First things first – is Delta moving to a dynamic redemption model? I’ve been assuming they would for some time now and to be clear, if they do – and they get away with it (meaning customers don’t actually voice their opinions with their wallets, other carriers follow, etc), that would be basically the end of frequent flyer fun as we know it.

Bear in mind the progression with Delta: create multiple (5!) award “levels” and then remove the actual award chart altogether. Get customer used to “what you see is what you get pricing.” Make low level awards so scare a customer is happy to find even a mid level award. Raise award prices. Make it SO hard to get more than 1-1.5 cents of value per mile. Rinse and repeat.

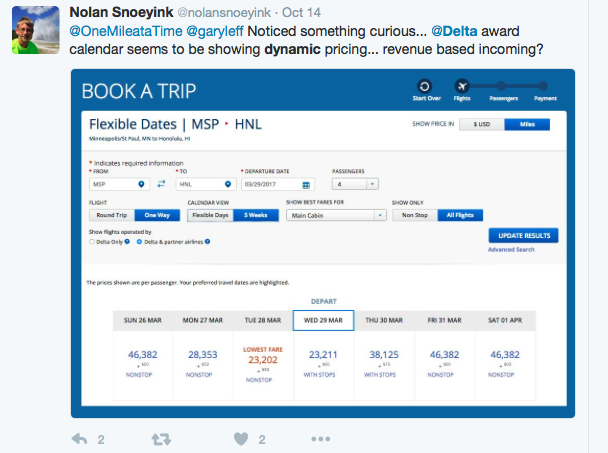

A couple of weeks ago I saw a very frightening post on Twitter. Take a look….

See those prices? They certainly LOOK dynamically priced based on the cost of the award. I didn’t see what the equivalent cost was here in dollars, but the key would be at what value they peg a Skymile. 1 cent? 1.2? Bear in mind that earning Skymiles via a credit card earns you 1 mile per dollar. If you had cash back credit card, you can get 2% cash back. So if a Skymile can’t be used for major redemptions like, for example, 160,000 Skymiles for a business class ticket to Australia “worth” $10,000, what good are they? Sure they will always have people blowing the miles on terrible deals, but if there is NOTHING to aspire to, I am sure I’m not alone in saying that I don’t need to ever choose to fly Delta nor do I need any credit card earning SkyPesos. Can you imagine Delta asking for 1,024,000 miles for your J flight to Australia?!?!

Let’s see what happens but of all my miles, I’m most eager to dump my Skymiles.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)