While neither of these is a must transfer, it’s always good to know about transfer bonuses. Perhaps more notably, we’ve seen very few transfer bonuses since COVID-19 began, so it’s encouraging that more brand are resuming transfer bonuses. I’m personally holding out for a nice Aeroplan transfer bonus to book Etihad with Aeroplan.

In this article

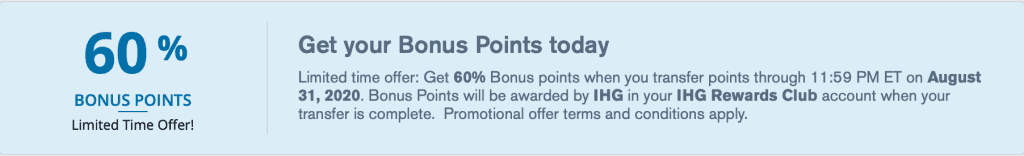

60% Transfer Bonus from Chase Ultimate Rewards to IHG

Normally, Chase Ultimate Rewards transfer 1:1 to all programs, including IHG. That makes Hyatt a great use of Chase points, since they are easily worth 1.6 cents each while it makes little sense to transfer to IHG (worth 0.5 cents) or Marriott Bonvoy (worth 0.6 cents).

With this bonus, you are getting 1.6 IHG points for 1 Chase point, giving you around 0.8 cents per Ultimate Rewards point in value. Given that you could redeem those same Chase points in the travel portal for 1.25 – 1.5 cents each depending on which card you have, this isn’t going to be a great deal for many.

That said, there are always cases where points transfers (or points purchases) can make more sense. If you had most of the points you need for an award in your account and need to transfer in some more to top off, that can make sense. As well, if you have the IHG Premier Credit Card, which gives you the 4th night free on an award, the math can make sense.

This transfer bonus is valid through August 31st, 2020.

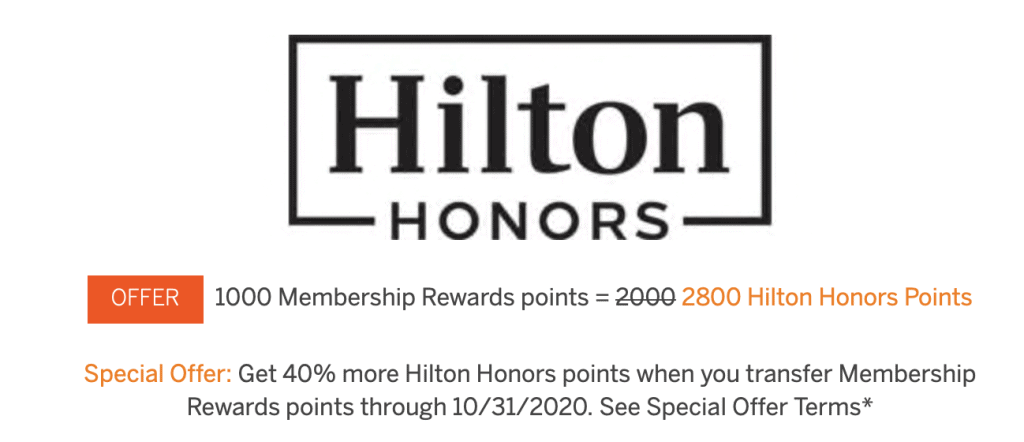

40% Transfer Bonus from American Express to Hilton Honors

There is a bonus of 40% bonus Hilton Honors points when you transfer Membership Rewards points through 10/31/2020.

Normally, Amex points transfer to Hilton at a 2:1 ratio, so this means you’ll get a 2.8 to 1 ratio. For instance, a 100,000 point transfer would net you 280,000 Hilton Honors points.

Is that a good deal? Well, Hilton Honors points are worth about 0.5 cents each. So with this bonus, you are getting a return of about 1.4 cents on your Membership Rewards points versus my expected redemption threshold for Membership Rewards of 1.7 cents each.

It’s certainly nothing to rush to transfer for, and this bonus has been higher (3 to 1) before. But again, to top off for an award (all Hilton awards get the 5th night free), or for certain cases where the redemption yield is high, it can make sense. For instance, I just redeemed 320,000 Hilton points for a stay that would have cost about $3,000. In this case, Amex points would be a much better value than cash, though I’d first point out that there are lots of great bonuses for Hilton Honors credit cards and that would be my first stop. If I’d gotten all those bonuses already and needed points, I’d consider this deal.

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.