Two welcome bonus offers expire this week:

In this article

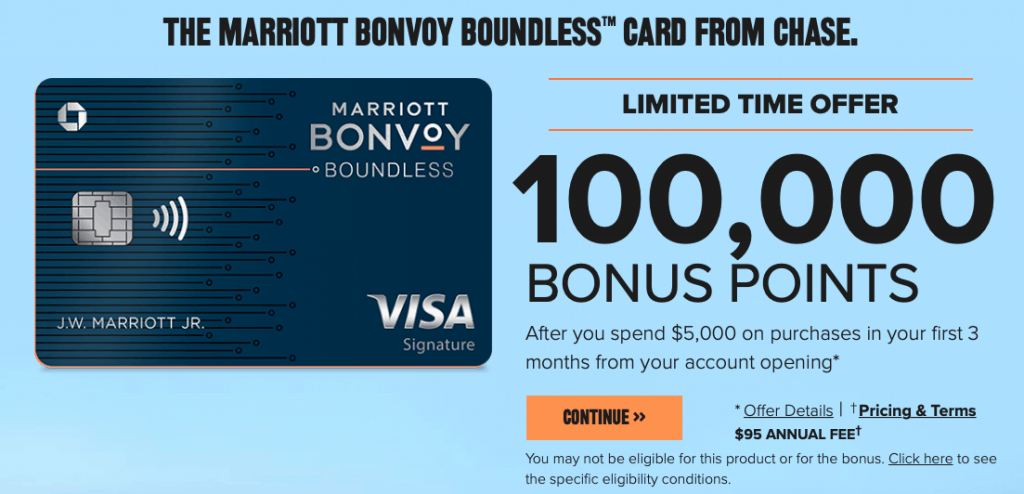

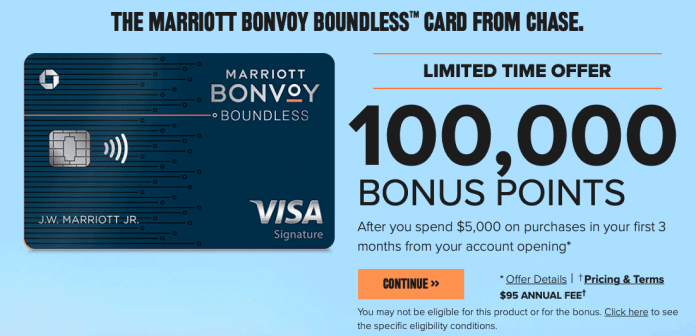

Marriott Bonvoy Boundless (Expires Weds. May 15th, 2019)

Tomorrow marks the end of an extended elevated offer on the Marriott Bonvoy Boundless Card from Chase.

If you don’t already have a Marriott card (either Amex or Chase as having any of them will disqualify you for the Boundless card), this is the best bonus we’ve seen. I suspect (this is just a guess) that we will see this bonus fall to 75,000 points for $3,000 in spend within 3 months.

Regarding the bonus limitations: They are extensive, but generally if you have recently opened or have (or had) another Marriott earning card in the last 24 months, you won’t be eligible.

If you are, 100,000 points is worth about $700 and can go a long way if used well.

NOTE: There is also a separate offer going on wherein you get 3 free nights at a Marriott Bonvoy hotel of up to 35,000 points a night for just $3,000 in spend within 3 months. It’s a lower required spend, but you won’t be able to combine these nights to get a “5th night free” award. Both are good offers but many favor the 100,000 points for the flexibility.

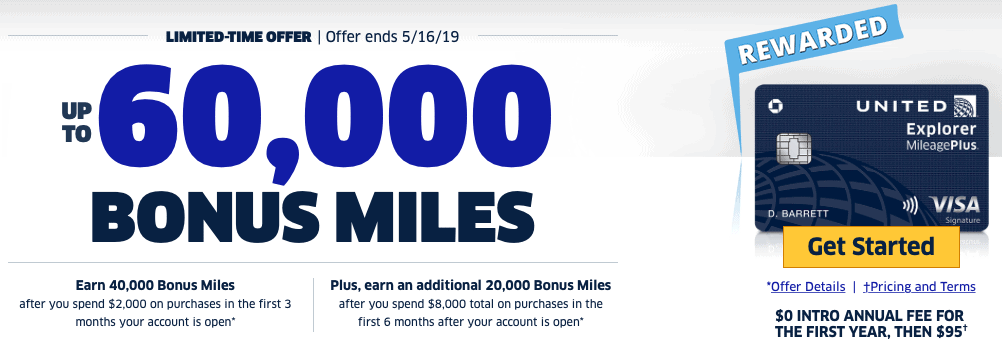

United Explorer Card (expires Thursday May 16, 2019)

This card is currently offering a bonus of up to 60,000 United miles. It’s two tiered: You get 40,000 when you spend $3,000 in the first 3 months and 20,000 more when you spend $8,000 in the first 6 months (total).

It’s not the best offer we’ve ever seen on this card, though if you have a near term need for the miles, I suspect the bonus may drop to either 40,000 or 50,000 miles when this expires on Thursday, May 16th.

Of course, you can also earn United miles with a Chase Sapphire Reserve, Chase Sapphire Preferred or Chase Ink Business Preferred (they transfer 1:1).

You can read more details on the United Explorer card, such as expanded award availability (to me, the best feature of the card) and decide for yourself.

Both cards above are Chase cards, meaning that they are subject to the 5/24 rule. (You won’t be approved if you have opened 5 or more personal cards in the last 24 months). Learn more about the 5/24 rule here.

Have more questions? Let me know here, on Twitter, or in the private MilesTalk Facebook group.

You can find other cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available now.