If you subscribe to the Your Best Credit Cards Newsletter, you already about about these offers. That’s always the best way to make sure you don’t miss any new credit card bonus offers.

In this article

IHG Premier Rewards Club credit card

This card comes with both an annual free night certificate and the ability to get the fourth night free (up to 40,000 points in value) on an award booking, so its $89 annual fee goes pretty far if you tend to stay at IHG properties (i.e. Intercontinental, Holiday Inn).

You also get IHG Platinum status which you can use to get on the Status Match Merry Go Round.

They’ve also added the following to the first year with this offer:

- An extra 15 points per dollar in your first year at IHG hotels.

- Earn 4X points on all other purchases for the first 12 months (then it goes to the standard 2X points at gas stations, grocery stores, and restaurants and 1 point/$1 on all other purchases.

If you already have the old IHG card, you can get this one too, but you won’t be approved if you are over 5/24.

United MileagePlus Explorer Business Card

Next, for those that spend a lot with your business cards, the United MileagePlus Explorer Business Card is offering up to 100,000 United miles as follows:

Get 50,000 bonus United MileagePlus miles when you spend $5,000 in your first 3 months and 50,000 more bonus miles if you spend $25,000 in total within 6 months.

While the miles from this card are not transferable (as, for example, Credit Cards That Earn Chase Ultimate Rewards Points are, including to United!), this is a pretty solid bonus if you had the spend to make it. I think 75,000 for $5,000 is otherwise the best I’ve seen. That said, that means you are spending an extra $20,000 for an extra 25,000 miles (against the best ever offer) so it’s good but not mind blowing given the extra spend. The annual fee is waived the first year. You are eligible for bonus if it’s been at least 24 months since you last got it and don’t hold the card.

You won’t be approved if you are over 5/24.

Don’t forget that the unofficial benefits are the reason to get and hold a United credit card:

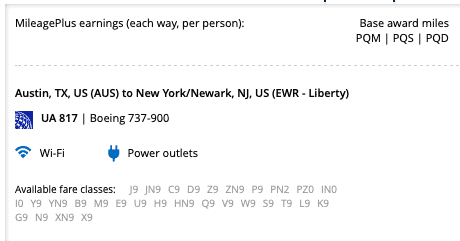

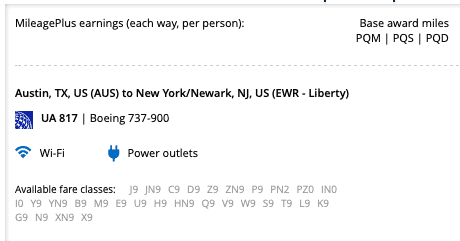

The biggest benefit is access to expanded award availability on United flights. United often makes additional award seats (coach only, sorry) available for its elites. This is in an inventory bucket called YN which you can search online easily.

You’ll notice it second from the end of the list above.

If you’re asking “Why can’t I see those in my searches?” it’s because you have to enable the feature in your United profile.

Other benefits of the United Explorer Business Card:

If you are a United elite member, this card will also unlock the possibility of being upgraded on award tickets and provide a PQD waiver if you spend $25,000 in a year.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)

![[TODAY!] Amazon Prime Day July 16-17: Pay One Point Discounts! amazon prime day discount](https://milestalk.com/wp-content/uploads/2021/06/prime-day-discount-218x150.jpg)

![HUGE 120,000 Point Bonus Offer on Chase Ink Preferred® [Best Ever] Chase Ink Preferred 120,000 Point Bonus Offer](https://milestalk.com/wp-content/uploads/2024/07/cibp-120k-218x150.jpg)