When I released the original version of Your Best Credit Cards back in 2019, it was a test of sorts.

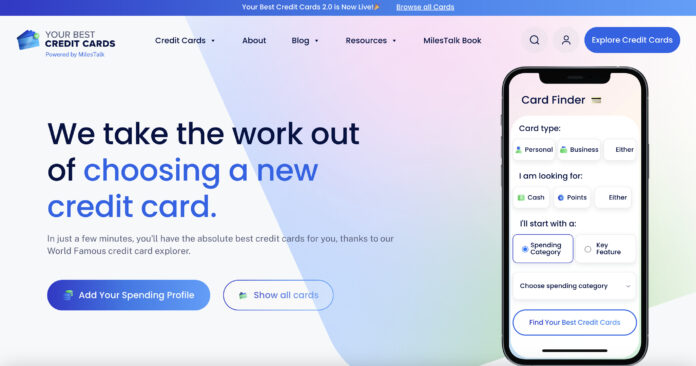

The very simple idea was to take the question of “What credit card should I get” and create an “automated Dave” of sorts that would ask you questions about your spend and crunch the numbers on which cards would earn you the most rewards.

The site has been a huge success, but at the same time the last 4 years were full of rumination about how I could reinvest back into the platform and create something truly unique. There were a number of features that 1.0 lacked and I was keen to continue on the journey to build the best credit card recommendation engine anywhere.

The most common complaint I heard with other sites that I won’t name are that they tend to provide categories of cards (like 0% intro APR) and then a series of card reviews. Sure, you could click a box to compare basic card features, but how could someone be expected to make an informed decision – easily? And how could I make the site equally effective for complete newbies as for points and miles geeks like myself?

I was determined!

This was going to require a much bigger team, and back in January 2022 I started talks with a team that I believed could not just handle the task, but be actively involved in it – with a strategic thinking mindset beyond just me.

That team, which has stretched to as much as 10 people, have been hard at work for the last 17 months culminating in today’s re-launch.

So what makes Your Best Credit Cards 2.0 so special?

Here are the 4 main features:

In this article

The World Famous Card Explorer Credit Card Recommendation Engine

The Card Explorer is the “secret sauce” of the entire site. And it’s the “Filters” that make it so good.

You see, on other sites you can look at a card that is great for groceries, for example, but how do you narrow down other features and benefits that you care about? Or tell it you spend a lot on 4 categories without having to go down the rabbit’s hole of entering your spend or connecting to a bank account (no thanks!!).

What we did was build every possible spend category, feature, and benefit into the Explorer so that you can filter away the cards. Why is that a big deal? Because you are simply telling us what you want in a card one by one and the more things you insist on, the less options you have. And less is more! We know for sure that while people want choice, too much choice is paralyzing.

Our goal is to get you down to 3 or less cards with in 3 clicks.

Here’s that in action:

I could spend all day talking about the Card Explorer – the ultimate in simplicity that took a year to get right 😉 But just try it out!!

Feedback is more than welcome as I plan to keep iterating this based on user feedback.

Potential Rewards Calculations

If you want to really dive in and get exact calculations on your potential rewards, you can securely enter your expenses in various popular bonus categories and the site will calculate exactly which cards are likely to earn you the most valuable rewards.

But the difference from 1.0 is that now you can combine the power of the calculator with the Card Explorer filters! In 1.0, you may have gotten the Hilton Aspire as the best fitting card, but you didn’t want a hotel card! Now you can specify things like “Transferable Bank Points Only” or whatever you want which layers on top of your calculated rewards.

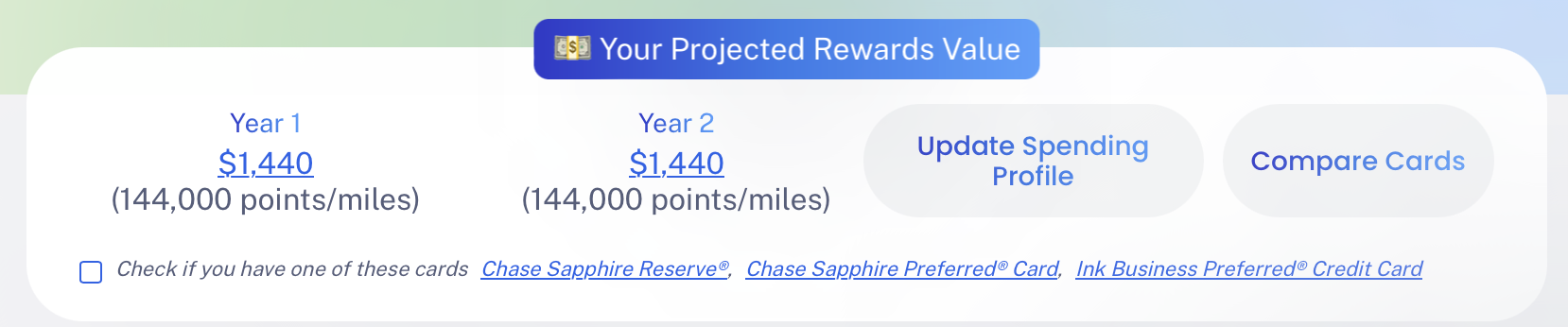

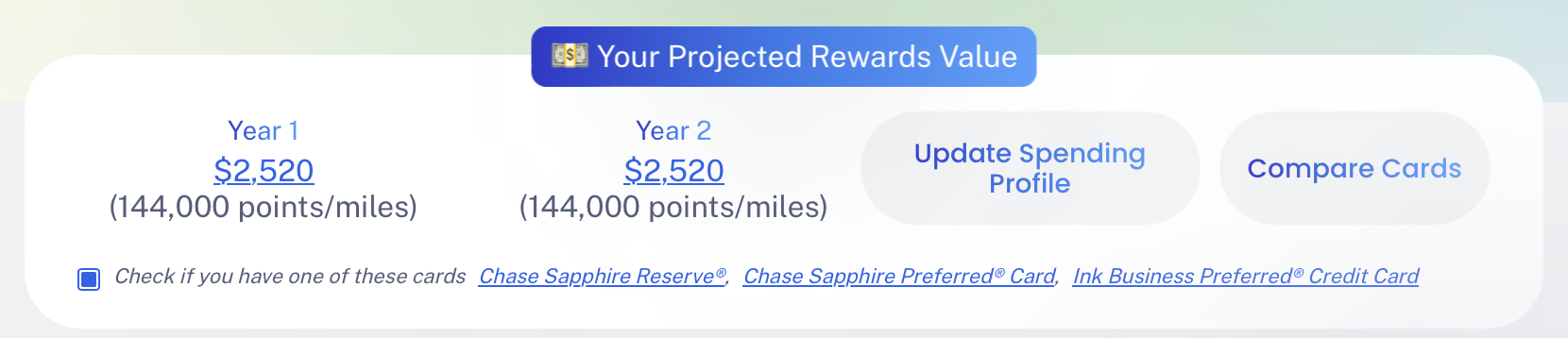

What about cards that require another card to maximize rewards? I’ve got that covered. If you are entering your spend and come across a card like a Chase Freedom Unlimited that has points worth a penny each on their own but (in our valuation) 1.75 cents each when paired with a Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Business Preferred, we present you with a checkbox to tell us that you have that card (or, if you have created an account and stored one of those cards, we’ll already know 🙂 ).

This will cause the value of the rewards on that card to adjust to the full point value rather than cash.

Here’s an example.

First, without a paired card:

And now with one:

As you can see the value jumped from 1 cent per point to 1.75c per point.

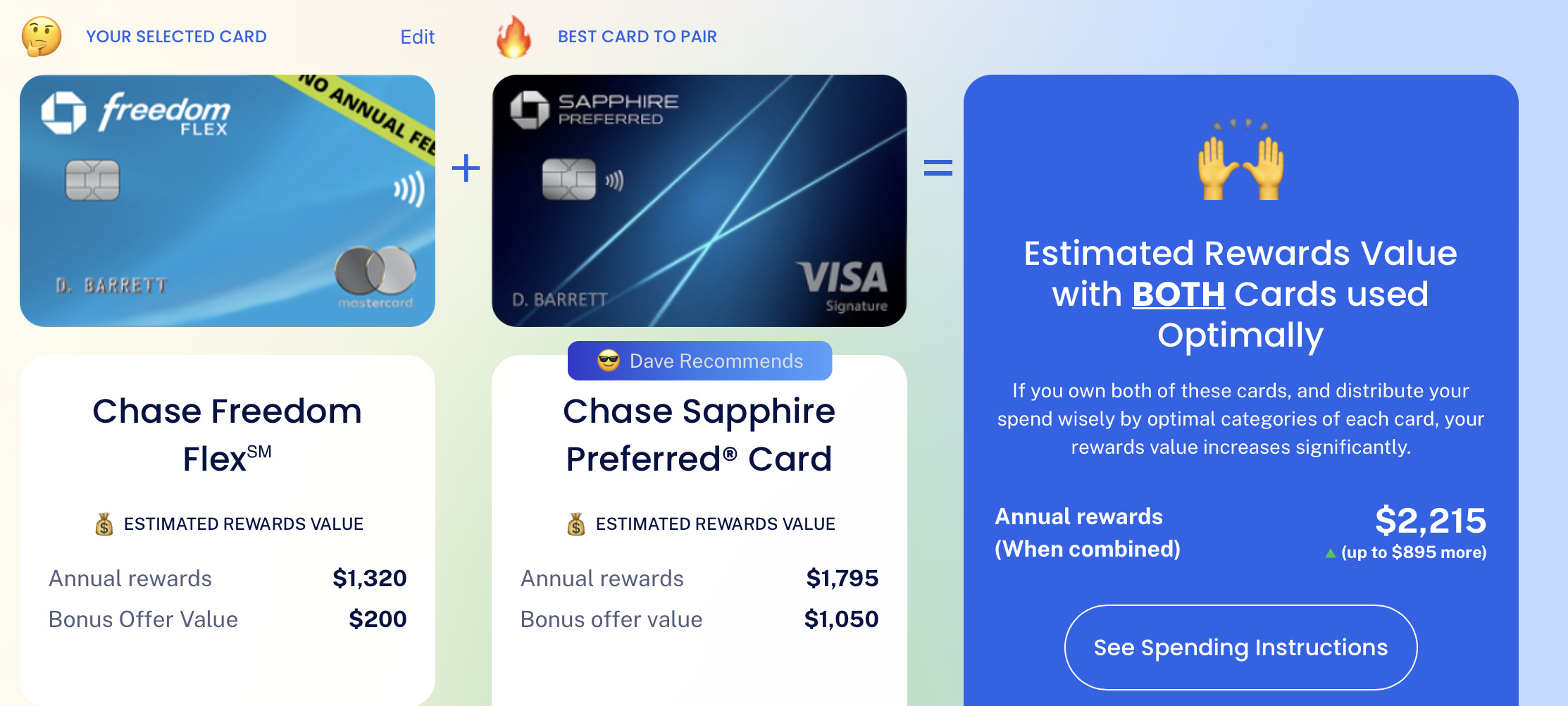

Best card combos

If you are open to two best cards, we’ll help you do that. Pick a card and the site will algorithmically identify the one that will pair best to maximize your rewards across both cards. You would navigate to the first card you have or would be interested in getting, scroll down to Card Combos, click there, and it will give you multiple best options for a second card. (This does require a spend profile, which you can either enter for one session or create a free account and save it to tweak in the future.)

Then we’ll even advise you on which card to use for what!

Bonus Offer Notifications

Did I bury the lede? 😉

For many of you, this will be all you care about and that is just fine with me.

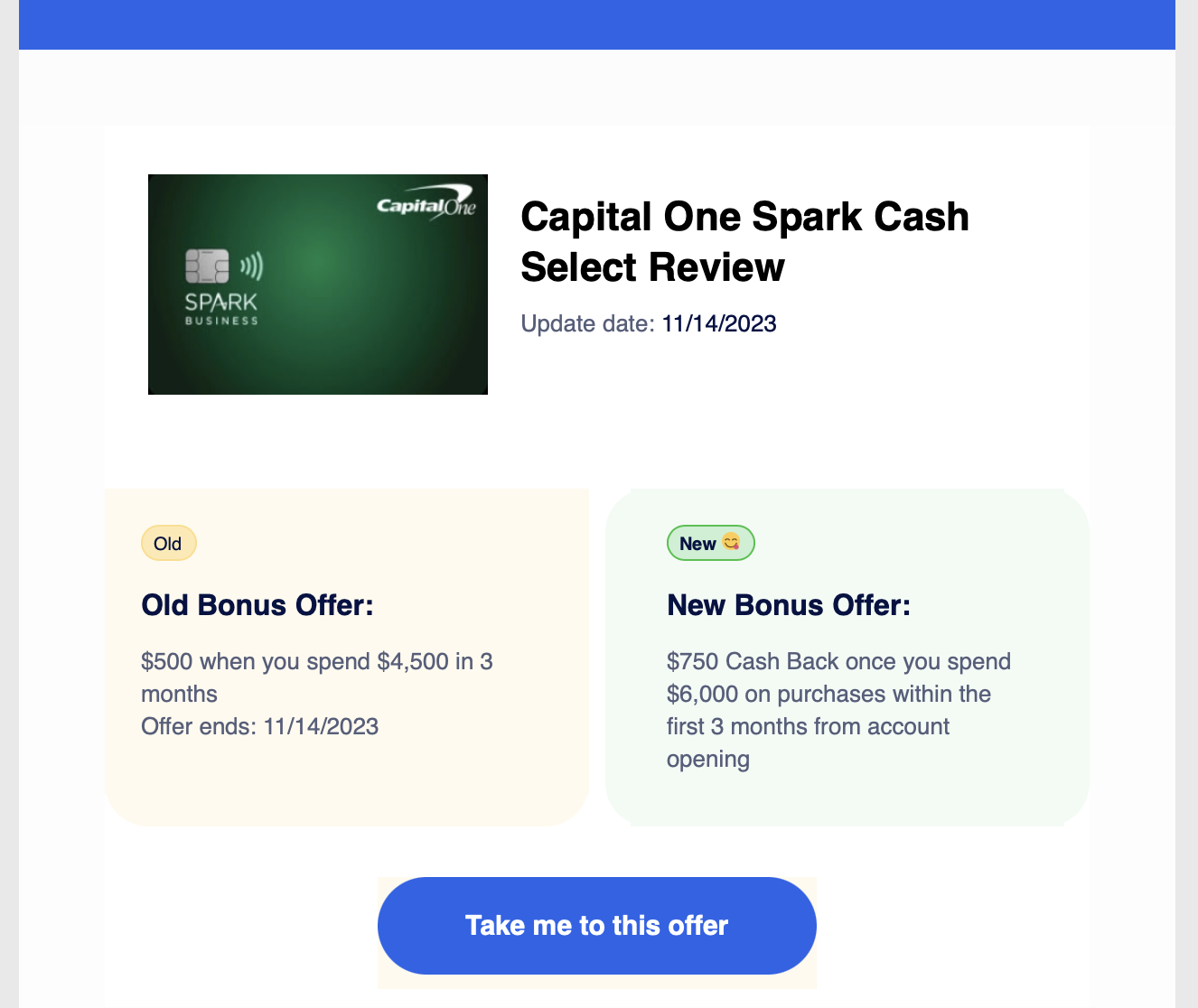

With a free account (create in one click via Google), you’ll be able to subscribe to bonus offer notifications.

Have a card that you really want but have just been biding your time until the bonus offer goes up? Just subscribe to a bonus offer notification and you’ll be automatically notified when an offer has changed (up or down!), what the old offer was, and what the new offer is.

Here’s an email I got last night when the notification that the early spend bonus on the Capital One Spark Cash Select went out.

Capital One Spark Cash Select Bonus Offer ChangeYou can subscribe in two places. One is on the card itself:

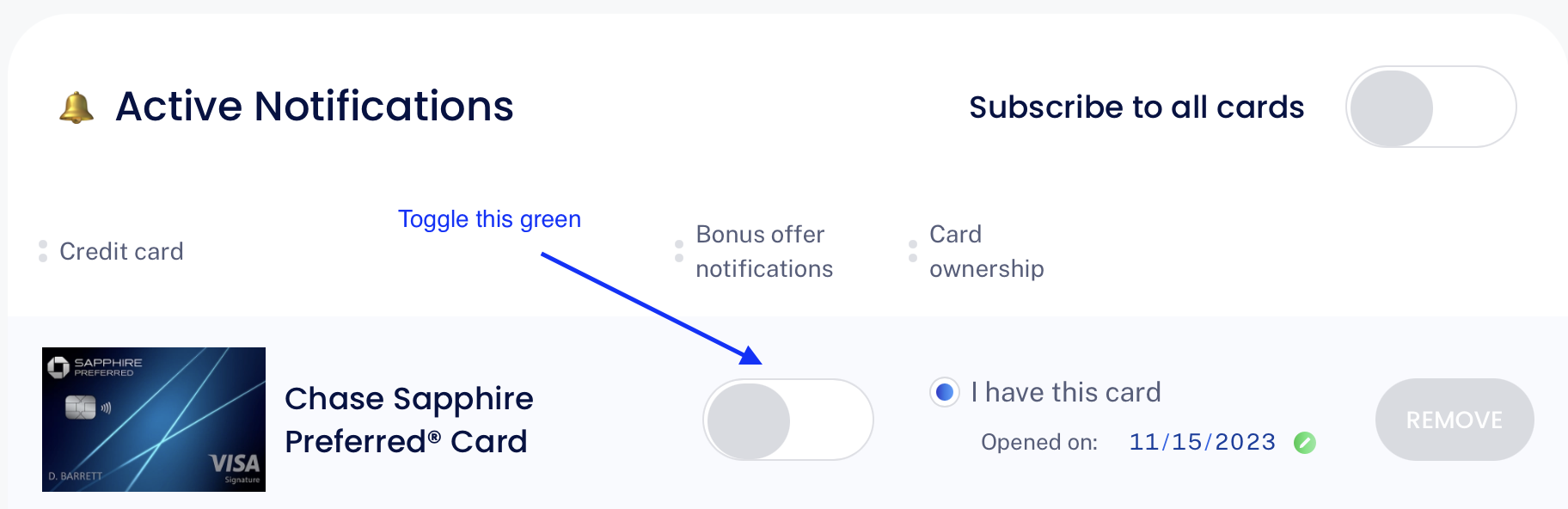

And the other is inside your account where you can add the cards you have.

You can’t currently add “ownership” of a card after you subscribe to offer notifications, so if you’ve clicked the button at the top right to be updated on ALL bonus offer notifications, just toggle that off, add the card and date opened, click Add, then once that has saved, you can Subscribe to All again.

At the moment, storing the cards you have is primarily for the recommendation engine to know what cards you already have. But in the future, we will be expanding the powers of having an account greatly. Basically, we had to launch this thing sometime and my head has an endless list of things in mind.

Lastly, I know there are many cards not currently in the site. Chase, American Express, Capital One, and Citi are all well covered. Now that we are live, I’ll be working to get more cards online as well.

We Want Feedback!

Please, please, please leave me a comment after you’ve tried it out. Good, bad, or indifferent. Feature improvements/requests will all be saved for future consideration. Expect constant iteration.

Thanks for reading, and I can’t wait to hear what you have to say!

You can explore the new site right here at Your Best Credit Cards.

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)