To those of us that have been doing this a while, it’s elementary. But if you are new to all of this, many things can be confusing. You need to sort them out before you can move on to the next building block of your miles and points expertise. So while the advanced among you can certainly skip this, beginners will be please to know that you can….

In this article

Combine Ultimate Rewards Points from ALL of your Chase Cards

First, let’s go over the credit cards that earn Chase Ultimate Rewards:

Business Credit Cards that Earn Chase Ultimate

Rewards

Chase Ink Business Preferred ($95 annual fee)

Chase Ink Business Cash (no annual fee)

Chase Ink Unlimited Business Credit Card (no annual fee)

Personal Credit Cards that Earn Chase Ultimate Rewards

Chase Sapphire Preferred Card ($95 annual fee)

Chase Sapphire Reserve ($550 annual fee)

Chase Freedom Unlimited Credit Card (no annual fee)

Chase Freedom Flex Credit Card (no annual fee)

More Details on all of these Chase Cards….

… can be found in Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide], so I’m not going to go over the “whys” of why you may have many of these cards in your wallet all at the same time. Suffice it to say that some are good for perks and certain bonus categories, while others are better for non-bonused spend.

Chase Ultimate Rewards Cards with Annual Fees vs Those Without

The only thing you need to know for the purpose of this post is that only Chase Ultimate Rewards credit cards with annual fees allow you to transfer to travel partners and redeem through the Chase travel portal.

In order to “unlock” real value from your no-annual fee Chase cards, you need one of the below cards in your arsenal.

Chase Ink Business Preferred ($95 annual fee)

Chase Sapphire Preferred Card ($95 annual fee)

Chase Sapphire Reserve ($550 annual fee)

Spending Chase Ultimate Rewards Points from Chase Cards with Annual Fees

The Chase Sapphire Reserve ($550 annual fee) allows for you to either transfer to airline and hotel partners or redeem in the Chase Travel Portal with each Ultimate Rewards point worth 1.5 cents (i.e. 10,000 points is worth $150 in free travel)

Chase Ink Business Preferred ($95 annual fee) allows for you to either transfer to airline and hotel partners or redeem in the Chase Travel Portal with each Ultimate Rewards point worth 1.25 cents (i.e. 10,000 points is worth $125 in free travel)

Chase Sapphire Preferred Card ($95 annual fee) allows for you to either transfer to airline and hotel partners or redeem in the Chase Travel Portal with each Ultimate Rewards point worth 1.25 cents (i.e. 10,000 points is worth $125 in free travel)

You can transfer Chase Ultimate Rewards points to the following airlines:

- Aer Lingus AerClub (instant transfer)

- Air France/KLM Flying Blue (instant transfer)

- British Airways Avios (instant transfer)

- Iberia Plus (instant transfer)

- JetBlue TrueBlue (instant transfer)

- Singapore Airlines KrisFlyer (1-2 days)

- Southwest Airlines Rapid Rewards (instant transfer)

- United Airlines MileagePlus (instant transfer)

- Virgin Atlantic Flying Club (instant transfer)

You can transfer Chase Ultimate Rewards points to the following hotels:

- IHG Rewards Club (about 24 hours)

- Marriott Bonvoy (1-2 days)

- World of Hyatt (instant transfer)

Or you can redeem through the Chase Travel Portal

This is the only time it matters if you have a Chase Sapphire Reserve vs a Chase Sapphire Preferred Card or Chase Ink Business Preferred – since the Reserve offers 1.5 cents per point vs 1.25 cents per point with the other two.

So you ALWAYS want to combine your Chase Ultimate Rewards into your most premium card

If you have a Chase Sapphire Reserve, then combine all points into that account. If not, combine into your Chase Sapphire Preferred Card or Chase Ink Business Preferred.

How to Combine Points from Different Chase Ultimate Rewards Accounts

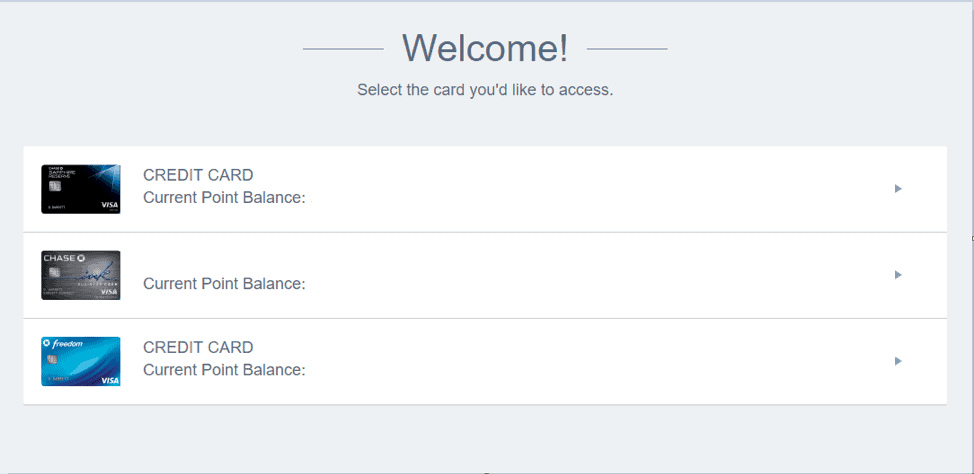

To combine your Chase Ultimate Rewards points, log into your Ultimate Rewards account and you’ll see a screen that looks like this:

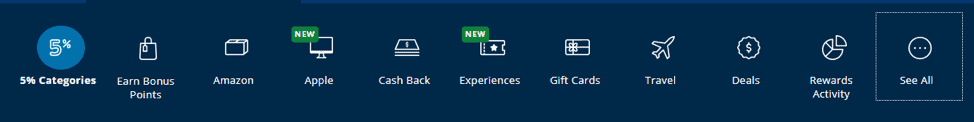

Click on the card you’d like to transfer FROM, for example the Freedom card, and you’ll see this banner on the top.

Then click on See All on the right and the banner will expand to include the option to combine points.

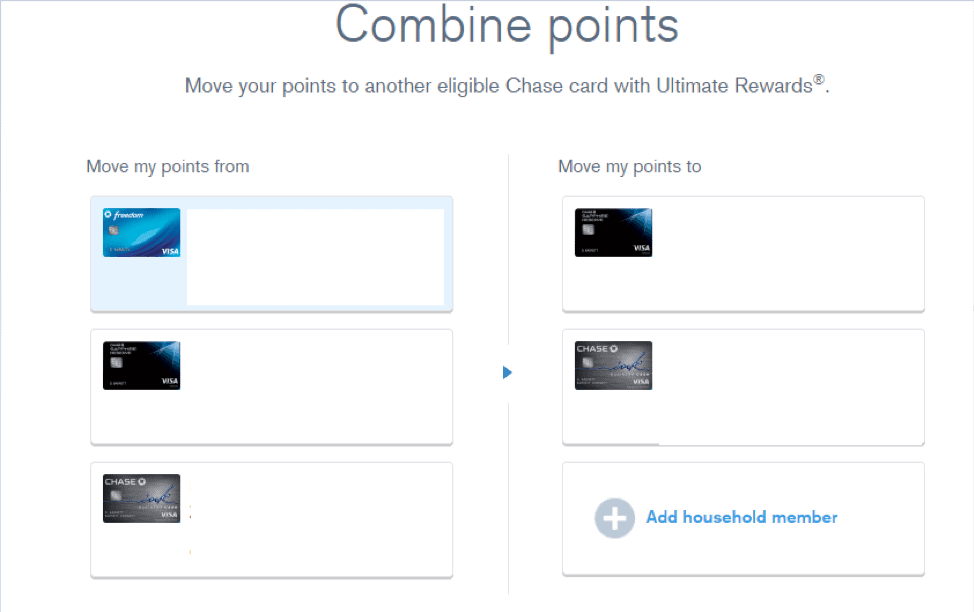

Now click on Combine Points and on the next screen choose to which card you want to transfer the points. You’ll also see an option to add a household member.

You can transfer between all of your cards, including from a Business account to a Personal account, as well as one household member. Note: do not try to “game” the definition of a household member. You would be putting all of your points at risk as Chase does not mess around there.

Got it?

Now that you get how to combine your account balances, you can learn more of the nuances of why Chase Ultimate Rewards points are so valuable: Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide]

Get the Cards

Questions?

Let me know here, on Twitter, or in the private MilesTalk Facebook group.

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)

![[TODAY!] Amazon Prime Day July 16-17: Pay One Point Discounts! amazon prime day discount](https://milestalk.com/wp-content/uploads/2021/06/prime-day-discount-218x150.jpg)

![HUGE 120,000 Point Bonus Offer on Chase Ink Preferred® [Best Ever] Chase Ink Preferred 120,000 Point Bonus Offer](https://milestalk.com/wp-content/uploads/2024/07/cibp-120k-218x150.jpg)