In this article

This offer has now expired.

New Bask Mileage Savings Account Holders Can Earn Loyalty Points as a Bonus (Ends Dec 15, 2022)

For the first time, new customers can earn loyalty points in the new Loyalty Points Bonus offer from Bask Bank.*

From September 15, 2022 – December 15, 2022, new customers that deposit $25,000 and meet all terms* will receive 5,000 American Airlines AAdvantage® Loyalty Points.

This is a unique and easy way to earn Loyalty Points.

The offer is now live to apply for a Bask Mileage Savings account.

How To Qualify

- You must be a first-time Bask Mileage Savings Account customer and successfully open an account during the offer period.

- Fund account $25,000 within 15 calendar days following initial account opening

- Maintain a $25,000 minimum daily account balance for 90 consecutive days out of the first 105 days following the initial account opening

- Provide Bask Bank with an AAdvantage® account number in the same name as the subject Bask Savings Account

Complete Offer Terms

Bask Bank is offering 5,000 American Airlines Loyalty Points for customers that (i) are first time Bask Mileage Savings Account customers; (ii) meet Bask Bank’s qualifications to open an account; (iii) complete the online account opening process between September 15, 2022 and December 15th, 2022; (iv) fund the account a minimum of $25,000 within fifteen (15) calendar days following the initial account opening; (v) maintain a minimum daily balance of $25,000 for ninety (90) consecutive days out of the first one hundred and five (105) days following the initial account opening; and (vi) provide Bask Bank with an AAdvantage® account number in the same name as the subject Bask Mileage Savings Account.

The Bask Mileage Savings Account will reflect the Loyalty Point Bonus within ten (10) Business Days once all of the conditions of this offer have been met.

Loyalty Points may take 6-8 weeks to post to the linked AAdvantage® account. This offer is limited to one 5,000 Loyalty Point award for each new customer. Customers that have previously opened a Bask Mileage Savings Account, whether the account is still open or if it has been closed, are not eligible for this Loyalty Point offering. This offer replaces the 1,000 AAdvantage® mile account opening bonus and is exclusive of all other offers and may not be combined with, or in addition to, any other Bask Bank offers of Bonus Miles.

Again, you can open a new Bask Mileage Savings account under this promotion right now at this link.

Link to full offer terms at Bask Bank

What are American Airlines Loyalty Points?

For those that don’t know, American Airlines’ AAdvantage® program replaced its traditional elite qualification method with a system called Loyalty Points.

Unlike the previous system, wherein you could only earn elite status by flying you can now earn Loyalty Points towards elite status in a number of ways that include: flying, using the AAdvantage® Shopping Portal, using the AAdvantage® Dining program, and their Simply Miles card-linked offer program. You also earn 1 Loyalty Point per dollar spent on any AAdvantage® credit card.

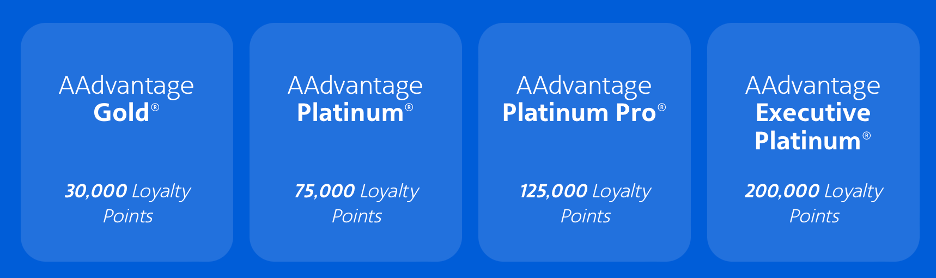

You earn elite status based on the number of Loyalty Points you collect in a year per the chart below.

With each status level, you gain a new set of benefits when you travel on American Airlines:

AAdvantage® Gold®

- Complimentary upgrades on American

- 24-hour upgrade window

- 40% status mileage bonus

- Complimentary Main Cabin Extra Seats at check-in

- Complimentary Preferred Seats

- 1 free checked bag

AAdvantage® Platinum®

- Complimentary upgrades on American

- 48-hour upgrade window

- 60% status mileage bonus

- Complimentary Main Cabin Extra and Preferred Seats

- 2 free checked bags

AAdvantage® Platinum Pro®

- 1 Loyalty Choice Reward

- Complimentary upgrades on American and Alaska Airlines

- 72-hour upgrade window

- 80% status mileage bonus

- Complimentary Main Cabin Extra and Preferred Seats

- 3 free checked bags

AAdvantage® Executive Platinum®

- Loyalty Choice Rewards

- Complimentary upgrades on American and Alaska Airlines

- 100-hour upgrade window

- 120% status mileage bonus

- Complimentary Main Cabin Extra and Preferred Seats

- 3 free checked bags

If you want to know more about Loyalty Points, you can view this article on the American Airlines website.

Now, I’ve talked a lot about Bask Bank on MilesTalk. Not only do they offer one of the highest savings rates anywhere with their Interest Savings Account, they offer the innovative Mileage Savings Account where you earn miles based on how much you keep on deposit.

I’ll refresh you on how that works in a minute.

Ever since American Airlines launched the Loyalty Point system, the number one Bask Bank-related question I get from MilesTalkers is “Can I earn Loyalty Points from Bask Bank?”

That answer has always been no, until now.

What if you are an existing Bask Bank Mileage Savings customer?

I know you are going to ask, so let’s just get it out of the way. At this time, an existing of former customer cannot take part in this offer. Let’s all hold out some hope that at some point, in some way, we’ll be able to earn Loyalty Points from cash on deposit in the future. Hey, we can dream, right?!

Still, this is an exciting new development for American Airlines AAdvantage® members as it is an easy way to earn Loyalty Points with little effort while saving money.

That said, existing Bask Bank customers have recently gotten a boost as well.

Earn Rate for Bask Bank’s AAdvantage® Savings Account is now 1.2 Miles Per Dollar

You may have missed this last month, but as of August 1st, the earn rate for money on deposit in your AAdvantage® Savings Account is now 1.2 Miles Per Dollar saved annually. This is a 20% increase in the rate and the first time we’ve ever seen Bask Bank adjust the miles earned per dollar annually. It makes sense. They offer one of the most competitive High Yield Savings account rates in the nation with a Bask Interest Savings Account so of course they want to keep their own Mileage Savings Account just as compelling.

Previously, you earned 1 mile per dollar saved annually. For instance, and for simplicity, if you deposited $100,000 and kept it on deposit for exactly 365 days, you would have earned 100,000 American Airlines AAdvantage® miles.

With the recent increase, you’ll now earn 120,000 AAdvantage® miles for the same amount on deposit.

While this increase isn’t as much of an increase as on the Bask Interest Savings account side, currently earning 2.20% Annual Percent Yield the case for earning miles remains compelling!

Remember that when you earn miles via Bask Bank, they are only taxed at a rate of 0.42 cents per mile. So, if you value AAdvantage® miles at around 1.5 cents each as I do, you are only being taxed on less than a third of that value.

In a future article, I’m going to do a more in-depth comparison of your ROI from a Bask Interest Savings Account vs a Bask Mileage Savings Account, but for now I’ll show you a quick comparison.

Remember that you can easily transfer money back and forth between your Bask Interest Savings Account and Bask Mileage Savings Account, depending on your current goals (money or travel).

Let’s look at a hypothetical example of someone that wants to decide between where they want to put $100,000 of available and liquid cash.

NOTE: The Bask Interest Rate adjusts frequently. The below rate is already out of date as it’s 2.53% as of Sept 12, 2022 and I’m sure will change further.

| Account Type | Bask Interest Savings Account | Bask Mileage Savings Account |

| Interest Rate | 2.20% | 1.2 Miles Per Dollar saved annually |

| You Earn in a Year | $2,200 | 120,000 miles |

| Taxes (Let’s assume 30% total tax rate; adjust for your own tax rate) | $660 | $151.20 |

| After Tax | $1,540 | 120,000 Miles (minus $151.20) |

This works out to “buying” AAdvantage® miles at 1.3 cents each. That’s not bad considering that American Airlines sells AAdvantage® miles at 2.95 cents each (plus tax).

Additionally, MilesTalk pegs the “average” value of an AAdvantage® mile at 1.5 cents, meaning you should be able to come out ahead without much effort.

However, MilesTalkers know that when you book First and Business Class international flights, your value per mile goes much, much higher. Consider that a round trip to Europe using AA miles has a standard saver rate of 57,500 miles (115,000 Round Trip). It’s virtually impossible to pay less than $2,000 on a business class seat to Europe – and that would be during a rare sale. $3,000 and up is more common, where you’d be seeing a return between 2.5 and 3 cents per mile.

In my next article I’ll talk more about the extreme value you can get from AAdvantage® miles earned from a Bask Mileage Savings account, but, for now, I’ll stick to the above promotion and the upcoming Loyalty Program bonus for new Bask Mileage Savings accounts who qualify.

And remember, if your goals change, you can swap your funds into a high-yielding Bask Interest Savings account in just a couple of clicks.

*Bask Bank is a division of Texas Capital Bank. Member FDIC.

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

Disclosure: Bask Bank is a MilesTalk partner, but I wouldn’t be working with them if I didn’t believe in their product and have personal experience with the same.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)