It’s another end of an era.

For as long as I can remember (and you may recall I remember quite a lot – even writing this anthology of the Citi ThankYou program from the card side of things with the Citi PremierPass, Chairman, and then Prestige cards), you have been able to earn Citi ThankYou points from banking.

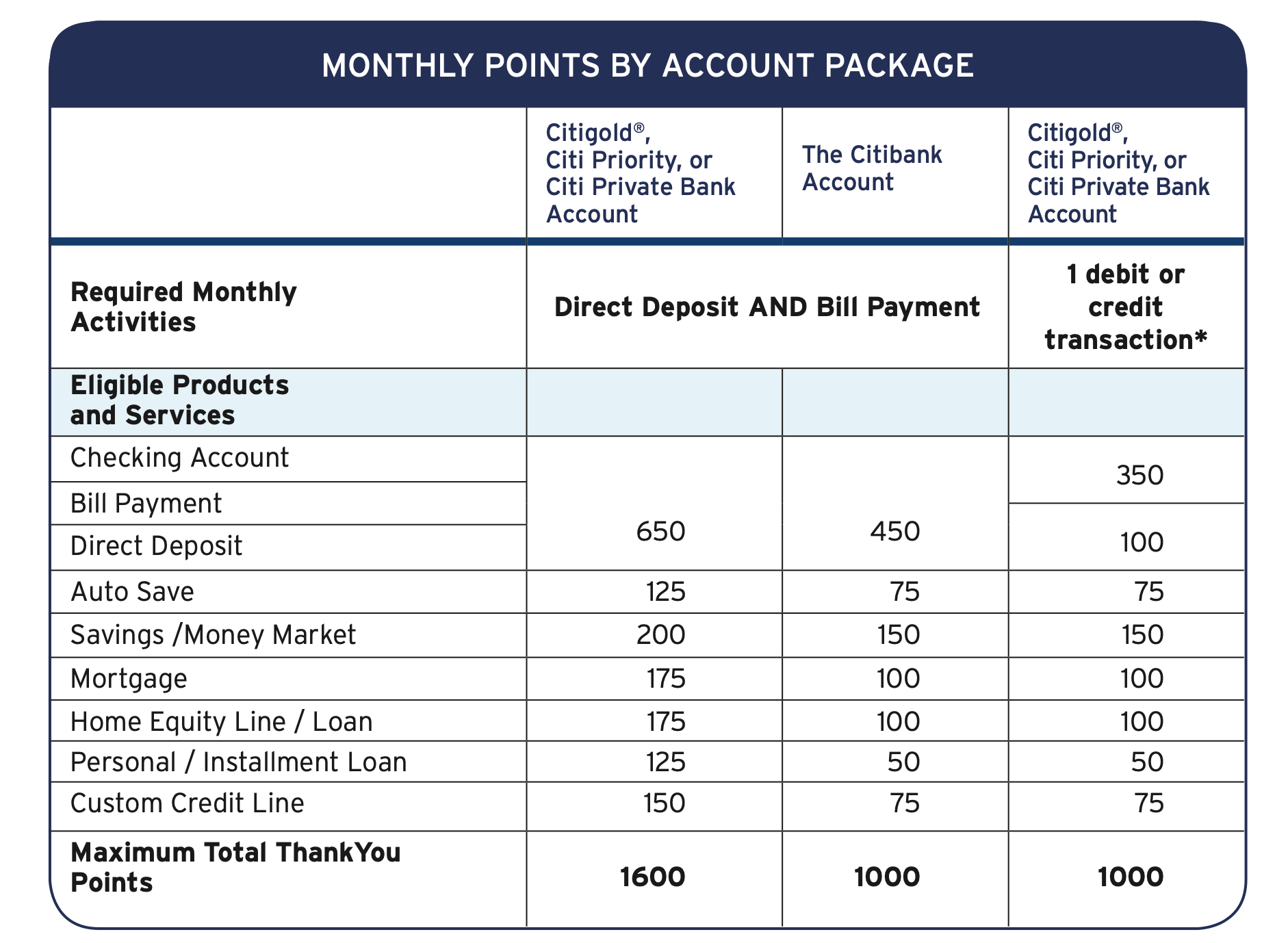

It’s always been a bit difficult to keep track of how you earn this way, but I did locate a chart on the Citi website.

I currently earn 950 points a month (honestly, I don’t know from what) – so that’s $114 a year in value. Why only $114? That’s because banking points can only be redeemed towards portal redemptions at 1 cent a point. They can never be transferred, do not get the Rewards+ 10% rebate, and they do expire.

Well, Doctor of Credit has discovered that it’s the end of this particular era.

Apparently, all Citi bank accounts are being converted (in what time frame, I’m not sure) to something called Simplified Banking. Indeed, they are simplifying away the ThankYou points earning 😉

Here is more info on Simplified Banking (you may need to be logged in to view).

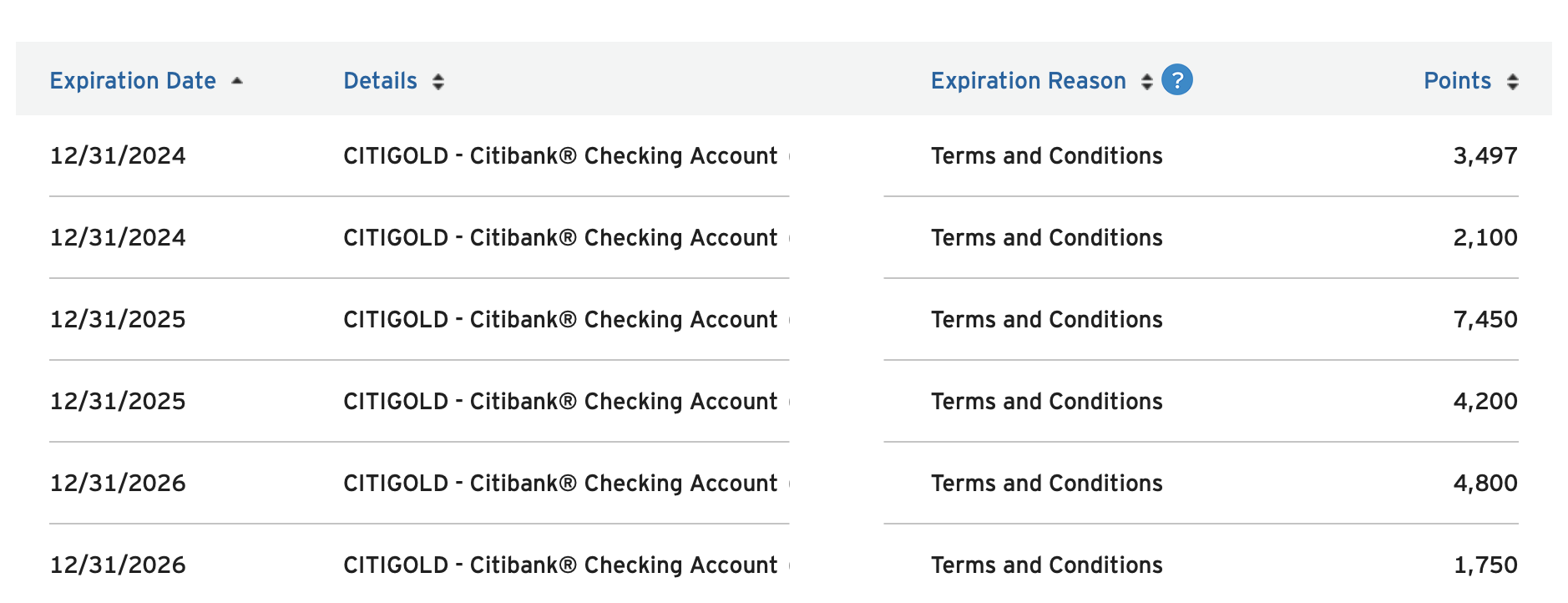

It’s important to know this info is not just so you can be sad about not earning ThankYou points from banking anymore, but more to make sure you redeem them before they expire. You can see right at the top of your ThankYou Points Summary page when points may be expiring.

As you can see, I have about 28,000 accrued “banking” ThankYou points. I’ll lose 5,600 if I don’t spend them by the end of next year and so on.

Even if you aren’t booking a trip, you can spend them on activities. Just don’t let them expire!

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)

I have a citi priority account primarily for the ability to earn 650 points a month for doing absolutely nothing and that’s inspite of Citi’s lackluster customer service on the banking side. The only good products IMO that remain at Citi, are on the credit card side, as I am a huge proponent of the citi trifecta