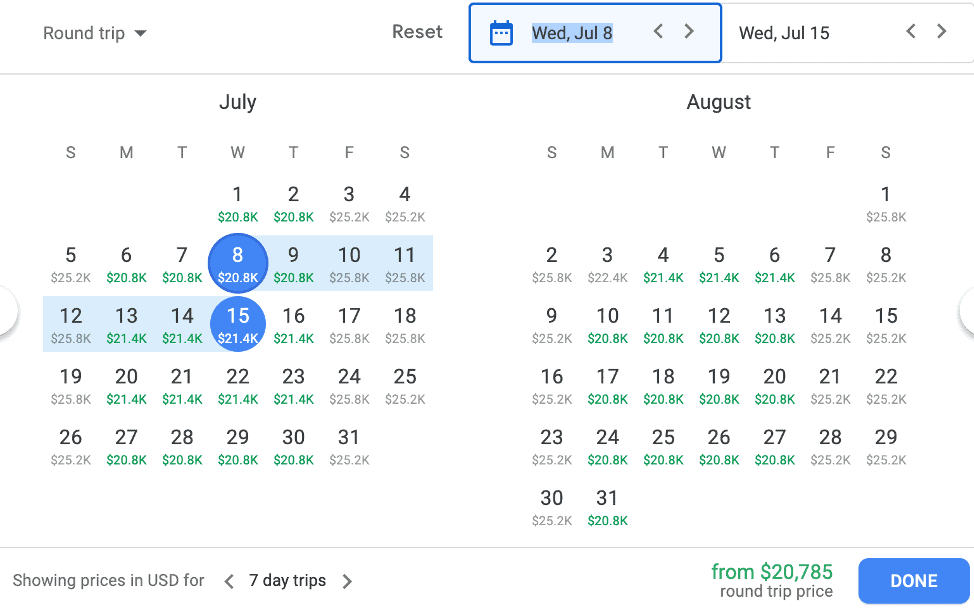

It’s rare to see a real fare sale on First Class. On the dates I’m using for this exercise, JAL wants $20,785 for this journey. Someone will comment “choose dates where it’s cheaper” so I also saved out a calendar view for the summer showing that this is as cheap as it gets for a two-month time period. (Of course, with awards, you are limited to dates made available for awards – so that’s worth keeping in mind, though it doesn’t change the value proposition).

Now, let’s be clear. I doubt that any of us would ever pay the cash rate on this. But that’s kind of the point, isn’t it? Miles and points can allow you to have experiences you wouldn’t have otherwise.

Let’s look at the math on this one:

AAdvantage® miles needed for a one-way business class flight: 80,000 + $5.60

One-way (half of round trip) cost with cash: $10,392.50

Value per mile: 13 cents

Approximate Bask Savings Account Balance for one year to earn 80,000 miles: $54,000

What $54,000 would earn at 1.7% APY: $918

Tax on $918 of interest if you earned cash interest at 40%: $367.20

Total money in your pocket on that 1.7% Cash Savings account for $54,000 on deposit for one year: $550.80

Tax you’d pay on the miles earned at Bask Bank: $226.80

Totals:

Pay $9,841.20 in cash using bank interest as a discount ($10,392.50 cash minus $550.80 in interest income after tax) using a 1.7% savings account.

-or-

Pay an effective $783.20 ($226.80 in income tax on the miles plus the “opportunity cost” of that $550.80 in after-tax interest income plus the $5.60 in tax on the award ticket) by putting the same money in Bask Bank for one year.

In this example, it is $9,058 cheaper per ticket putting the same $54,000 to work in a Bask Savings Account vs. in a 1.7% APY high-yield savings.

Setting Goals with Bask Bank

The beauty of a Bask Savings Account is that you can move money in and out depending on your upcoming travel plans. If you know you have a flight in mind that you can book with AAdvantage®, you can easily figure out how much money you need to add to your Bask Savings Account balance to get there. You can do the math on what makes sense for you and both your financial goals and your travel goals.

I’ll note that an advantage of cash fares is that you don’t need to worry about award availability. In all of these examples, you do need the partner airline involved to release award inventory in the premium cabins and it won’t be available on all dates. You’ll need to be flexible.

In exchange for that flexibility, you’ll get a heck of a deal.

You can sign up for a Bask Savings Account here.

What are your thoughts on the new Bask Bank?

Tell me here, on Twitter, or in the private MilesTalk Facebook group.

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My introductory book MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

Bask Bank and BankDirect are divisions of Texas Capital Bank, N.A. Member FDIC. The sum of your total deposits with (i) Bask Bank; (ii) BankDirect; and (iii) Texas Capital Bank, N.A. are insured up to $250,000. Additional coverage may be available depending on how your assets are held.

![Amazon “Pay One Point” Deal Links (Compilation) [UPDATED] amazon pay one point pay 1 point links amex chase citi discover](https://milestalk.com/wp-content/uploads/2023/11/payonepoint-218x150.png)