This offer has expired

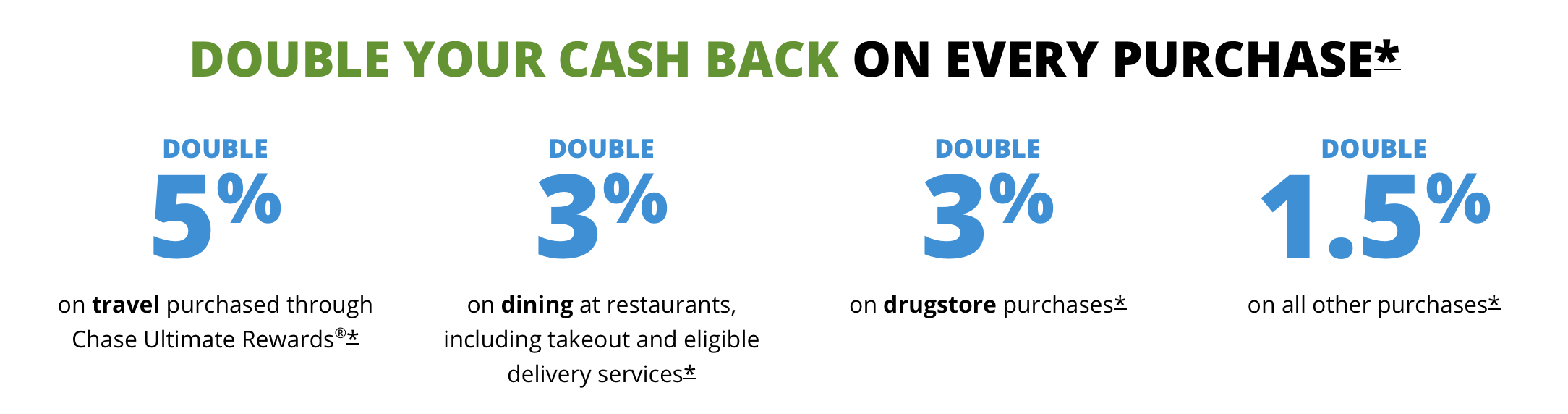

It applies to ALL categories. That’s a total of 10% on purchases at Chase Travel, 6% on drugstores, dining, including takeout and eligible delivery services, and then 3% on everything else.

Chase has changed up the offer on the Chase Freedom Unlimited® with what will be a boon for big spenders.

Rather than getting $200 for $500 in spend (yes, that is awarded as 20,000 points that become fully transferable if you also have a Sapphire Preferred, Reserve, or Ink Preferred), you will instead have your entire first year’s earned points – including bonus categories – doubled.

Since it normally earns 1.5%, this means you will earn 3% on all non-bonus category spend for a year. and up to 10% on bonus categories.

And since, as mentioned above, these points become fully transferable if you also have a Sapphire Preferred, Reserve, or Ink Preferred (otherwise, you are earning straight cash back).

So, how does that compare against 20,000 points for $500 in spend and then no end of year kicker?

Old Offer ($200 for $500 in spend within 3 months): If you spend $5,000 in that first year, you’d earn 20,000 points plus 7,500 points = you’d have 27,500 points.

New Offer (1.5x now, doubled at end of year for 3% total): If you spend $5,000 in that first year, you’d earn 15,000 points. Even if $2,000 was drugstores, it would be 21,000 points.

So we see off the bat there’s a threshold of spend to like this new offer.

How about at $15,000 in spend during year 1?

Old Offer ($200 for $500 in spend within 3 months):

If you spend $15,000 in that first year, you’d earn 20,000 points plus 7,500 points = you’d have 22,500 from spend and 20,000 from the bonus = 42,500 points (or $425 cash back)

New Offer (1.5x now, doubled at end of year for 3% total):If you spend $15,000 in that first year, you’d earn 45,000 points (or $450 cash back).

We can see that at just under $15,000 you get ahead with this new offer.

But that’s without counting the BONUS CATEGORIES.

BETTER

Old Offer ($200 for $500 in spend within 3 months):

If you spend $15,000 in that first year, you’d earn 20,000 points plus 7,500 points = you’d have 22,500 from spend and 20,000 from the bonus = 42,500 points (or $425 cash back)

New Offer (1.5x now, doubled at end of year for 3% total):If you spend $15,000 in that first year, with $5,000 of that on dining and drugstores, you’d earn 75,000 points!!!!!!!

We can see that at just under $15,000 you get ahead with this new offer, and even less if you have bonus category spending.

Now some offers have a kicker of 5% on groceries for a year, which this does not have, so that needs to be factored in.

But if you are a BIG SPENDER, this gets to be crazy good.

If you spend $10,000 a month on your card, $120,000 in a year, you will earn 360,000 Chase Ultimate Rewards points – and that doesn’t count any additional points from bonus categories which can make this much richer!

If you pay a lot of estimated taxes, which come with a minimum 1.85% credit card fee, you are up 1.15% on every dollar you pay.

And it’s UNLIMITED. I did expect a cap when I first heard of this Special Offer.

[Unfortunately, this offer has expired.]

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Launch Offer Ends by 7 AM EST on 8/21/2025] The New Chase Sapphire Reserve® – A Complete Transformation The New Chase Sapphire Reserve](https://milestalk.com/wp-content/uploads/2025/06/new-chase-sapphire-reserve-feature2-218x150.jpg)

![16 Months of Frontier Elite Gold Status for $69 [LAST CHANCE] frontier airlines status match](https://milestalk.com/wp-content/uploads/2025/08/frontier-status-match-218x150.jpg)