In this article

What is the Robinhood Gold Card?

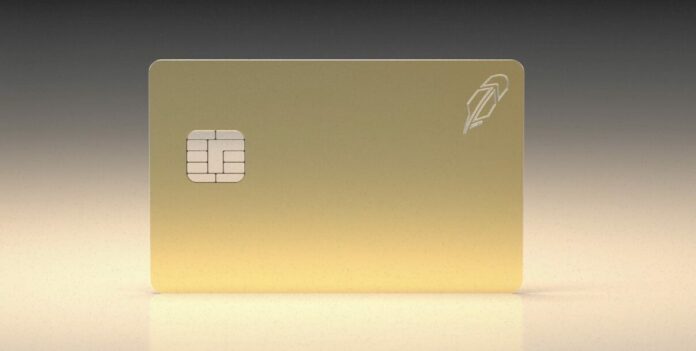

If you’ve been online anytime since last night, there is a good chance you’ve heard of the new Gold credit card being offered by Robinhood (yes, the online brokerage that got somewhat famous during the Gamestop /Meme stock craze a few years ago and is known for gamification of stock and option trading).

It makes show stopping headlines, as it advertises 3% cash back on everything – which is, no doubt, fantastic as far as a cash back credit card goes. It also earns 5% cash back on travel booked in their own travel portals (and you know I’m not a huge fan of travel portals for many reasons), so I pretty much discount that.

The card launch comes on the heals of Robinhood’s acquisition of X1 last year, which was the hint that they planned to expand into credit cards – and now they have.

While you can only get on the waitlist for the card now (I have no referral link myself but here is the page you can join the waitlist from), I wanted to go over a few questions you are likely to have.

Can You Transfer Cash Back from the Robinhood Gold Card to Airline or Hotel Partners?

No – they aren’t points. You are earning cash back, pure and simple.

Does the Robinhood Gold Card Have an Annual Fee?

No, but yes. You’ll need to subscribe to Robinhood Gold at a cost of $5 a month in order to be eligible for the Gold Card. Robinhood Gold includes other things like 5% APY on your cash (you could earn 5.3% + easily in a money market fund you could buy through Robinhood, Gold or not, though) and free margin on your first $1,000 of margin. (Margin is often not a great idea for investors as, at an 8% borrow fee, you have that much more to lose if you bet on the wrong stock).

This also makes you eligible for a 3% IRA match on eligible IRA contributions to your Robinhood IRA account.

Is Robinhood Gold Worth It?

You need to get $60 a year in value. If you would have borrowed $1,000 for a year on margin anyway, then yes. If you’ll take advantage of the 3% IRA match, that gets you back up to $21 of the fee as well. And that brings us to the Gold Card.

Is the Robinhood Gold Card Worth It?

3% on everything is great. However, there are a few things to keep in mind to determine if it’s a great fit for you.

- There’s no signup bonus. By contrast, the no-annual fee Capital One SavorOne card gives you 3% on dining and groceries (but to be clear, not on everything!), yet it also comes with a $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening. Assuming you already carry a no annual fee 2% card, you could get the SavorOne one for the 3% categories and pocket the $200. On the difference from 2% to 3%, you need to spend $20,000 to get even if you only had the Robinhood Gold Card.

- Would you have paid the $60 a year for Robinhood Gold anyway? If not, deduct that from your 3%. That’s $6,000 of spend to break even against a no-annual fee 2% credit card. Or you’d need to be using other Robinhood Gold benefits to offset it.

- Where as many cash back cards have cash back that is convertible to transferable points (to then send to airline and hotel programs for outsized value), this card does not have any such option. I earn 2% cash back on my Citi Double Cash but then I can transfer those out to Citi’s airline and hotel partners because I also carry a Citi Prestige (and Citi Premier) which open up that avenue.Not to mention that the Premier earns 3% on a range of popular bonus categories. So I’m earning well over 3% in the end once I redeem for First and Business class flights or high end hotels.

- The card is clearly designed to suck you into the Robinhood ecosystem where the grand plan is to have custody of all your assets. That may be fine for you, but know that is the end game of the generous 3%.

- Importantly, here’s who I think this card is excellent for: someone who spends a lot, has zero patience to play the credit card rewards game, and would never redeem for anything other than cash back or gift cards. At high spend levels, the card definitely gets lucrative for a cash back only consumer.

One more thing to note is that if the 3% proves too costly for them – I can see people really running up large tabs on these cards in ways unintended – we could see a cap on how much cash back you can get at 3% in a year.

Bottom Line

I feel like I gave my bottom line in the above section but to summarize: If you don’t mind being tied to the Robinhood ecosystem, only want cash back (that can’t be used for anything but cash back), don’t want multiple credit cards in your wallet, and you spend quite a lot annually, this card is going to be a goldmine for you (no pun intended).

If you are into credit card rewards, though, you’ll have to take several things into account before you get overly excited. If it came to have a signup bonus, that would change the equation for sure but, for now, it does not.

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)