Since April 22, 2023, this card has changed. There are no more 3X rotating categories.

You now earn 3x on eligible travel, office supply store purchases and professional services, year round.

In this article

CitiBusiness ThankYou Card

It’s a bizarre thing.

Citi offers a small business credit card called the CitiBusiness ThankYou Card.

But they don’t even list it on their Small Business card page.

If you Google perfectly, you may find the card here. But even then, they won’t show you the current bonus offer and you can’t apply online. You’ll have to walk int a Citi branch and apply with a business banker. Not only that, the webpage doesn’t give you any details on the card!

Why does Citi have a card that is so hard to apply for?

I have absolutely no idea. You’d *think* they would either want people to actually get it and have an online application – or pull the card entirely.

Yet for years now this card has sat in exactly the same place, with a signup bonus that varies every few months – and you can only even find out what that offer is by asking someone in a Citi branch to check for you in their system.

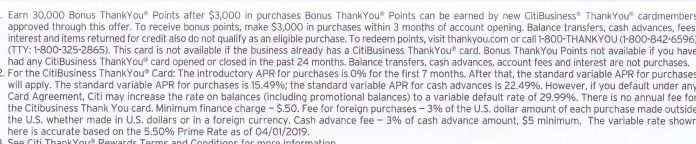

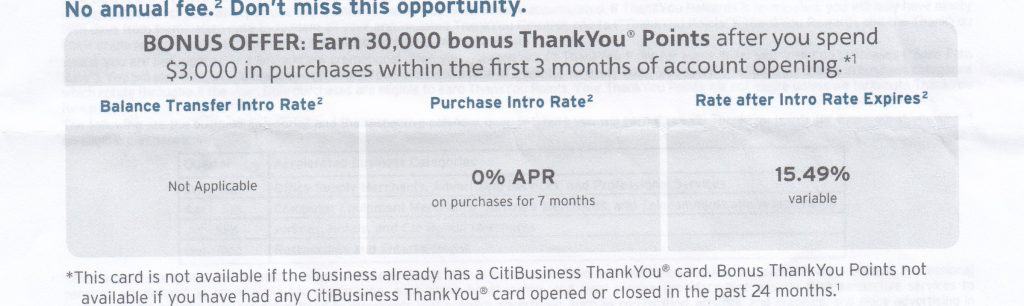

The bonus offer sits between 20,000 and 40,000 ThankYou points for spending $3,000 in 3 months. Today, it’s at 30,000. When I checked in March it was 20,000. Is a 40,000 point offer coming up? I have no idea.

Still, this is actually a gem of a card and I don’t know why I haven’t even pulled the trigger myself yet – although I fully plan to ASAP.

Beyond the bonus (which you are only able to get if you haven’t opened or closed this same card in the past 24 months and also don’t currently have the card, it’s got some nice features.

Most importantly, there’s no annual fee.

You’ll earn 3x on eligible travel, office supply store purchases and professional services, year round.

Timing Your Application

Since you can only get this card at most every 3 years (since you can’t get the bonus if you have the card or have opened or closed it in the last 24 months and since we know one should always keep a card open at least a year, you’ll want to max your bonus. Since it varies from 20,000 – 40,000 ThankYou Points, I certainly wouldn’t take 20,000. 30,000 might be acceptable if you know you’ll put the bonus categories to good use in Q2. Else you can always wait for the 40,000 to return. I haven’t decided if I will apply for the 30,000 or wait for the 40,000 yet myself.

FAQ

I’m going to pull three questions out of the comments below and answer here as well as they were good questions:

Q: Can you get this card if you have another CitiBusiness card like the CitiBusiness AAdvantage card?

A: Yes, as long as it has been more than 90 days since you were approved for that card.

Q: Can you get this card if you have gotten a bonus on a ThankYou Premier/Prestige in the last 24 months?

A: Yes, no impact. This is a separate category of card.

Q: Can you combine these with a Premier/Prestige to transfer points to airlines?

A: Yes.

Questions?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)

![[TODAY!] Amazon Prime Day July 16-17: Pay One Point Discounts! amazon prime day discount](https://milestalk.com/wp-content/uploads/2021/06/prime-day-discount-218x150.jpg)

![The “Citi Trifecta / Quadfecta” + Best Uses of Citi ThankYou Points [Guide] citi trifecta](https://milestalk.com/wp-content/uploads/2020/10/citi-trifecta-218x150.jpg)

If one has any personal TYP card Premier, Preferred or Prestige, does the 1/24 rule apply in addition? Or is this counted separately, as a business card?

Great question. The 1/24 rule in this case applies ONLY to this card. The cards you mentioned have no effect nor does a CitiBusiness AAdvantage card. The one thing to know, though, is Citi won’t approve two Business cards within 90 days. So if you got a CitiBusiness AA card in the last three months, that would be the only disqualifier.

Citi won’t approve two Business cards within 90* days

Are the points fully combinable with TYP from Prestige / Premier, and transferrable to airlines?

So, this is only available at a Citi branch? Thanks!

I’ll echo @Diamond Vargas’s question: Are the points fully combinable with TYP from Prestige / Premier, and transferrable to airlines?

These seems crucial for assessing the value of the card.

Thank you! I don’t know why I wrote 30. Yes, 90 is correct and I updated the above comment 🙂

Yes, the points are fully combinable. You will still need a Prestige or Premier to transfer to airlines.

Is this a “no fee”? , if there is a fee what is it?

Thanks, Dave!

[…] The CitiBusiness ThankYou card that you have to apply in-branch for […]

[…] While you are in-branch, ask about The “Secret” CitiBusiness ThankYou Credit Card You May Not Know About. […]

Anyone know if the TY points earned with this card can be combined with points earned from Citi Custom Cash or Double Cash. I don’t have any TY point earning personal cards and am trying to stay under 5/24.

They would combine with Custom Cash points. Double Cash doesn’t earn points (although the cash can also be converted to points).

Still waiting for a business card that offers 3x or more on insurance and/or tax payments. Wouldn’t that be a game changer.

How do you get a credit limit increase on this card?

looking to get citi thank you for my business but any branch is tried couldnt find the offer.

any way to get it?

Maybe try another branch? It’s *possible* they have paused new applications while the finish converting everyone to the new program. We got new cards, a new online portal, etc. Just guessing as there is zero corporate info online.

5/24 assume it does NOT count? (if mentioned and I missed…sorry)

Correct – standard business card and will not count against 5/24