The United Business Card which replaced the MileagePlus Explorer Business credit card earlier this year. It feels like more of an upgrade than a brand new card, but Chase is treating it as an entirely new card.

In this article

United Business Card Bonus Offer

They have increased the bonus offer on this card to 75,000 bonus miles after $5,000 in purchases in your first three months.

Previously, when the card first launched, there was a 100,000 mile offer, but that required $10,000 in spend. Since then the offer was just 60,000 miles, though with a $3,000 spend requirement.

This card has replaced the United MileagePlus Explorer Business Card and is considered a new / different card for purposes of the bonus. If you have/had the United MileagePlus Explorer Business Card, you can still get this bonus.

Per the Chase website: This new Cardmember bonus offer is not available to either (i) current Cardmembers of this business credit card, or (ii) previous Cardmembers of this business credit card who received a new Cardmember bonus for this business credit card within the last 24 months.

United Business Card benefits:

- 2 miles per $1 spent on United purchases, at gas stations, office supply stores and restaurants and on local transit and commuting – which includes taxis, mass transit, tolls, and ride share services

- 1 mile per $1 spent on everything else

- 5,000 bonus miles each anniversary when you have both a (new) United Business Card and a ANY personal United card

- You’ll get a $100 annual United travel credit after 7 United flight purchases of $100 or more

- 25% back when you make United inflight purchases, including Wi-Fi, food and beverages with the card.

United Business Card Annual Fee: $99

(It was $95 on the United MileagePlus Explorer Business Card)

Other benefits include:

- Free first checked bag (must buy the ticket with your United card

- Priority boarding

- 2 United ClubSM one-time passes at account opening and on each Cardmember anniversary

- No foreign transaction fees

- Primary Collision Damage Waiver on car rentals when used for business purposes

- Trip Cancellation / Trip Interruption Insurance(From the Chase website) You can be reimbursed up to $1,500 per person and $6,000 per trip for your pre-paid, non-refundable passenger fares, if your trip is canceled or cut short by sickness, severe weather or other covered situations.^

- Baggage Delay Insurance(From the Chase website) Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 3 days.

- Lost Luggage Reimbursement(From the Chase website) If you or an immediate family member check or carry on luggage that is damaged or lost by the carrier, you’re covered up to $3,000 per passenger.

- Trip Delay Reimbursement(From the Chase website) If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

Unofficial benefit which can be a great reason to get and hold the United Business card:

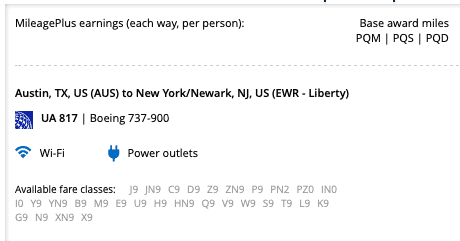

The biggest benefit is access to expanded award availability on United flights. United often makes additional award seats (coach only, sorry) available for its elites. This is in an inventory bucket called YN which you can search online easily.

<< How to apply for the United Business card >>

Thoughts?

Let me know here, on Twitter, or in the private MilesTalk Facebook group.

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My introductory book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![Amazon “Pay One Point” Deal Links (Compilation) [UPDATED] amazon pay one point pay 1 point links amex chase citi discover](https://milestalk.com/wp-content/uploads/2023/11/payonepoint-218x150.png)