In this article

Today, American Express rolled out a pair of new Qantas offers.

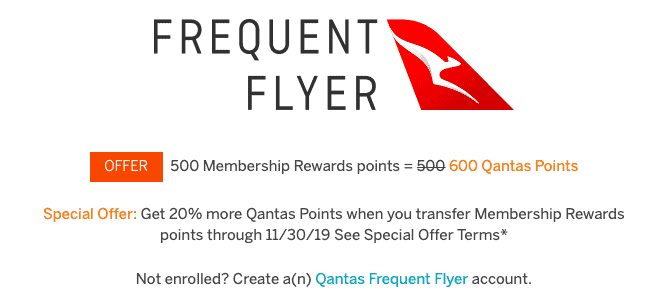

First, from now until November 30th, you can get a 20% transfer bonus when you move your American Express Membership Rewards points to Qantas.

Will you want to transfer?

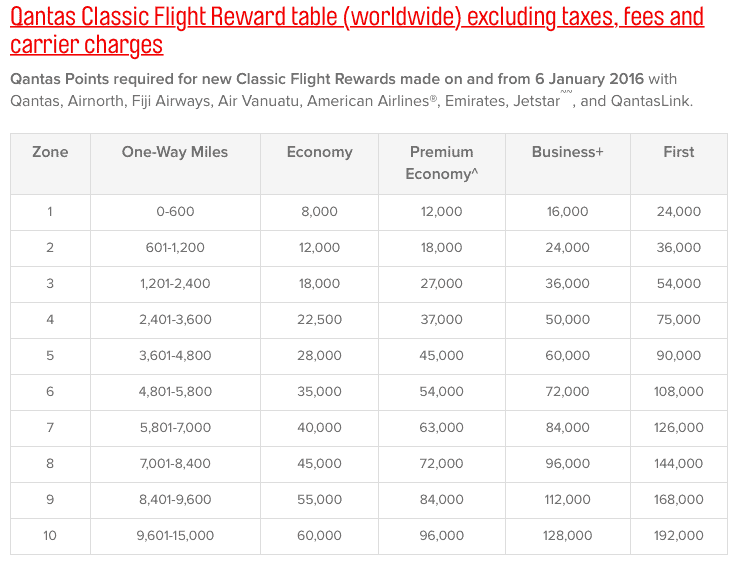

Qantas isn’t a great place to store points because their rates for awards aren’t very competitive and on top of that they levy high surcharges. Additionally, there’s a long expected transfer time to Qantas which also won’t hold awards. So that’s not a great combo. But there are some great redemptions to be had if these line up for you.

So Then, What’s Worth Considering?

- Normally, you can book flights on El Al. Spencer Howard did a deep dive on this for one of his award alerts which you should sign up for. You can fly from NYC (or Toronto) to Israel in Business Class for 78,000 Qantas each and minimal fees. That’s a GREAT deal.(NOTE: El Al appears to be currently blocking their premium cabin awards to partners like Qantas – see this article by Dan’s Deals for more info)

- If you are set on a Qantas First Class flight US <–> Australia, Qantas members get access 24 days before American’s AAdvantage members do, at 355 days before departure.

Qantas First Class - You can use Qantas points to book Emirates First Class. You’ll pay 126,0000 points plus a massive surcharge to Dubai, but it’s another option, given that using Emirates Skywards you can only transfer Amex or Marriott, JAL added big surcharges and it is hard to earn miles in their program and and Alaska miles are also hard to earn. Alaska remains the only way to avoid massive fuel surcharges on EK, though they now charge a lot more than before. So it’s an option.

4) You could use Qantas to reduce fuel surcharges on a British Airways premium cabin flight by mixing cabins. You can book, for example, Madrid to London in Economy and then London to NY in Business and reduce the taxes and fees. You can also read my unrelated article on How to Lower BA Business Class Surcharges by 42% or More.

Should you transfer speculatively?

No. And I’d say that for just about any transfer bonus. Sure, it stinks when 3 months later you want to make a booking that you could have had a bonus on, but it stinks more when you transfer speculatively to a program that changes its rewards structure or your points accidentally expire before you can use them.

There’s also an “Amex Offer” on for $200 off $1,000

I found it on my Marriott Bonvoy Brilliant American Express Card. Just check all of your cards until you find it (assuming you are targeted).

How to Stack Both Offers

You wouldn’t naturally think about stacking a mileage offer and an Amex Offer, but conceivably you could.

You could buy a cash ticket to Australia and upgrade with your transferred miles. Of course, upgrading paid coach tickets is rarely a simple thing and is usually both confusing and technically complicated by fare bucket availability factors. Chris Chamberlain wrote a nice guide to Qantas upgrade rules here.

I absolutely would not do this unless you called Qantas and they definitively confirm the upgrade space, as that’s a long flight in coach! But it’s a possibility.

Will you take advantage of these offers?

Let me know here, on Twitter, or in the private MilesTalk Facebook group.

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? The MilesTalk “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)