Updated: July 5th, 2023

In this article

Using a Chase Credit Card via Digital Wallet Before Receiving the Card

Yesterday, I wanted to add my Chase Marriott Bonvoy Boundless card to my Apple Pay wallet so I could have the option to use it for promotions without having to actually carry the card in my wallet.

Chase Now Lets You Add Your Credit Card to Your Digital Wallet Without Having the Card in Hand

When I’ve had to replace my iPhone, it’s always frustrating having to find all of my physical cards to re-add because with Citi and Amex you need your 3 or 4 digit security code.

Marriott Bonvoy Boundless Card

From my Chase app, I was able to add it with verification done via text message instead of needing the CID number. How great, I thought. I wonder if you could do this with a brand new card as well?

And right on cue, in my Twitter feed, was today’s post from Doctor of Credit that you can now, in fact, add a brand new card to your digital wallet without having the card in your hand.

This is extremely valuable because when you apply for a new credit card, the clock starts ticking on your bonus offer period – the amount of spend you need to make in a fixed amount of time – once you are approved. And you may well be applying for the card specifically because you have some payments you want to make.

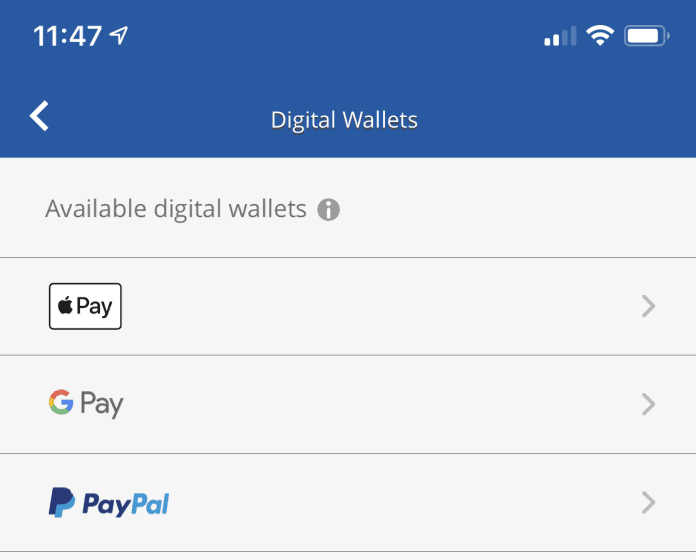

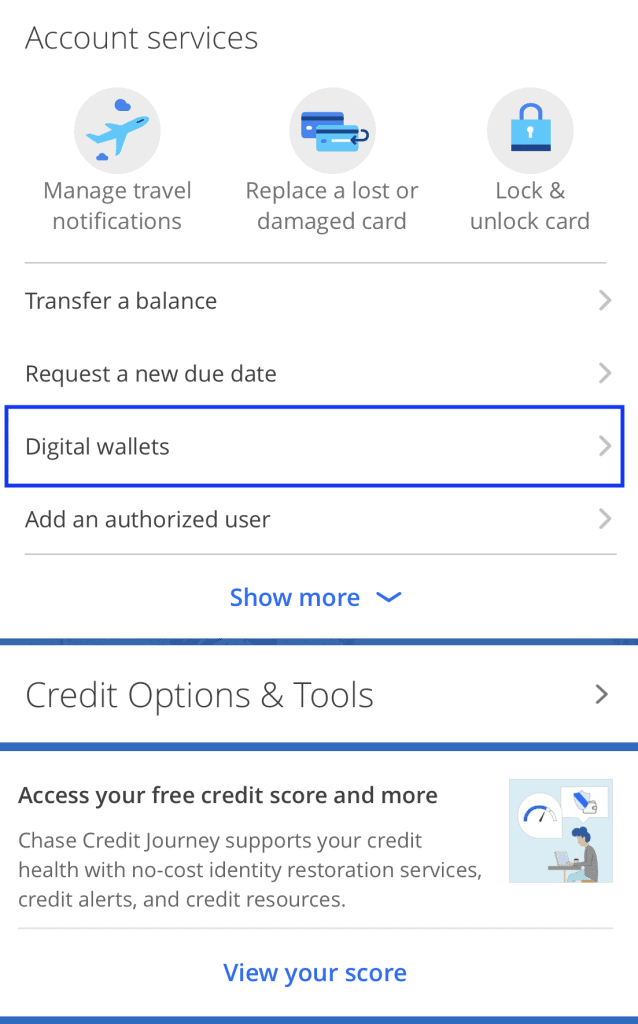

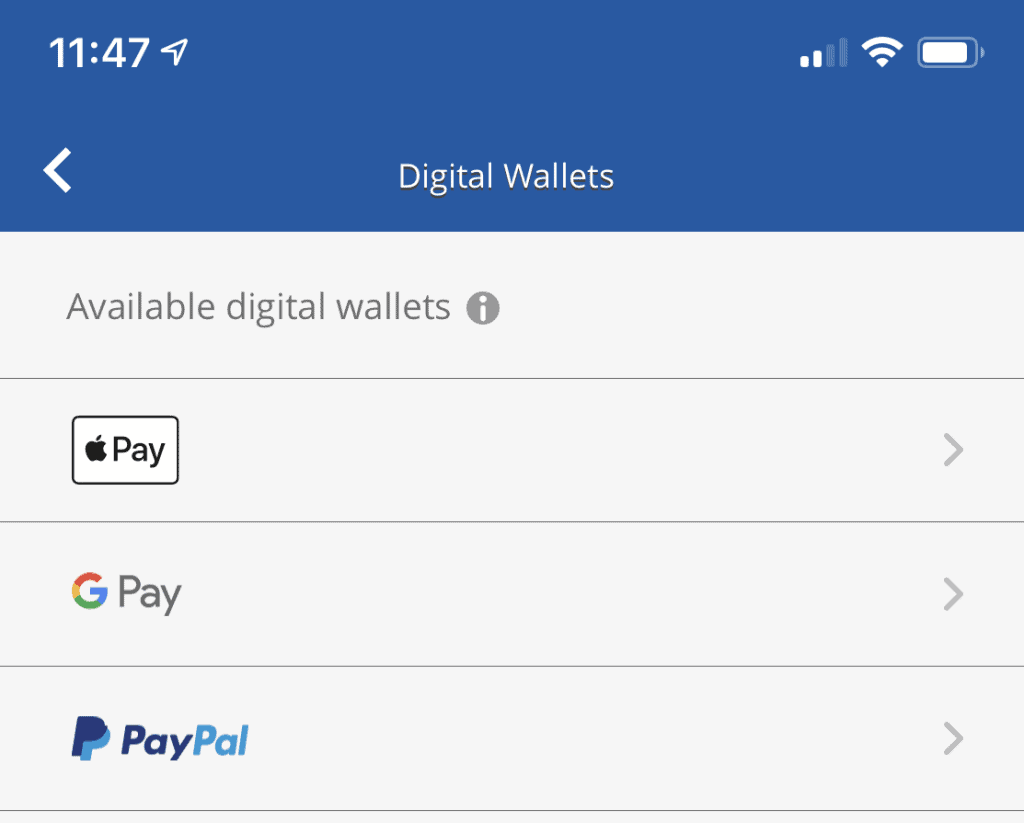

Here’s where to look inside your Chase app.

What Digital Wallets Can You Add Your Chase Card To?

You can add any of your personal Chase credit cards, like a Chase Freedom Unlimited, to Apple Pay, G Pay, or PayPal. It will text you a code (or you can get a voice call to your number on file).

For a while in 2021/2022, you could add business cards from the app once you’d activated the physical card, but at some point unknown, they’ve taken that feature away.

Chase will generally let you call and request your card expedited anyway – which is great – but this will give you an even greater head start on your spend.

American Express will almost always give you a digital number you can use right away, but only for personal cards. Citi, by contrast, will almost never expedite your card and you cannot add Citi cards to your wallet.

While not life changing, this is a nice new feature and good to know about.

Have you done this?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)

![[TODAY!] Amazon Prime Day July 16-17: Pay One Point Discounts! amazon prime day discount](https://milestalk.com/wp-content/uploads/2021/06/prime-day-discount-218x150.jpg)

![HUGE 120,000 Point Bonus Offer on Chase Ink Preferred® [Best Ever] Chase Ink Preferred 120,000 Point Bonus Offer](https://milestalk.com/wp-content/uploads/2024/07/cibp-120k-218x150.jpg)

I added my new Hyatt card to Apple Wallet, but it only showed the last 4 digits of the new card number, so I couldn’t use it to order stuff online.

@sharon. That’s right – it will allow you to use it inside a wallet only. It won’t give you the card number. If you need it outside of the three wallets, you’d need to ask to have the card expedited in ~2 days.

I tried to add my new account to the Chase digital wallet since I haven’t received my card yet and it won’t let me. It’s saying that I don’t have any eligible cards to add right now. Any idea why this might be happening?

Afraid not. You might try Chase phone support to ask.

I’ve got Paypal and Google Pay installed on my device, but for some reason it’s only showing me Google Pay as a digital wallet…and even if I go to Google Pay, it’s saying I have no eligible cards (I only have personal cards). Wonder if they’ve started to close this loophole.

Same on all of your cards?? Odd!

I lost my card and had to order a replacement but now that I go in to add my new card I get a message stating card is already in wallet, but its not..

I got an email from Chase a few days after instant online approval for a card. It said the new card ending in XXXX can be used prior to receipt via digital wallet. Only PayPal is listed as an available wallet when I attempted this. However, when I click on PayPal wallet to add the new card, the new card XXXX is not listed, so the Chase email is incorrect and I’m doubtful this method even works for using a card prior to receipt. BTW, I tried this using the Chase app and the Chase website. Fail both ways.

This method worked great for me! It took me a couple tries. I had to do it from the Chase app and then selected which wallet I wanted to add it too. I chose google wallet, it asked for several prompts reading terms and conditions (the first time I tried this it said the card wasnt eligible, which turns out was because I didnt have NFC turned on in google wallet, once I did that it worked). Then it took me straight to google wallet and my card showed up and I can use it now! Note: with this method it said I could only use half of the total credit allowance, after that you have to wait for the physical card. Not a big deal for me, but good to know.

This is not correct. I can add the card to a digital wallet, but can’t actually use it for any purchases. Adding to a digital wallet is all that Chase allows prior to the card showing up. If you can’t make a purchase, what’s the point?

Sounds like a technical error on your account. It works fine for most of us. Sorry you’re having trouble!

I have requested a new chase visa because mine was damaged but I cannot buy a physical card from my rewards. It only says digital which I do not want or use

This seems to ONLY work if you already have a Chase account with an account number, since you can’t create an account without this info.

This appears to only work for non-business cards. I added a personal chase card this way a couple months ago, and now I don’t see the option for my business card.

Indeed, at some point in the last year, this feature vanished and I’d been meaning to update this post. I have now done so. Sorry the issue wasn’t user error 😉

yep same for me. Sapphire Preferred had the Digital Wallet option, Ink Business Preferred does not.

Mine worked one day the next wont work decline no matter what why i dont know

I recently opened a chase card but the branch manager inputted the address incorrectly and there was a huge delay in getting the physical card, leaving me with only 2 weeks to reach by bonus spending goal. Chase gave me a 2 week extension but spending $4000 in 2 weeks is not possible for me. What should I do?

They tried to tell me the card was available on Apple wallet and that’s why the bonus point deadline couldn’t be met but I couldn’t access it on my Apple wallet until the card arrived.

If it was a personal card, you should have had access via your Chase app. If it was a business card, you would not have and would have a stronger case. Good reason to not open cards in branch, though!

I was excited about the feature. I got a notice about my new Freedom Unlimited and tried to add it to Digital Wallet for Apple Pay. I got a message “It looks like this isn’t working right now” That’s very folksy. Fails in a browser and fails in the Chase app. Tired the next day. Logged out and back in. Still fails.

How long would it be available for paypal?

I’m not sure if I follow the question but all digital wallets become available around the same time you can access your new account online – for most personal cards. No difference between PayPal and Apple Pay, for instance.

I was able to do it yesterday for the Chase Marriott card. I tried the Chase checking account years ago so I still had my old Chase login. I actually applied through the my Chase app. I have gotten turned down by Chase in the past so applied from the app to see if it would give me an edge. Not sure if it did, but I was approved. Also I had to call the reconsider line because I was auto denied because of a 7 year old ch 7. I have a good rebuild with 1 percent credit used. I am not sure one would be able to add a credit card that you haven’t gotten yet to a wallet. I was only able to because I had that Chase account already set up. One more thing it seems, like with Amex once I add payment accounts they seem to be willing let you add a wallet or give you a temp number for Amex.

I was able to do it yesterday for the Chase Marriott card. I tried the Chase checking account years ago so I still had my old Chase login. I actually applied through the my Chase app. I have gotten turned down by Chase in the past so applied from the app to see if it would give me an edge. Not sure if it did, but I was approved. Also I had to call the reconsider line because I was auto denied because of a 7 year old ch 7. I have a good rebuild with 1 percent credit used. I am not sure one would be able to add a credit card that you haven’t gotten yet to a wallet. I was only able to because I had that Chase account already set up. One more thing it seems, like with Amex once I add payment accounts they seem to be willing let you add a wallet or give you a temp number for Amex.