I just noticed this deal and while I’m not recommending it (I have no experience or opinion on this product), it seems worth knowing about.

American Express has a new investment platform that is essentially Vanguard’s robo-invest, white-labeled.

You’ll pay a fee for the asset management of 0.5% to 0.55%, so this isn’t something you can just transfer/park.

However, if you were using the Vanguard auto-invest plan offered through Vanguard anyway, it could make sense to move it over to this plan where you earn points.

You need to know that if this is your only account earning Membership Rewards, they are not “full” MR points.

They state: “To redeem points, you must have a Membership Rewards-enrolled Card (which may include a Debit Card associated with an American Express Rewards Checking Account) or continue to be enrolled in INVEST at the time you redeem points. If you have a Membership Rewards-enrolled Card at time of redemption, you will be able to redeem the points the same way you always have. If you no longer have a Membership Rewards-enrolled Card at time of redemption, but continue to be enrolled in INVEST, you will be able to transfer points to limited hotel and travel partner rewards programs starting after your INVEST account anniversary. Until then, you may not be able to redeem points unless you open a new Membership Rewards-enrolled Card.”

However, I don’t see anyone opting for this service if they don’t already have a credit card earning American Express Membership Rewards points!

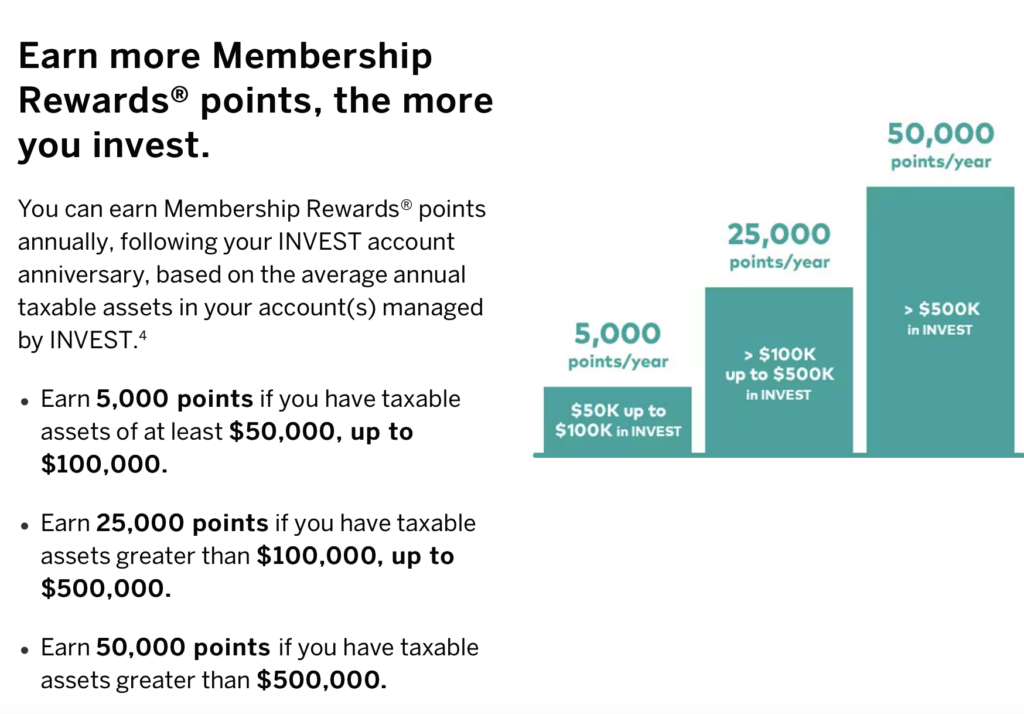

If you had $100,000 in the auto-invest, you would pay $500 a year in management fees to Amex (who re-shares with Vanguard). But then you’d get back 25,000 points worth about $425 using MilesTalk points and miles values.

So if you are someone that wants a robo-advisor anyway, this isn’t a bad deal as you are recouping most of your fees in points – as long as you have assets near the bottom end of threshold range (i.e. $100k – $499.99k earns the same $25,000 points, so the math gets worse if you have an amount invested near the high end of a range.

You do get one session with an advisor before you start (or unlimited sessions if your assets are over $50,000).

I’ll be curious what MilesTalkers think about this option.

Here’s a link to the page with all the details.

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![Amazon “Pay One Point” Deal Links (Compilation) [UPDATED] amazon pay one point pay 1 point links amex chase citi discover](https://milestalk.com/wp-content/uploads/2023/11/payonepoint-218x150.png)

Worthwhile to go slightly above the bare minimum required so that the volatility doesn’t bump you into the lower tier “Membership Rewards points are determined as of each anniversary of your enrollment in INVEST based on the average end-of-day balance of taxable assets under management with INVEST over the 12 months prior to your INVEST anniversary”