You may recall a post from September talking about the about-to-be-launched Chase Sapphire Banking. In short, it’s a new version of their Platinum checking, aimed at those with a Chase Sapphire Reserve or Chase Sapphire Preferred credit card.

The offer:

60,000 Ultimate Rewards points when you open a new account with a banker (who must first double check the offer is “on your account”) and fund it with $75,000 in new money within 45 days and keep it there for 90 days. The account only has a service fee if the balance is below $75,000, so assuming you are in this for some points, that won’t be an issue.

You can check the current offer here.

And you get a shiny new Sapphire Banking Debit card:

(no, it’s not metal)

But many people screamed about this offer to say “Not worth it!”

The OPPORTUNITY COST, they screamed.

The chatter was that if you parked $75,000 in a Chase checking account at nearly 0% interest, you

However, there are two easy ways around this. While you DO need to have $75,000 available to move in cash or assets, you do not have to take a hit in order to earn this bonus.

That is because investments count. And Chase’s new “You Invest” product is fee-free and can be linked to your Sapphire Checking account. While you can only trade stocks, ETFs, and funds, that’s all you need.

Option 1) If you don’t have the liquid cash, but you do have $75,000 in investments, you can simply move them over. Using the automated clearing system with each broker (called ACAT), your costs should be close to zero. After you have fulfilled the terms, you can always transfer them out. Or maybe you’ll enjoy it enough to stay!

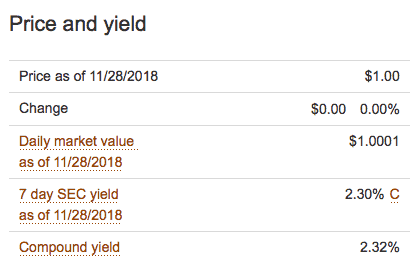

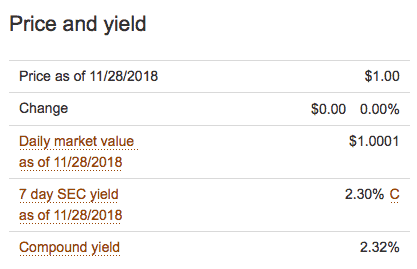

Option 2) Many people play bank bonuses using cash. And they are the ones saying you can’t make this work. But if you are sitting on cash, you probably have it in a “high yield” (high yield for 2018, anyway, which is a laughable rate) savings account such as Marcus, from Goldman Sachs. Marcus is currently paying 2.05%. So what if I told you that you could link your online savings account to your Chase account, transfer it in and then straight over to your You Invest account where you could then instantly park that money, at no fee, into a Vanguard Money Market fund? When you purchase (at no fee) the mutual fund with the ticker VMMXX, you are buying the Vanguard Prime Money Market fund.

While not technically FDIC insured (because it’s not a bank account), one share is pegged to one dollar and it currently yields 2.30%. So you’ll earn, for example, 0.25% better than in Marcus. The fund has over $100 Billion in assets and is one of the most conservative places to park your money. If you don’t know Vanguard, they are among the most trusted financial companies in the business. This particular fund has been around since 1975 and has always never “broken the buck” meaning that there has never been a day it couldn’t be redeemed, at par, for the amount invested plus interest.

If you had the money in an online savings account and moved it to You Invest, your total opportunity is maybe a couple of days of interest. Under $10.

One note: They may or may not issue a 1099 for the points, and we don’t know how they would value them if they did. But last year, during a similar offer for points when upgrading to Chase Private Client, they warned of a 1099 and nobody I’ve asked has heard that they actually sent one. So YMMV.

You can check the current offer here.

Some key terms for the offer: Maintain at least a $75,000 balance for at least 90 days from the date of funding. Gains, losses, or market fluctuations will not be counted when determining if you have maintained the $75,000 net new money for 90 days. Excludes insurance products; fixed and variable annuities; 529 College Savings Plans; any retirement accounts including but not limited to Traditional and Roth IRAs, Keogh, Simple IRAs, and 401(k) Plans. The qualifying new money cannot be funds or securities held by Chase or its affiliates.

Have you opened a Sapphire Banking account? Do you plan to? Let me know here, in the comments, on Twitter, or in the private MilesTalk Facebook group.

New to all of this? My new “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available now.

| Small Business Credit Cards | Bonus Offer | Best Features | More info |

|---|---|---|---|

Chase Ink Business Preferred Credit Card | 120,000 Ultimate Rewards points when you spend $8,000 in your first 3 months | Earns 3x points on travel, advertising, and shipping. This massive Welcome Bonus offer makes this card a great first business card. These points can be transferred to a range of Ultimate Rewards partners like United and Hyatt at a 1:1 ratio or spent in the Ultimate Rewards portal on travel with a value of 1.25 cents per point. Also provides complimentary cell phone insurance if you pay your monthly bill with the card. | Learn More |

Ink Business Unlimited® Credit Card | Get $750 in the form of 75,000 Ultimate Rewards points when you spend $6,000 in your first 3 months. Points are transferrable if you also hold a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred. | Best for small businesses with a lot of every day spend. This card earns 1.5x everywhere. If you don't spend a lot in the bonus categories of other cards, or want a second card to pair with one that you use in the bonus categories, this is a great card. No annual fee. Pair this with the Chase Ink Preferred for a killer 1-2 card combo. | Learn More |

Chase Ink Business Cash® Credit Card | Earn $350 in the form of 35,000 Ultimate Rewards points when you spend $3,000 on purchases in the first three months and an additional $400 in the form of 40,000 Ultimate Rewards points when you spend $6,000 on purchases in the first six months after account opening. Points are transferrable if you also hold a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred. | 5x points on up to $25,000 in office supplies, internet, cable, and phone annually. There are lots of ways to maximize this amazing 5x benefit. If you combine these points into a Chase Sapphire Reserve account to book travel, it's like 7.5% effective cash back. No annual fee. | Learn More |

The Business Platinum Card(R) from American Express | 120,000 Membership Rewards points when you spend $15,000 within 3 months. Terms apply. | Access to Centurion Lounges, Priority Pass lounges, Delta SkyClub lounges (with Delta ticket) $200 annual airline credit | Learn More |

Chase Southwest Airlines Rapid Rewards Premier Business Credit Card | 60,000 Rapid Rewards points when you spend $3,000 in 3 months | Those trying to get a Southwest Companion pass (the bonus points count). Read more about how to qualify for the Companion Pass here. | Learn More |

The Business Gold Card | 70,000 Membership Rewards points when you spend $10,000 in 3 months | Earns 4x Membership Rewards points on two categories that you spend the most on each statement cycle - up to $150,000 a year in spend). Other eligible purchases earn 1X. This card is a good choice IF you will spend heavily on at least one of the bonus categories, as this card has a moderately high annual fee. | Learn More |

Capital One Spark Miles for Business | You will earn a bonus of 50,000 miles when you spend $4,500 in the first 3 months of opening your account | This card earns 2 miles per dollar. These miles are transferable to 11 frequent flyer programs (0.75 airline miles per one Capital One mile for most partners). | Learn More |

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)

![[TODAY!] Amazon Prime Day July 16-17: Pay One Point Discounts! amazon prime day discount](https://milestalk.com/wp-content/uploads/2021/06/prime-day-discount-218x150.jpg)

![HUGE 120,000 Point Bonus Offer on Chase Ink Preferred® [Best Ever] Chase Ink Preferred 120,000 Point Bonus Offer](https://milestalk.com/wp-content/uploads/2024/07/cibp-120k-218x150.jpg)

Hey how do you go about linking the you invest account to the sapphire checking?

You just open a YouInvest account inside your Chase account. However, if they are still offering this deal (I don’t know) you should reconfirm the YouInvest still “counts” as some recent Chase deals have excluded it.