Note: The bonus offers described below have ended. However, with interest rates more than half as low as when I wrote this article, you probably still come out further ahead with Bask than when I wrote it, as the earn rate remains the same 1 mile per $1. See the current bonus offer directly at Bask Bank‘s website. (I do not earn a referral commission or bonus of any kind when you use this link.)

In this article

You have probably heard of BankDirect… I’ve written about their checking account from time to time.

I’ve also been a longtime customer of BankDirect, an online-only division of Texas Capital Bank, N.A.

In fact, since opening my BankDirect account in 2011, I’ve earned just shy of one million American Airlines AAdvantage® miles – solely via BankDirect. I’ve also earned miles many other ways, such as AAdvantage® credit cards, dining, shopping and, of course, flying.

Texas Capital Bank N.A. has launched their newest banking product, called the Bask Savings Account, by Bask Bank, and it’s essentially a new, more modern version of the Bank Direct product.

Using American Airlines AAdvantage® Miles for Once-in-a-Lifetime Experiences

These miles have taken me far and wide – in style. I’ve flown to Japan in First Class on Japan Airlines, feasting on Grade A4/A5 Wagyu steak and sipping vintage Salon champagne.

I’ve flown Qantas First Class to Australia, where my now-fiancée met me in Sydney. She traveled from Hawaii on a business class flight on Hawaiian Airlines that I booked for her.

We flew home from Australia together on Etihad Airways, experiencing the famed Etihad Apartments.

And we flew home from Singapore last year on Qatar Airways in the fabled “First in Business” QSuites.

If it seems odd that I’m referencing these opulent flights on airlines that aren’t American Airlines, that would be understandable.

The reason is that the American Airlines AAdvantage® program partners with all these airlines, meaning that I was able to “pay” for each of these flights with AAdvantage® miles. That’s the beauty of airline alliances and partnerships.

Texas Capital Bank, N.A. launches Bask Bank

I first heard about Bask Bank late last year in the context of a letter I’d received from BankDirect about the intent to 1099 miles. I then discovered the soft-launch of Bask Bank, which is similar to BankDirect, except that it is a savings account and earns miles slightly differently.

I was initially concerned about the value they’d use for the 1099 forms, but was thrilled when eagle-eyed MilesTalk readers spotted in Bask Bank’s Terms and Conditions that it would be valued at just 0.42 cents. Since I value miles at more than 3x that, it means that this account has tremendous value.

While there are technically now two Texas Capital Bank N.A. divisions offering AAdvantage® earning bank accounts, it would make sense to focus on the new Bask Bank now and open it with Bask Bank as it’s the better deal when compared to BankDirect. I’ll explain in a moment.

I’ll note that the Bask Savings Account is the only savings account that earns American Airlines AAdvantage® miles instead of interest.

Bask Bank Technology

The Achilles’ heel of the “old BankDirect” was its technology platform. The tech platform was clunky and somewhat difficult to use. And as fintech became a thing, with great mobile banking websites and apps, it felt even more “old school.” Still, it earned those AAdvantage® miles and they always provided solid customer support.

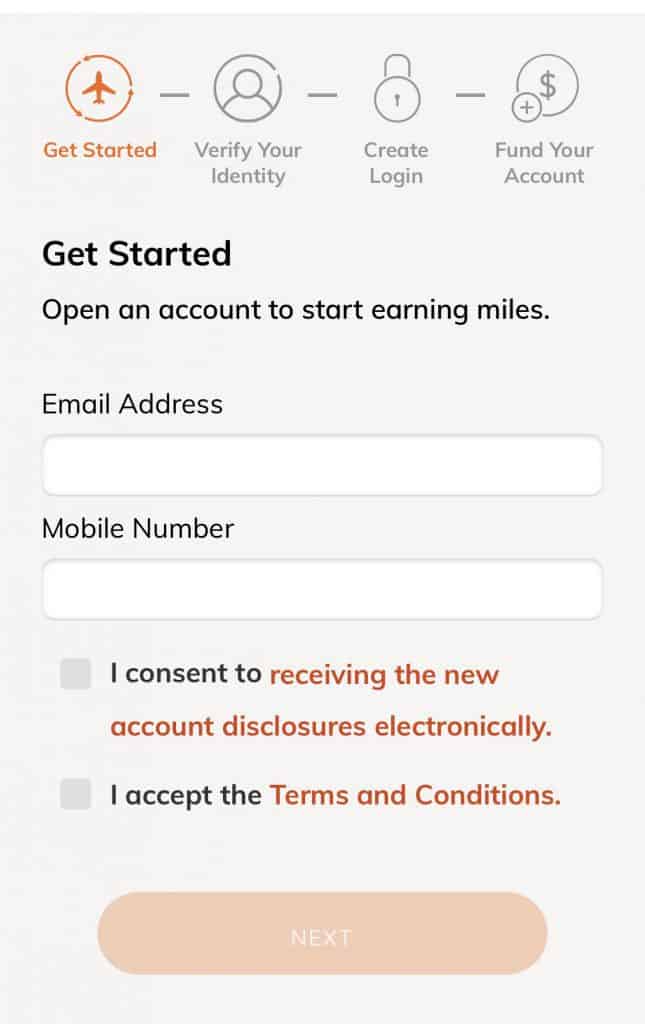

The new Bask Bank is built from the ground up as a technology-focused, mobile-friendly platform, complete with a really nice app.

Getting set up with your new Bask Savings Account is an absolute breeze. It’s pretty much as simple as providing an email and phone number, verifying your identity, creating your account, and funding it. It’s a snap, and I’m impressed. You can tell this launch has been meticulously planned.

Once you’re up and running, you’ll be able to easily check balances and move money via the app.

Bask Bank Earns More AAdvantage® Miles Per Dollar than BankDirect

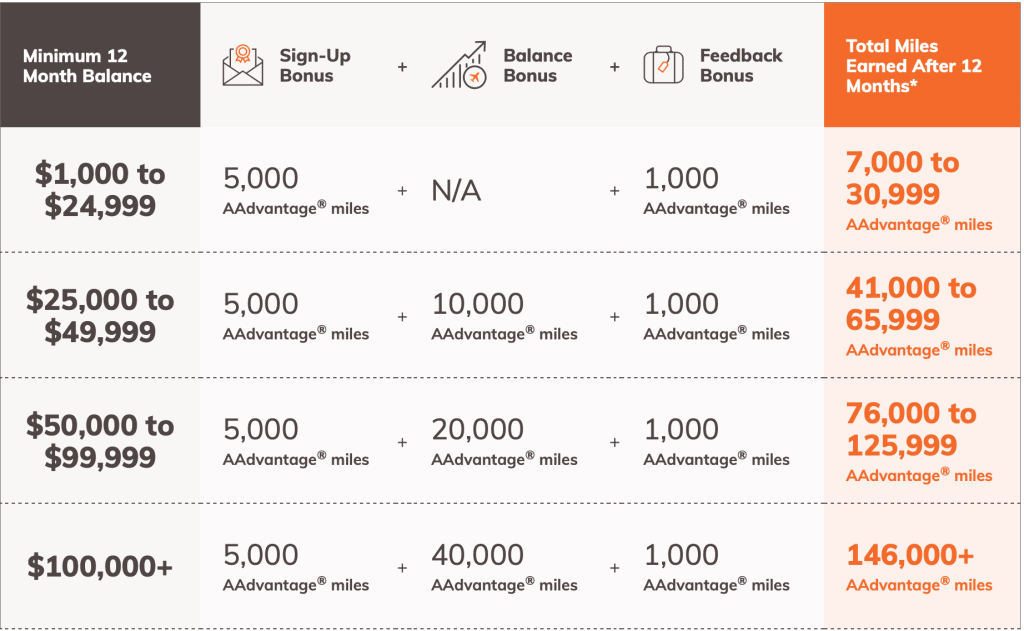

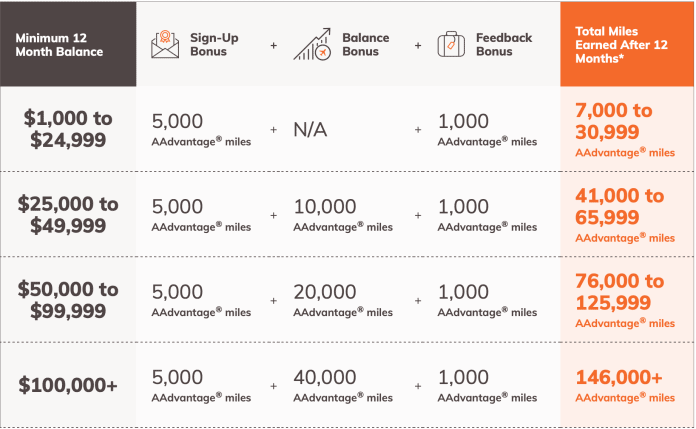

When you open an account before March 1, 2020 and deposit and hold $1,000 for 30 days within 60 days of opening the account, you’ll earn 5,000 miles. Then just for giving some feedback on the new Bask Bank, you’ll earn another 1,000 miles. And then you’ll earn one AAdvantage® mile per dollar on deposit per year, paid monthly, plus “threshold bonuses” of up to 40,000 bonus miles for the first year.

But they’ve also simplified earning. I’ll explain using a $100,000 balance kept for 12 months to make it easy.

With BankDirect, $100,000 on deposit for a year would have earned 120,000 miles, and you would have been charged $144 in account fees.

With Bask Bank, under their current first-year promotion, you would earn 146,000 AAdvantage® miles (100,000 standard miles + 1,000 feedback bonus + 5,000 new account bonus + 40,000 bonus miles). And better yet, there are no account fees. Even without the one-time new account bonus and feedback bonus, you’d earn 140,000 miles and be ahead by 20,000 miles over BankDirect.

Here’s a table from the Bask Bank website showing what you’ll earn based on your balance:

The sweet spot is clearly $100,000 as that maxes out your bonus tiers. Currently, balances over $100,000 will continue to earn the one mile per dollar per year.

You can open a new Bask Savings Account here. And you’ll even be eligible for that feedback bonus right away, so it may come in handy if you’re just a few miles short of an award.

A few things to note:

1) You’ll pay tax on the “interest” earned in American Airlines AAdvantage® miles, but it’s very, very reasonable at a reported value of just 0.42 cents per mile. You will do much better than that as a MilesTalk reader. I value American Airlines AAdvantage® miles at 1.5 cents apiece. I’ll break down in another post how a year or two of miles earned at Bask Bank instead of standard cash interest can really supplement your other mileage earning sources when planning your travel goals.

2) This is a bank account that supplements your other savings products. For example, I’ll be moving money from my Marcus Online Savings Account to Bask Bank so I can earn AAdvantage® miles instead of interest. With Bask Bank, I can do much, much better earning miles and redeeming for premium cabin awards. I’ll also do a deep dive on that math in a subsequent post.

Some Fine Print

There are terms and conditions around all of the current offers, as you’d expect, so I’ll list those below. It’s all very straightforward, but you’ll want to know the various deadlines and requirements for all the bonuses.

Account Opening Bonus:

- Deposit $1,000 in your Bask Savings Account and earn 5,000 bonus miles.

Must open account before 3/1/2020. Must hold $1,000 balance for 30 consecutive days within 60 days of opening an account. Valid through 2/29/2020

Feedback Bonus:

- Help Bask Bank perfect their program and earn 1,000 bonus miles.

Must complete the Bask Bank online feedback survey within 60 days of opening an account. Valid 11/1/2019 through 6/20/2020.

Balance Bonus:

- Maintain a $25,000 balance in your Bask Savings Account and earn 10,000 bonus miles.

Must maintain a $25,000 balance for 12 consecutive months within 14 months of opening an account. 5,000 miles paid after 6 consecutive months of $25,000 balance, 5,000 miles paid after 12 consecutive months of $25,000 balance. Cannot be combined with other offers. It may take 6-8 weeks after the eligible date for miles to post. Valid December 1, 2019 through March 31, 2020.

- Maintain a $50,000 balance in your Bask Savings Account and earn 20,000 bonus miles.

Must maintain a $50,000 balance for 12 consecutive months within 14 months of opening an account. 10,000 miles paid after 6 consecutive months of $50,000 balance, 10,000 miles paid after 12 consecutive months of $50,000 balance. Cannot be combined with other offers. It may take 6-8 weeks after the eligible date for miles to post. December 1, 2019 through March 31, 2020.

- Maintain a $100,000 balance in your Bask Savings Account and earn 40,000 bonus miles.

Must maintain a $50,000 balance for 12 consecutive months within 14 months of opening an account. 20,000 miles paid after 6 consecutive months of $100,000 balance, 20,000 miles paid after 12 consecutive months of $100,000 balance. Cannot be combined with other offers. It may take 6-8 weeks after the eligible date for miles to post. December 1, 2019 through March 31, 2020.

What are your thoughts on the new Bask Bank?

Tell me here, on Twitter, or in the private MilesTalk Facebook group.

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My introductory book MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views and opinions of Texas Capital Bank, N.A.

© 2020 Bask Bank and BankDirect are divisions of Texas Capital Bank, N.A. Member FDIC. All rights reserved. Bask Bank and BankDirect, the Bask Bank and BankDirect logos and Texas Capital Bank are registered trademarks of Texas Capital Bancshares, Inc. NASDAQ®: TCBI

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)