SoFi customers (and for a while in 2019 I talked a lot about SoFi offers) are getting emails prompting them to upgrade their SoFi account to earn a higher interest rate….

David, if you’d like to earn up to 1.00% APY1 on your balances (33x the national average interest)2 — we’ve made it super simple.

Just accept the terms for SoFi® Checking and Savings accounts, then set up direct deposit to start earning up to 1.00% APY

Sure, 1% sounds good in the current rate environment, when Marcus pays 0.6% and Bask Bank pays 0.7%. Notably, TMobile Money pays 1%, although there are strings attached that you use the debit card enough times (and you must be a Tmobile customer).

But on top of the Direct Deposit requirement, there’s something they don’t call out front and center.

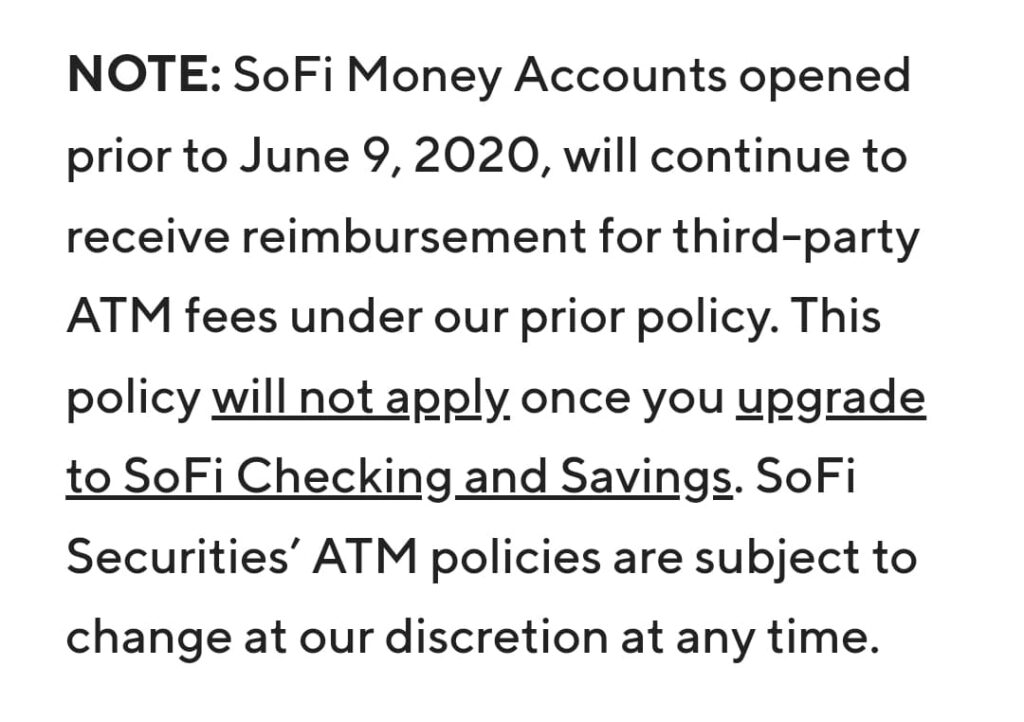

One of the best features of SoFi’s program is that they reimburse third party ATM fees.

But if you upgrade to the “better” account, you lose the fee reimbursement.

For many, that juice isn’t worth the squeeze.

(Note that in 2020, I also warned about something similar, but totally different, with SoFi.)

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![What to know about the Chase 5/24 rule on credit card signups [2025]](https://milestalk.com/wp-content/uploads/2016/04/524-218x150.jpg)

![Should you Pay Taxes with a Credit Card? [2025]](https://milestalk.com/wp-content/uploads/2016/04/cropped-miles2-2-218x150.jpg)

![Guide: Status Matching for Car Rentals [2025] car rental status matches](https://milestalk.com/wp-content/uploads/2022/01/New-Project-56-218x150.jpg)