Overnight and without warning, American Express and Delta overhauled their suite of Delta SkyMiles credit cards, raising the annual fees on all but the no-fee Delta SkyMiles® Blue American Express Card.

Well, without warning to me anyway. Judging by how many detailed articles I woke up to today, other media were well looped in 😉 So, sorry for my delay!

I spent pretty much the entire day overhauling every Delta credit card on Your Best Credit Cards.

Before I forget, existing cardmembers will see the new annual fee when their card next renews on or after May 1st, 2024.

So, here we go…. with my blunt, as always, thoughts at the end.

In this article

Delta SkyMiles® Gold American Express Card and Delta Business SkyMiles® Gold American Express Card

The Delta Gold and Business Gold cards raised their annual fees from $99 to $150, still with a $0 introductory fee the first year.

The $100 flight credit has been upgraded: After you spend $10,000 in purchases in a year, you can receive a $200 Delta Flight Credit to use toward future travel. That was $100 before.

And you get a new Delta Stays credit: Earn up to $100 back annually on eligible prepaid Delta Stays bookings on delta.com on the personal card and $150 for the same on the business version.

And a slight bonus category change on the Delta Business Gold:

- Earn 2 miles per dollar spent on purchases at U.S. Shipping providers and at U.S. providers for Advertising in select media on up to $50,000 of purchases per category, per year.

That pretty much covers it.

Delta SkyMiles® Platinum American Express Card and Delta Business SkyMiles® Platinum American Express Card

The annual fees on these cards jumps from $250 to $350.

I’m not going to mention the 2,500 MQD Headstart that the four Platinum and Reserve cards get just for holding the card (stackable up to all 4!) or that both Delta Platinum cards offer 1 MQD for every $20 spend and both Delta Reserve cards offer 1 MQD for every $10 spend – because those changes already happened 🙂

The big enhancements across both cards are:

- The companion certificate is now valid on domestic, Caribbean, or Central American roundtrip flights – a big upgrade from domestic only. They state “to select destinations” but I’m not honestly sure what that means as it should include those regions in full.

- Upgrade Potential: Card Members with an eligible ticket will be added to the Complimentary Upgrade list, after Delta SkyMiles Medallion Members. (So it’s no longer just a tie breaker for Medallion members but on a super empty flight you could get an upgrade without even having Medallion status by virtue of holding the card.) You’d be behind everyone else including Delta Reserve / Business Reserve Cardmembers, though.

- $120 Resy Credit: With the Delta SkyMiles® Platinum American Express Card Resy Credit, earn up to $10 per month in statement credits on eligible Resy purchases using your enrolled Card.

- $120 Rideshare Credit: You can earn up to $10 back in statement credits each month on U.S. rideshare purchases with select providers after you pay with your Delta SkyMiles® Platinum American Express Card. Enrollment Required.

- $150-$200 Delta Stays Credit: Delta SkyMiles® Platinum American Express Card Members can earn up to $150 back annually on eligible prepaid Delta Stays bookings on delta.com. The business version gets a $200 credit.

- Hertz Five Star® Status

- The Delta Business SkyMiles® Platinum American Express Card also gets a new set of bonus categories, adding 1.5X miles on eligible transit and U.S. shipping purchases.

Again, that about covers it! Forgive me if I missed a finer point here and there. I’m digesting all of this on the fly!

Delta SkyMiles® Reserve American Express Card and Delta Business SkyMiles® Reserve American Express Card

The annual fee on these cards move up from $550 to $650.

I won’t cover any of the lounge access changes since, again, those are not new.

The big enhancements across both cards are:

- Like the Platinum upgrade, the companion certificate is now valid on domestic, Caribbean, or Central American roundtrip flights – a big upgrade from domestic only. It still includes Comfort+ and First Class as well which I consider a huge value assuming you can use it.

- Upgrade Potential: Card Members with an eligible ticket will be added to the Complimentary Upgrade list, after Delta SkyMiles Medallion Members but ahead of Delta Platinum / Business Platinum Cardholders.

- $240 Resy Credit: With the Delta SkyMiles® Platinum American Express Card Resy Credit, earn up to $20 per month in statement credits on eligible Resy purchases using your enrolled Card. This is double the Platinum cards.

- $120 Rideshare Credit: You can earn up to $10 back in statement credits each month on U.S. rideshare purchases with select providers after you pay with your Delta SkyMiles® Platinum American Express Card. Enrollment Required.

- $150 – $200 Delta Stays Credit: Delta SkyMiles® Platinum American Express Card Members can earn up to $150 back annually on eligible prepaid Delta Stays bookings on delta.com. The business version gets a $200 credit.

- Hertz President’s Circle® Status

- The Delta Business SkyMiles® Platinum American Express Card also gets a new set of bonus categories, adding 1.5X miles on eligible transit and U.S. shipping purchases.

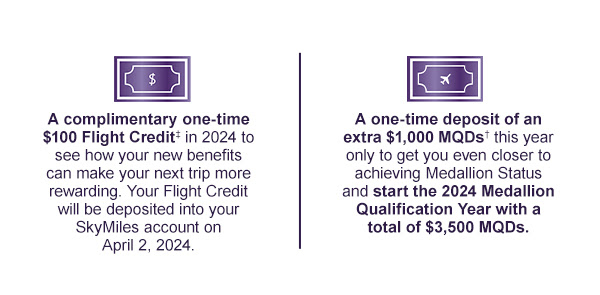

If you are an existing Reserve or Business Reserve Cardmember, they are sweetening the deal one time only as well:

And it does soften the blow 😉

Here’s My Take

It’s not all bad. But it’s not a set of changes I personally prefer. Annual fees seem to be going up with Amex across the board at a pace that is a bit dizzying. I have a LOT of cards with annual fees and analyze each one yearly for value.

On the plus side, I really like the addition of the Caribbean or Central America to the ticket. With a Reserve or Business Reserve, that makes it a lot easier for me to get value. In fact, we are booked on a Caribbean flight that I booked the three of us on in First where, if I could have used my certificate, I’d have saved more than $800 – more than annual fee in one shot. So I want to emphasize that is a MAJOR improvement vs only domestic (especially since transcon Delta One routes are excluded).

While the cards all add new value for higher fees, a majority of the value is in the form of new credits I don’t need, don’t want, or can’t use. Resy is not huge in the suburbs and, with a child, we don’t venture into the city for date nights.

For the few spots we do have that are on it, I don’t think I’m so inclined to force it into the schedule monthly for the $20 (I have the Delta Business SkyMiles® Reserve American Express Card). That is a much heavier lift than using the two dining credits on the personal American Express® Gold Card where we order in all the time and use both the Grubhub and Uber credits by the 5th of the month (across both of our cards ;-)).

The rideshare credit… I’d rather set my rideshares to my Chase Ink Business Preferred® Credit Card for 3X (Uber) or 5X (Lyft), so using this perk means remembering to add my Delta Business Reserve and use it once a month, and I can’t even use that for Uber Eats (which would be more useful).

The Delta Stays credit hits me the same way as earning MQDs from Delta Stays does – not well. I need every single night in a hotel to count towards re-qualifying for status and I don’t want to show up at a chain where I am loyal and have status and be treated like a nobody because I booked third party. I get it’s a huge money maker for Delta (I once owned an online travel agency) but I certainly don’t value it at face value. If I need a boutique hotel even once a year, fine, but it’s even harder to use than the Capital One Venture X credit which I can at least use for a flight or car rental.

And the new bonus categories also don’t do much for me. I have other cards I earn more on these categories for.

Obviously, Delta and American Express are hoping one of these cards can be your all-in-one card – and outside of our world of miles and points, plenty of people do just that.

It’s nice you can be upgraded without Medallion Status, but that is going to be rare indeed. I have a hard enough time scoring an upgrade as Platinum because they sell upgrades in a way that leaves few left for Medallions.

Still, I like the idea of keeping my Business Reserve for the 2,500 MQDs a year, the ability to earn 1 MQD per $10 spent, and the now semi-international Companion certificate.

I’ll probably renew this year, see how the next qualification goes with Delta because let’s not forget that whole debacle, and then re-evaluate.

I’d love to hear from you, though…. Are these changes good, bad, or are you indifferent?

PS: All of the cards have new Welcome Bonus offers as well for up to 110,000 SkyMiles. You can see those on our Delta Credit Cards page.

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)

![[Last Day for Old Pricing – March 25] Hyatt’s Yearly Category Changes Are Up Impression Isla Mujeres by Secrets](https://milestalk.com/wp-content/uploads/2023/12/SEIIM-P0007-Main-Pool.16x9.jpg-218x150.webp)

Overall I was pleased with the changes. I was already inclined to keep the card due to my geography and the 2500 MQD boost. This just sweetened the pot a bit. Then again, for whatever reason I had the fee at $650 in my head so this just aligned with expectations! lol. The Resy credit is meh.. footprint is small. I might get $60 if value there. But the expanded companion cert is really great. And the hotel credit is fine – yes I need the nights for status too, but I’m sure there’s one night somewhere I can use. If nothing else it makes for one or two great pool parties for my kid and her friends at the end of the year!

I was actually pleased with the changes and will be able to use some of the new credits like the hotel stay at some non-chain hotels. I agree that the Resy credit probably won’t be useful but I might be able to use the ride share credit a few months.

I have the personal Reserve and just got the Biz Platinum so between the MQD boost I already have 6000 MQD so Silver already. My wife has the personal DL Platinum so we might be able to get a few credits on her card as well.

I will say that the Companion pass upgrade does not apply to companion certs that were issued prior to Feb 1. My Reserve one was issued at end of Dec 2023. Same goes with my wife’s companion cert but in 2025 they may come in handy.

I also look at annual fees vs. benefits and feel that I’m still coming out ahead on most of my cards.