Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Update August 2023: We are now seeing Citi offers inside CardMatch. I know of at least one recent approval for a Custom Cash. If you get offered a Citi card offer, can you please comment below with your offer? (All Amex cards remain in CardMatch).

The Platinum Card® from American Express generally offers 80,000 Membership Rewards points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership as its  welcome bonus. But there’s a way that some people – from time to time – are targeted for a 150,000 point welcome bonus. Used well, those points are worth well over $2,000, so this is a fantastic deal – even with the high annual fee.

welcome bonus. But there’s a way that some people – from time to time – are targeted for a 150,000 point welcome bonus. Used well, those points are worth well over $2,000, so this is a fantastic deal – even with the high annual fee.

As well, some people are seeing the American Express® Gold Card with an offer for 90,000 Membership Rewards points after meeting minimum spend requirements.

How is this possible?

In this article

What is CardMatch?

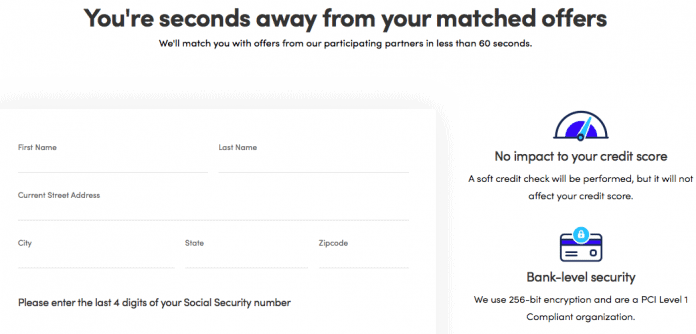

Sometimes, the CardMatch tool provides that targeted offer you’ve been waiting for. CardMatch is a personalized credit card offer tool that various card companies use. You should know that it will ask for your SSN but that it’s doing only a soft inquiry and NOT a hard credit pull. Using the tool will not impact your credit in any way unless you choose to actually apply for a card.

Please that these offer may not be available to everyone. They vary by algorithms only the credit card companies know….

Link to: CardMatch™

New 150,000 Point Platinum and 90,000 Point Gold CardMatch Offers Exist

Now, the CardMatch offers have gotten even higher.

I suggested that the reader check CardMatch, as there are reports of Amex targeting people for a welcome offer of 150,000 Membership Rewards points for $6,000 in spend over 6 months plus 10X points on up to $25,000 in spend at restaurants worldwide and to Shop Small – and that reader reported back that he indeed was offered that welcome bonus.

Others are offered similar offers, but with 100,000 or 125,000 point welcome bonuses.

It seems that the *most likely* targets for this offer are those with 0-1 Amex card in total in their wallet, however, given the current situation, they may be more broadly targeting people that don’t already have the Platinum Card.

If you are offered the 150,000 point welcome bonus for an American Express Platinum Card or the 75,000 or 90,000 point welcome bonus for the American Express Gold Card, should you take it?

Yes, without question, it’s the best way to get up to 150,000 Membership Rewards points for the least required minimum spend – if it’s offered to you.

There are some amazing redemption opportunities with 100,000+ Amex points. With 125,000 total Amex points, for example, you could fly around the world in Business Class, up to 12 segments!, by transferring your points to ANA (a Japanese Star Alliance airline). Or for a 100,000 points, you could fly from the US to Europe round trip in First Class on AA using Etihad miles or in Delta One using Virgin points.

So yes, this is a GREAT deal.

Note that you’ll want to make sure that after submitting your info inside CardMatch you have “Show All Offers” checked on the left hand side, or the deal could be hidden from you.

This offer comes and goes regularly, so don’t think that if you are reading this post months or even years after the posting date, that it’s too late to check. It’s not.

If you are not familiar with the card, you can get more details on the fees and benefits of the American Express® Platinum card or the American Express® Gold Card / Rose Gold Card

Check if you are targeted for this offer at: CardMatch

Questions?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)

![[TODAY!] Amazon Prime Day July 16-17: Pay One Point Discounts! amazon prime day discount](https://milestalk.com/wp-content/uploads/2021/06/prime-day-discount-218x150.jpg)

![[EXPIRED]💰Find Dave, Make Money: The MilesTalk $1,000 Challenge💰 find dave make money milestalk](https://milestalk.com/wp-content/uploads/2024/01/new-rectanglev2-218x150.jpg)

Is the card match tool meant for one use? I used it today, but found my special offers were only available for 10 minutes. I didn’t want to jump into a new credit card so quickly. Can I use the tool again and still be targeted for special offers?

You can definitely use it multiple times and as there’s no hard credit pull. It won’t affect your credit. That said offers may not always reappear.

I had 8 Citi cards included: Premier, Double Cash, Custom Cash, Diamond Preferred, Rewards+, Costco, Costco Business, AAdvantage Executive.

Did any have higher offers than the standard ones?

Interesting. Just got the Citi AA Exec. Had that and a bunch of other Citi and Chase cards offered. No Amex cards at all on my list, perhaps due to the recent Citi AA Exec add?.

I didn’t see any special offers matched to me and nothing form issuers I have any interest. There was nothing from Chase or AmEx – only Citi, Bank of America, Wells Fargo, and Discover – all ones I have zero interest in. Makes no sense as I have over 800 credit score, not close to 5/24 for Chase, etc. What gives?